According to a recent announcement by the Hanoi Stock Exchange (HNX), Thang Long Thermal Power JSC has issued a correction regarding its 2023 financial statements.

Specifically, the company’s 2023 financial report mistakenly interchanged the columns for “previous period” and “reporting period.”

Prior to the correction, Thang Long Thermal Power reported a net profit of nearly VND 122 billion for 2023, while the company incurred a loss of over VND 528 billion in 2022. Following the revision, the company’s financial statements reflect a loss of more than VND 528 billion for 2023, with a profit of VND 121.9 billion in the previous year.

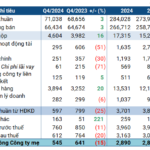

As of December 31, 2023, Thang Long Thermal Power’s owner’s equity stood at VND 3,981 billion, a decrease of nearly 12% compared to the same period last year.

The debt-to-equity ratio increased slightly from 2.38 to 2.46; corresponding to total liabilities at the end of 2023 of nearly VND 9,800 billion. Of this, bond debt amounted to VND 677 billion.

According to information disclosed on HNX, in 2021, Thang Long Thermal Power issued bonds with the code TLPCH2126001, valued at VND 1,125 billion, with a five-year term and a maturity date of December 30, 2026.

On February 28, 2025, the company repurchased VND 19 billion of these bonds, reducing the outstanding value to VND 408 billion.

In 2024, Thang Long Thermal Power also issued two additional bond series, TLPCH2427001 and TLPCH2427002, with issuance values of VND 899.5 billion and VND 900 billion, respectively.

Both bond issues carry a coupon rate of 10% per annum and have a term of 36 months, maturing in 2027.

Thang Long Thermal Power, established in August 2007, is headquartered in Ha Long City, Quang Ninh Province, and is part of the Geleximco ecosystem.

Image: Geleximco

The company is the investor of the Thang Long Thermal Power Plant project in Quang Ninh Province. With a total investment of over VND 20,000 billion, the project is the first large-scale private thermal power plant in Vietnam, approved by the Prime Minister in Decision No. 627/QD-TTg dated July 29, 2002.

The plant has a capacity of 600MW and produces 4.1 GWh/year of commercial electricity, reaching a capacity of 3.7 billion KWh/year.

Currently, Mr. Vu Van Tien serves as the Chairman of the Board of Directors and legal representative of the company.

Mr. Vu Van Tien is also known as the Chairman of Geleximco Group and Vice Chairman of ABBank.

The Shark Hưng-Linked Companies Continuously Roll Over Their Bonds, Putting Up a Residential Area in Quang Ninh as Collateral.

The bondholders of Cen Land and Cen Invest, companies associated with Mr. Pham Thanh Hung (Shark Hung) and part of the Cen Group ecosystem, have agreed to a second extension for both bond issues, pushing the maturity date to October 13, 2025. This development comes as the share price of CRE dips below 7,000 VND, prompting the need for additional collateral to be pledged by the issuers.

The Esme Di An Project Owner Raises Over a Thousand Billion Dong from Bonds Despite Business Losses

Despite consecutive losses since 2022, the developers of The Esme Di An project have successfully raised a substantial amount of capital through three bond issuances, totaling VND 2,500 billion.