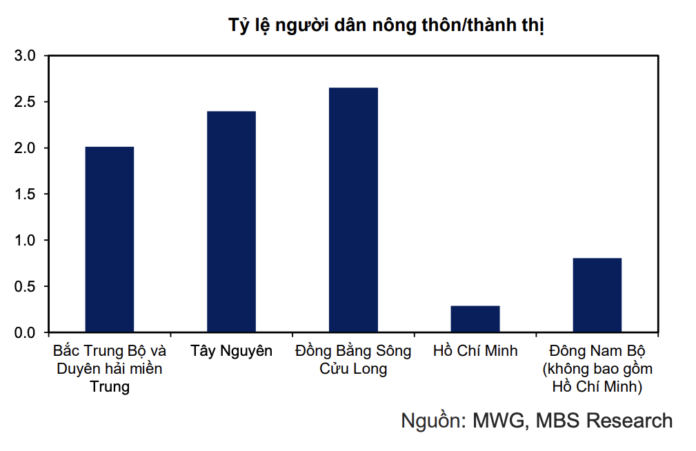

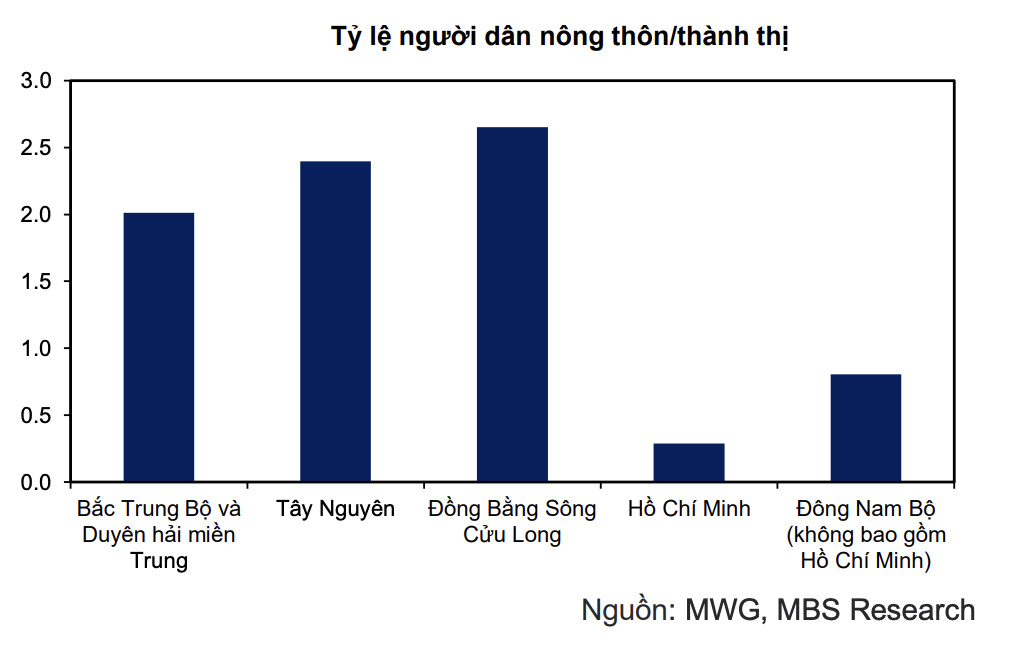

In a recent report by MB Securities (MBS) on March 24th, Bach Hoa Xanh will face certain challenges in deploying its retail model in Central Vietnam. The first hurdle stems from the high proportion of rural residents and their inherent shopping habits that lean towards thriftiness. Consumers in this region tend to favor traditional markets and prefer to pick their fresh produce on the spot rather than buying pre-packaged items.

“The chain’s modern mini-model has yet to meet the needs of the majority of consumers here,” the report stated.

Beyond consumer behavior, logistics and transportation in Central Vietnam also pose barriers. Despite having a population equivalent to half of the Southeast region, the density of modern stores is still low. Expanding into this area necessitates additional investment in warehouses and distribution means to ensure the quality of goods, especially perishable food items, which are the chain’s forte.

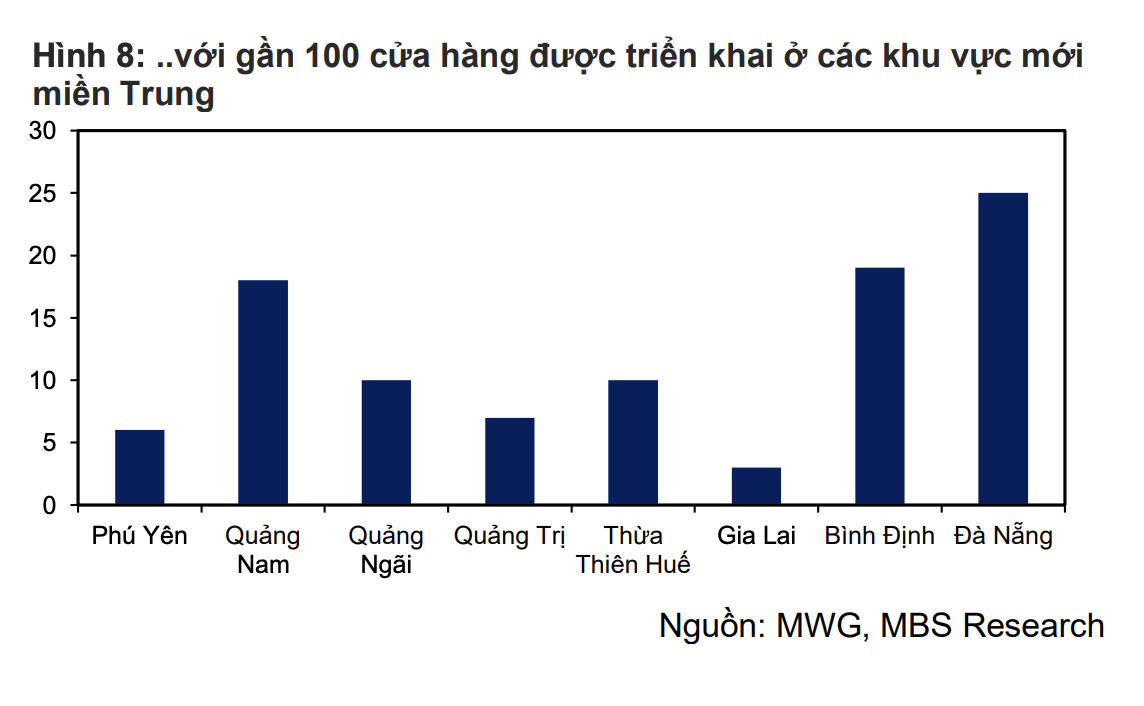

As of March, despite facing certain challenges, Bach Hoa Xanh has inaugurated 206 new stores, with approximately 98 of them located in Central provinces such as Da Nang, Binh Dinh, Quang Nam, and Gia Lai. The average revenue at these new stores fluctuates between 1.2 and 1.5 billion VND per month, slightly lower than the system-wide average (2 billion VND/month)

MBS assessed that this revenue level is comparable to the 2021-2023 period, reflecting initial stability in a nascent market.

In 2024, the retail chain under Mobile World Investment Corporation recorded net profits for the first time since its 8 years of operation. The average revenue per store increased by 28.6% year-on-year, surpassing 2 billion VND per month. The system-wide net profit reached 100 billion VND.

These results are attributed to a focus on fresh produce, which increased purchase frequency and, in turn, improved revenue and profit margins.

Based on the assumption of opening an additional 240 stores this year, MBS forecasts that Bach Hoa Xanh could increase its total number of sales points to over 2,000, with 70% located in Central Vietnam. The average revenue per store in 2025 is projected to reach 1.92 billion VND per month.

During the Q4 investor meeting in 2024, Mobile World Investment Corporation’s leadership also divulged insights into Bach Hoa Xanh’s future plans. Accordingly, in 2025, Bach Hoa Xanh aims to increase its revenue by a minimum of 7 trillion VND, primarily through growth in revenue from existing stores.

In parallel, the company will categorize stores into distinct groups to implement tailored strategies, thereby enhancing business efficiency. In the first half of the year, Bach Hoa Xanh plans to open 200-400 new stores, focusing on existing areas and expanding into several Central provinces.

The enterprise reiterated its commitment to a strategy that prioritizes the quality of sales points over quantity. Additionally, the online sales segment will be bolstered, targeting a minimum revenue growth of 300%.

FPT Telecom (FOX) Aims for Record-High 2025 Profits, Targets 5,000 VND Cash Dividend per Share

FPT Telecom is taking a dynamic approach to capital expansion with a proposed 50% stock dividend. This strategic move will increase the company’s charter capital from 4,925 billion to approximately 7,388 billion VND. This stock issuance is a supplementary measure to the company’s cash dividend policy, demonstrating FPT Telecom’s commitment to rewarding its shareholders and fostering sustainable growth.

A New Era for Vimeco: Focusing on Construction and Real Estate Post-Vinaconex Divestment

On March 18, 2025, Vimeco Joint Stock Company held its Annual General Meeting of Shareholders to approve the 2025 business plan and elect new members to its Board of Directors.