Specifically, the bank plans to use operating capital to buy back more than VND 12,271 billion of bonds. BIDV stated that the buyback is to exercise the issuer’s right to repurchase, meeting investors’ expectations and demonstrating BIDV‘s credibility and financial strength. This move will facilitate the bank’s future bond issuance plans.

BIDV explained that the repurchase is based on commitments made to bondholders, the bank’s anticipated capital adequacy at the time of the buyback, and compliance with the State Bank of Vietnam’s (SBV) regulations.

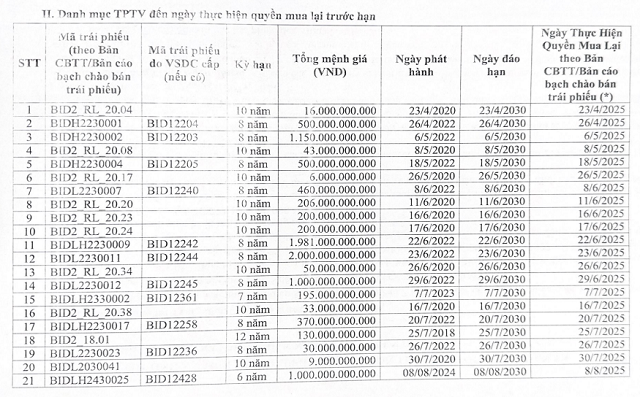

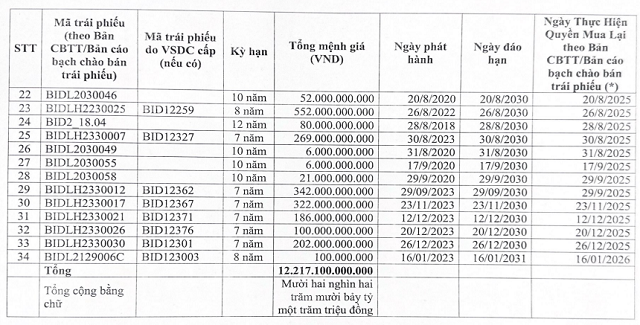

According to the bank’s capital-enhancing bond portfolio, the issued bond codes have a minimum par value of VND 100 million and a maximum of VND 2,000 billion. There are a total of 34 bond codes with maturities ranging from 6 to 12 years.

These bonds were issued between 2018 and 2024 and are expected to mature in 2030 and 2031. The bank plans to repurchase all these bonds in 2025 and 2026.

|

List of BIDV Bond Codes to be Repurchased

|

On April 4th, BIDV will also hold its Annual General Meeting for 2025 in Hanoi. The bank’s Board of Directors will present the 2025 business plan, targeting credit growth in line with the limit set by the SBV, expected to increase by 15-16%. Capital mobilization will be managed in alignment with capital usage while ensuring compliance with regulations.

BIDV‘s pre-tax profit will be in line with the approval of the state authorities, and non-performing loans are expected to be maintained below 1.4%.

– 10:18 24/03/2025

The Greenback and the Yuan: A Tale of Two Currencies’ Decline

At Vietcombank, one of the leading commercial banks in Vietnam, the USD exchange rate stands at 23,157-23,460 VND/USD (buying-selling), a decrease of 7 VND from the morning of December 6th. Meanwhile, the Chinese Yuan also witnessed a drop of 5 VND.

The Release of Quốc Cường Gia Lai CEO, Nguyễn Thị Như Loan: Can She Resume Her Leadership Role?

“The question on everyone’s mind: What happens next for Nguyễn Thị Như Loan, the recently released CEO of Quốc Cường Gia Lai? With her newfound freedom, will she resume her role at the helm of this prominent company, and what does this mean for the future of Quốc Cường Gia Lai?”