To accurately calculate bank loan interest rates, customers need to determine the interest calculation period, actual balance, number of days maintaining the actual balance, interest rate, and interest calculation formula.

Interest calculation period: This is determined from the day following the disbursement of the loan to the end of the repayment of the credit amount (excluding the first day and including the last day of the interest calculation period). The point at which the balance is determined for interest calculation is the beginning of each day within the interest calculation period.

Actual balance: This refers to the daily balance at the beginning of the interest calculation period of the outstanding principal balance, overdue principal balance, and accrued interest that the borrower owes to the lender. This balance is used to calculate interest according to the agreement and legal regulations related to credit.

Number of days maintaining the actual balance: This is the number of days that the actual balance at the beginning of each day remains unchanged.

Interest rate for interest calculation: The interest rate is expressed as a percentage per annum, with one year being 365 days.

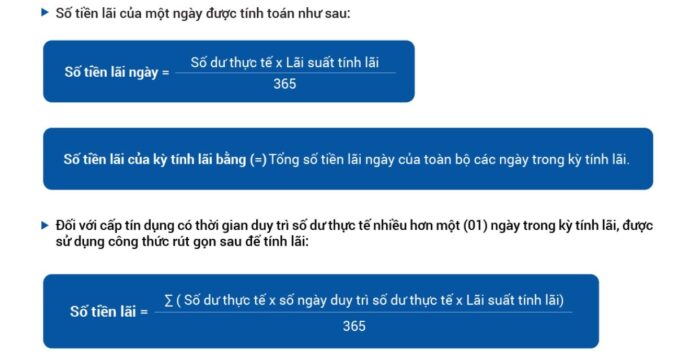

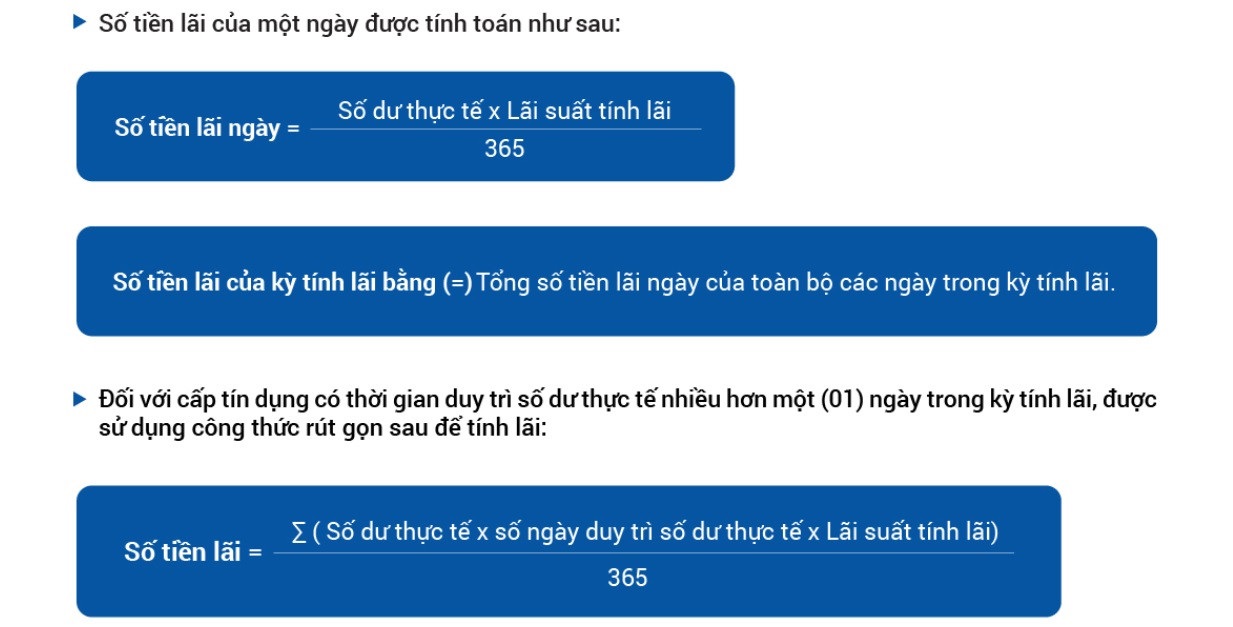

Interest calculation formula: The interest for each interest calculation period is determined as follows:

How to calculate bank loan interest rates for installment loans based on the original debt balance

When taking out an installment loan from a bank, the borrower repays a fixed and equal amount each month, including both interest and principal, throughout the loan term specified in the contract. Notably, the monthly interest payment remains unchanged during the loan period.

The formula for calculating the interest rate on a bank loan is as follows:

Monthly interest payment = Original debt balance x Interest rate x Number of days of the loan/365

Percentage of interest rate on bank loans each month = (Monthly interest payment/Loan amount) x 100%

The repayment period can be calculated monthly or annually, depending on the agreement stipulated in the loan contract.

For example, Customer A wants to borrow 36,000,000 VND for one year at an interest rate of 12% per annum and chooses to repay it in equal installments based on the original debt balance each month.

– Monthly principal repayment = 36,000,000/12 = 3,000,000 VND.

Monthly interest payment = (36,000,000 x 12%)/12 = 360,000 VND.

Thus, the total amount (including principal and interest) that A has to pay each month is 3,360,000 VND.

How to calculate bank loan interest rates based on the reducing debt balance

The method of calculating interest rates based on the reducing debt balance is commonly applied in consumer loan contracts. Accordingly, each subsequent repayment period is recalculated based on the outstanding principal balance of the previous period. As a result, the amount repaid each period gradually decreases over time.

The formula for calculating the interest rate based on the reducing debt balance is as follows:

Principal repayment for each period = Loan amount/Loan term

Interest for the first period = Loan amount x Interest rate for the period

Interest for subsequent periods = Remaining principal balance x Interest rate

| Repayment period | Monthly repayment (interest + principal) | Interest | Principal | Outstanding balance |

| Month 1 | 9,333,333 | 1,000,000 | 8,333,333 | 91,666,667 |

| Month 2 | 9,250,000 | 916,667 | 8,333,333 | 83,333,333 |

| Month 3 | 9,166,667 | 833,333 | 8,333,333 | 75,000,000 |

| Month 4 | 9,083,333 | 750,000 | 8,333,333 | 66,666,667 |

| Month 5 | 9,000,000 | 666,667 | 8,333,333 | 58,333,333 |

| Month 6 | 8,916,667 | 583,333 | 8,333,333 | 50,000,000 |

| Month 7 | 8,833,333 | 500,000 | 8,333,333 | 41,666,667 |

| Month 8 | 8,750,000 | 416,667 | 8,333,333 | 33,333,333 |

| Month 9 | 8,666,667 | 333,333 | 8,333,333 | 25,000,000 |

| Month 10 | 8,583,333 | 250,000 | 8,333,333 | 16,666,667 |

| Month 11 | 8,500,000 | 166,667 | 8,333,333 | 8,333,333 |

| Month 12 | 8,416,667 | 83,333 | 8,333,333 | 0 |

Tuân Nguyễn

Why Homebuyers Are Afraid to Take Out Loans

In an effort to boost credit growth in the final months of the year, banks are lowering interest rates on real estate loans, particularly for home purchases, which currently account for a small proportion of total real estate lending. However, potential homebuyers remain cautious due to the surge in property prices, making them hesitant to take on loans.

Maximizing Your Bank Interest: The Ultimate Guide

“Maximizing your savings interest rate is paramount when you’re looking to simply save money rather than invest it. It’s a key concern for those wanting to make the most of their hard-earned cash.”

Deputy Minister Bui Xuan Dung: The Pressure to Meet the Timelines for Social Housing Projects in 2024 is Immense

At the regular Government press conference for July 2024, Deputy Minister of Construction Bui Xuan Dung emphasized the significant pressure to complete social housing projects on schedule by the end of 2024. In a separate development, the State Bank of Vietnam is seeking feedback from ministries and sectors on a proposed interest rate reduction of 3-5% for individuals taking out loans to purchase social housing.

Deputy Minister Bui Xuan Dung: The Pressure to Complete Social Housing Projects in 2024 is Immense

At the regular Government press conference for July 2024, Deputy Minister of Construction Bui Xuan Dung highlighted the significant pressure to complete social housing projects on schedule by the end of 2024. In a separate development, the State Bank of Vietnam is seeking feedback from ministries and sectors on a proposed reduction in interest rates for individuals purchasing social housing by 3-5%.

Never before have real estate loan interest rates been this low, but…

These are fresh loans sanctioned with interest rates at an all-time low. Even real estate lease deeds are being accepted as collateral by several banks. Yet, the market has failed to absorb this liquidity and credit growth remains subdued.