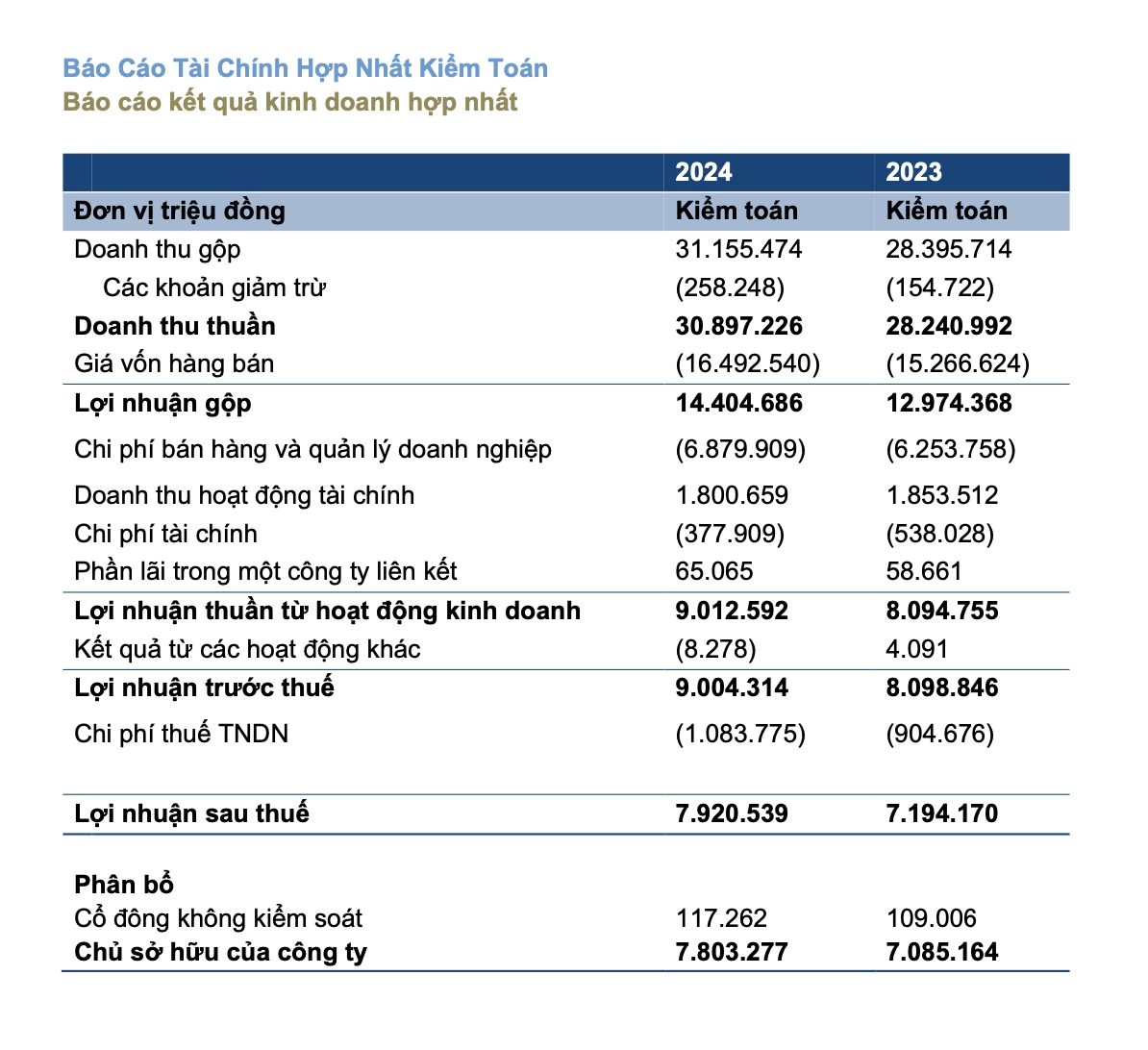

Masan Consumer Holdings (MCH), Vietnam’s leading consumer goods company, reported impressive financial results for 2024. With a revenue of approximately VND 30.9 trillion, MCH achieved a remarkable 9% increase compared to the previous year. What’s more, their after-tax profit surged to over VND 7.92 trillion, marking a significant rise of more than 10%.

This success can be attributed to the robust growth in sales across their spice, convenience food, and non-alcoholic beverage segments. A key driver of this growth has been the company’s focus on maintaining and developing strong brands, with a particular emphasis on taking the CHIN-SU label global and leveraging digital platforms for product distribution.

As of December 31, 2024, Masan Consumer’s total assets stood at VND 27.9 trillion, marking a decrease of 31% from the previous year’s figure of VND 40.553 trillion. This reduction is primarily due to the utilization of accumulated profits to pay dividends during the year.

Looking ahead, MCH has set ambitious goals for 2025, targeting an impressive 8-15% growth in revenue. To achieve this, they have outlined several key strategies. Firstly, they plan to implement core growth strategies and develop the “Retail Supreme” digital supply chain. This initiative aims to digitize traditional channel operations, enhance supply and demand planning, and improve production, distribution, and marketing efficiency.

Secondly, MCH intends to premiumize its spice and convenience food offerings by solidifying its market leadership in the premium segment. They will expand their instant meal offerings to include ready-to-eat meals like self-heating hot pots and self-cooking rice dishes, as well as handheld hot pots to capture the growing trend of on-the-go consumption.

Additionally, MCH will introduce new products in the beverage and personal and home care segments. They plan to expand their Wake-up 247 portfolio and capture market share in the bottled tea segment with their innovative BupNon Tea365 products. Furthermore, they will optimize their portfolio to focus on enhancing the Chanté and Net brands while also entering the personal care market.

Another critical aspect of MCH’s strategy is their focus on global expansion, targeting high growth in key markets such as the US, South Korea, Japan, and the EU for their spice, convenience food, and instant coffee products.

At the 2024 Annual General Meeting of Shareholders, Mr. Nguyen Dang Quang, Chairman of the Board of Directors of Masan Group, emphasized the strategic importance of MCH within the Masan ecosystem, referring to it as the “family jewel.” This underscores the company’s vital role in the group’s overall success.

In early 2025, MCH made headlines with its decision to delist from the UPCoM and seek a listing on the Ho Chi Minh City Stock Exchange (HoSE). Prior to this, MCH had obtained shareholder approval through written consent and completed insider trading transactions to meet the eligibility requirements for the transfer from UPCoM to HoSE, including having at least 300 non-major shareholders holding a minimum of 20% of the voting shares.

On March 7, MasanConsumerHoldings, MCH’s direct parent company, reported the completion of the purchase of over 69.2 million MCH shares, bringing its total holdings to nearly 740.6 million shares, or 70.4% of MCH’s total issued shares after the new issuance.

Prior to this transaction, MasanConsumerHoldings held nearly 671.4 million MCH shares, representing 92.65% of the total issued shares. Following the additional purchase, their ownership percentage decreased to 70.4% due to the increase in the total number of issued shares after the new issuance.

Week of 16-20/12: Masan’s Subsidiary Shareholders Enjoy ‘Dividend Shower’

During the week of December 16-20, 2024, 19 companies will finalise their cash dividend payments. The highest rate, an impressive 95% (equivalent to VND 9,500 per share owned), goes to a subsidiary of the Masan Group.

The $75 Billion Bill Gates Charity Fund is About to Buy 458,000 More Shares in Vietnamese Billionaire’s Company

Bill Gates’ investment fund has long had an indirect presence in Vietnam, particularly in the stock market. The fund’s involvement in the country’s economy dates back several years, and its impact has been significant. With strategic investments in various sectors, the fund has played a pivotal role in shaping Vietnam’s economic landscape. The fund’s interest in the country underscores its potential as an emerging market and a promising destination for global investors.