Recently, BIDV issued its fifth notification to find buyers for secured assets from CTCP Hang Ha’s debt.

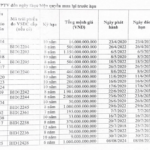

BIDV stated that as of October 31, 2024, the company’s total debt to Hang Ha exceeded VND 730 billion, including nearly VND 434 billion in principal and over VND 296 billion in overdue interest and penalties.

The collateral for the above loan includes the current and future upgrades and other real estate permanently attached to or located at the facilities. It also covers any construction and/or real estate built and/or purchased within the land area in Duc Giang Ward, Long Bien District, Hanoi, as per the Land Use Right Certificate and Ownership of Houses and Other Assets Attached to Land issued by the Hanoi Department of Agriculture and Environment on December 5, 2017.

Cotec Health Care: A rendering of the Duc Giang International Obstetrics and Gynecology Hospital

|

The pledged land for the loan is the Duc Giang International Obstetrics and Gynecology Hospital, with a capacity of 120 beds, 600 daily examinations, and 70 daily births.

To address Hang Ha’s bad debt of over VND 730 billion, BIDV decided to sell the secured assets mentioned above, reducing the starting price by nearly VND 197 billion (approximately 27%) compared to the initial auction, setting it at over VND 534 billion.

The starting price excludes related costs such as ownership/usage transfer fees, registration fees, and other expenses (if any) incurred during the debt purchase process. These costs will be borne by the auction winner, and the debt purchase is exempt from VAT.

Previously, BIDV also struggled to resolve a trillion-dollar debt of Construction Production Commerce Finance Resource Company Limited (Tai Nguyen), attempting the sale nine times.

The debt offered for auction includes the total principal and interest balance as of July 26, 2024, amounting to over VND 5,720 billion, comprising VND 2,506 billion in principal and VND 3,215 billion in interest.

The collateral for this debt includes the land use rights and future assets of the Phuoc Nguyen Hung Residential Area Project (now known as the Kenton Project) in Phuoc Kien Commune, Nha Be District, Ho Chi Minh City, and the mining rights at Hoa Thach and Phu Man communes, Quoc Oai District, Hanoi.

In the ninth auction, BIDV set the starting price for Tai Nguyen’s debt at VND 4,419 billion, a reduction of over VND 1,300 billion (23%) compared to the initial auction.

Tai Nguyen is the investor in the Kenton Node super project, with a capital investment of 300 million USD. Initially known as Kenton Residence, the project broke ground in 2009 and is located on Nguyen Huu Tho Street in Nha Be District, Ho Chi Minh City.

A closer look at the massive concrete structure at the Kenton Node project

|

According to the original plan, the project covered an area of 9.1 hectares and consisted of nine towers ranging from 15 to 35 stories, with 1,640 luxury apartments and a 20,000m2 shopping center. However, due to market difficulties, construction halted in 2011, and the project remains inactive without any signs of resumption.

Khang Di

– 14:28 26/03/2025

“BIDV’s Strategic Move: Investing VND 12,271 Billion in an Early Bond Repurchase”

The Board of Directors of the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) has approved a plan to repurchase its capital-raising bonds ahead of schedule. The bank now has the option to repurchase these bonds from the 2nd quarter of 2025 until the end of the 1st quarter of 2026.

The Capital Injection Conundrum: Why Are Businesses Still Struggling to Secure Loans Despite Banks’ Efforts?

The banking sector injected nearly VND 200,000 billion into the economy in the first few months of the year, yet businesses still cry out for easier access to this capital. Experts assert that directing this bank funding towards businesses requires a harmonious interplay between governing policies, strategic banking initiatives, and proactive enterprise from businesses themselves.

‘Money Flow into the Market is Not Fast Enough to Stimulate Growth’

“Domestic consumption and investment incentives currently contribute over 90% to GDP growth. With exports facing challenges, it is imperative to find solutions to stimulate and unleash these two drivers. However, as Dr. Can Van Luc, a renowned economist, points out, there is a prevailing issue of increasing money supply but slow velocity of money circulation. This results in a lag in the infusion of money into the market, hindering the desired growth trajectory.”

“A Billion-Dollar Deal: The Astonishing Transaction Between Two Vietnamese Business Giants”

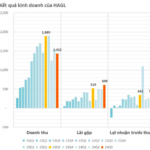

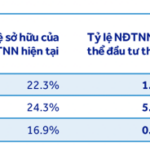

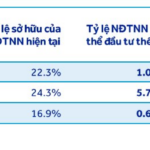

As of December 30, 2024, HAGL had repaid a total of VND 1,030 billion in principal on the bond issuance to BIDV. This significant repayment showcases HAGL’s commitment to fulfilling its financial obligations and strengthening its relationship with BIDV, a key financial partner.