Services

|

In line with the Government’s directives and under the guidance of the State Bank of Vietnam (SBV), BAOVIET Bank has been determined to implement various solutions to reduce costs and, in turn, lending interest rates. This has made it easier for individuals and businesses to access capital, boosting production and trade. As a result, BAOVIET Bank has achieved notable operational results in 2024.

As of the end of 2024, BAOVIET Bank’s total assets exceeded VND 90.6 trillion, a 7.06% increase compared to the previous year. Total credit outstanding reached VND 54.58 trillion, meeting the SBV’s credit growth target for 2024.

Funds mobilized from economic organizations and individuals grew significantly by 8.66% year-on-year to VND 59.4 trillion. Total operating income increased by 13.2% compared to 2023.

The bank’s pre-tax profit reached nearly VND 86 billion, demonstrating its stability and efficient cost management. The non-performing loan ratio remained at a healthy 2.84%.

|

BAOVIET Bank continuously conducts market research and designs diverse product packages tailored to different customer segments and markets. This ensures that the bank meets the consumption and business expansion needs of its customers.

Recently, the bank introduced a preferential credit package for individual customers with short-term lending rates as low as 3% per year. This offering provides additional capital for consumption or production and trading activities.

For corporate clients, BAOVIET Bank launched a preferential loan package for purchasing new automobiles for transportation or cargo transportation. This package features an attractive interest rate of just 6.69% per year and allows for loans of up to 85% of the vehicle’s value. Domestic automobile dealers can enjoy even lower interest rates, starting at only 7.5% per year, along with quick approval processes and simplified paperwork.

As part of the Bao Viet Group’s “Synergistic Strength” initiative, BAOVIET Bank enhances cross-selling with other members of the group. This collaboration increases sales, expands the customer base, and paves the way for centralized data management within the Bao Viet ecosystem, contributing to the group’s sustainable development. BAOVIET Bank offers credit products, payment services, and card services to employees, consultants, and customers of Bao Viet, with exclusive interest rates and fees.

|

Recognizing the importance of technology and digitalization, BAOVIET Bank has consistently invested in modern technological foundations. These investments aim to develop and enhance digital banking services, improve customer experiences, and contribute to the reduction of operating costs. Ultimately, these efforts support the growth of e-commerce and bring numerous benefits to the economy.

BAOVIET Bank is set to launch a new version of its electronic banking service for corporate customers (BVB eBiz), featuring superior functions that effectively meet enterprise management needs.

Leveraging the strengths of its next-generation digital banking platform, BVB eBiz simplifies workflows and lightens the burden of financial management for businesses. It offers features such as account management, money transfers, information queries, transaction history tracking, scheduled transactions, payroll management, and more.

Notably, BVB eBiz enables enterprises to perform functions that were previously unavailable, such as quick money transfers through Napas 247, scheduled money transfers, and scheduled salary payments. It also allows for the retrieval of information from various account types beyond just payment accounts.

| BAOVIET Bank is a member of the Bao Viet Group, Vietnam’s leading finance and insurance group. To commemorate Bao Viet’s 60th anniversary, BAOVIET Bank and other group members introduced a range of products, services, and promotions for customers. These initiatives contribute to enhancing Bao Viet’s competitiveness and promoting effective and sustainable growth. |

– 07:00 29/03/2025

The First Bank Targeting Over 30% Profit Growth by 2025

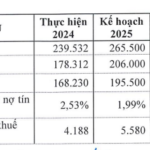

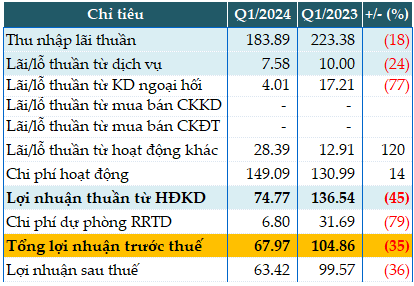

This bank has set an ambitious target for its 2025 performance, aiming for a pre-tax profit of 5,338 billion VND, representing a remarkable 33% increase from 2024.

Governor: The Banking Sector Will Provide Maximum Capital for Production, Business, Import-Export, and Priority Areas

Governor Nguyen Thi Hong affirmed that the SBV will continue to conduct flexible monetary policy management, closely following macroeconomic developments and inflation trends. At the same time, the banking industry will continue to accompany and provide maximum capital for production and business, import and export, priority areas, and strengths of each region and locality.

“Eximbank Aims High: Targeting a 33% Surge in Profit for 2025”

On February 17, 2025, the Board of Directors of the Vietnam Export Import Commercial Joint Stock Bank (Eximbank, HOSE: EIB) approved the proposal of the Acting General Director regarding the 2025 business plan for submission to the Annual General Meeting for approval.