There are, in fact, numerous reasons why the apartment segment in Binh Duong has the opportunity to increase in value, given the positive news currently surrounding the area. Thanks to its proximity to Ho Chi Minh City and developed infrastructure, Binh Duong has long been a “promising” destination for both residential and investment demands.

According to the new land price table applied from January 1, 2025, land prices in many areas of Binh Duong have increased by 30-80%. This adjustment has directly impacted apartment prices in the area. In early 2025, Binh Duong apartment prices rose by 10-20% compared to the same period last year. Notably, some apartment projects in the area reached nearly VND 70 million/sqm – a price on par with apartments in Thu Duc City (Ho Chi Minh City).

In the future, Binh Duong real estate prices will continue to rise thanks to infrastructure and planning incentives. Photo: Illustration

Observing the basket of apartments currently for sale in Binh Duong shows that it is not easy for buyers to find apartments priced from VND 40-55 million/sqm. The price increase over time has caused some projects located near Thu Duc City (Ho Chi Minh City) to set quite high new price levels.

For example, the Green Tower project by TBS Group is expected to be sold at VND 68-70 million/sqm; Midori Park The Ten by Becamex Tokyu is priced at VND 58 million/sqm, the Lapura project by Phat Dat (formerly Astral City) is “rumored” from VND 60 million/sqm, and Sycamore by CapitaLand is priced at about VND 50 million/sqm,… The high price range and the long distance from the center of Ho Chi Minh City inadvertently create pressure on the liquidity of the projects.

A survey of apartment projects along National Highway 13, from Thu Duc City (Ho Chi Minh City) to Thuan An and Thu Dau Mot (Binh Duong), shows that projects with prices ranging from VND 45-50 million per sqm are almost “extinct,” while apartments priced below VND 55 million per sqm are becoming rarer. Especially, it is not easy to find a project located near Thu Duc City (Ho Chi Minh City) at this price range. If there is, the price increase will surely continue in the future. This shows that price fluctuations are happening quite rapidly in the area adjacent to Ho Chi Minh City.

Located on the frontage of National Highway 13, in Thuan An district (Binh Duong province), but only 800m from the boundary of Thu Duc City (Ho Chi Minh City), currently, only the The Emerald 68 project of Le Phong and Coteccons Groups, distributed by DKRA Realty, is offering prices ranging from VND 48-60 million/sqm. This price is considered a “rarity” in the area. If we consider the location on the same route as some projects in Thu Duc, the price is 30-50% softer.

Currently, some projects “next to” The Emerald 68, such as apartments in the Van Phuc Urban Area in Thu Duc City, are expected to be priced at no less than VND 120 million/sqm, or Urban Green (Thu Duc) with prices ranging from VND 75-82.3 million/sqm. Even compared to projects in Thuan An and Thu Dau Mot, The Emerald 68 is still at a good price threshold. Not to mention, the project has complete legal status, the prestige of the investor, construction quality, the distance to move to District 1 (only 11.5km), etc., are all “plus points” for this project.

Recently, the project has received positive attention from the market. Buyers expect that at the above price, The Emerald 68 will also increase in value if considered from the perspective of living, transfer, and leasing. This is especially true given that Binh Duong is currently receiving a lot of positive information about infrastructure and mergers…

In the data on the level of interest in real estate after the information about the merger of provinces and cities, Batdongsan.com.vn points out that in Binh Duong, Thuan An has a 26% increase in real estate interest, the highest in the area; followed by Di An with 23%, Dau Tieng with about 19%, and Bau Bang with 10%.

These figures accurately reflect the positive psychology and consensus of investors with the potential of the merger, especially in areas with strategic locations near Ho Chi Minh City. However, the merger is only one of the reasons why buyers increase their demand for Binh Duong real estate.

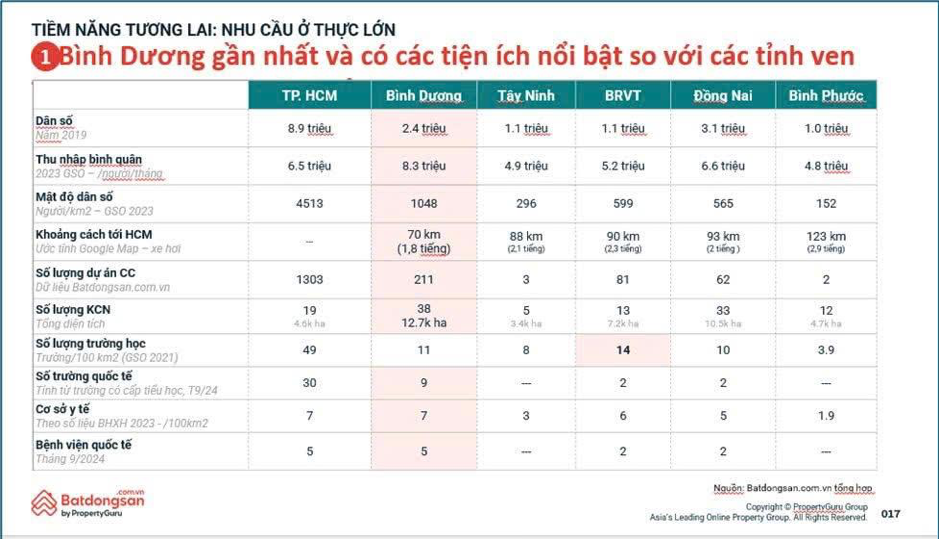

Binh Duong has many advantages in terms of population and per capita income, making it a “promising” destination for both residential and investment demands over the years. Source: Batdongsan.com.vn

Previously, in a report on the Binh Duong market, Batdongsan.com.vn pointed out that Binh Duong currently has more than 210 apartment projects with an existing population of 2.5 million, equivalent to 12,000 people/project. This demand is much higher than in Ho Chi Minh City with 8.9 million people/1,035 projects and Hanoi with 8.5 million people/1,010 apartment projects.

In addition to the existing population, Binh Duong also has the second-highest net immigration rate in the country, after Bac Ninh. This means that for every five people in Binh Duong, one person immigrates from another place each year, mainly concentrating around industrial parks in Di An, Thuan An, and Thu Dau Mot. Accordingly, the demand for buying apartments in Binh Duong remains high, and there are still many more projects that can continue to be launched in this market with a good absorption rate.

Ms. Nguyen Bao Khue – CEO of DKRA Vega (Member of DKRA Group) assessed that the impact of price increases in the East of Ho Chi Minh City has spread to neighboring areas and created advantages for many Binh Duong projects implemented nearby. If apartment prices in Thu Duc City (adjacent to Binh Duong) are mostly above the threshold of VND 100 million/sqm, the price level in Binh Duong is currently only 50-70% of that, along with an infrastructure connection that is even more advantageous. Because there is still room for price increases, many investors have turned to this area as an alternative option with more reasonable prices.

According to Ms. Khue, there are many factors affecting the price level of apartments in Binh Duong. First is the land price adjustment, which creates pressure on project development costs, leading to an increase in apartment selling prices.

Second, the development of arterial routes and connections between Binh Duong and Ho Chi Minh City increases the value of real estate in the area. Some notable routes include National Highway 13, the main traffic route directly connecting Ho Chi Minh City and Binh Duong, which will be expanded to 10 lanes; Ring Road 2 and 3 connecting Binh Duong with the Southeast region and Ho Chi Minh City; and My Phuoc – Tan Van expressway, an important route that significantly reduces travel time from Binh Duong’s industrial parks to Ho Chi Minh City’s major seaports.

Third, compared to Ho Chi Minh City, Binh Duong apartment prices are still reasonable, although they are increasing rapidly. With the rapid pace of urbanization, the demand for buying and renting houses from the local and neighboring labor forces will drive Binh Duong real estate potential in the future.

The Birth of a Global Financial Hub: Proposing a 687-ha International Financial Center in Ho Chi Minh City

The Ho Chi Minh City Department of Finance has proposed two options for the development of a Financial Center, based on thorough surveys and consultations. The department has recommended the second option, encompassing an area of approximately 687 hectares, for the construction of an international financial hub.

The Trial of Trung Hau 68: A Defendant Pays VND 20 Billion in Damages

Phùng Mỹ Luông has paid the highest amount in remedial fines, a staggering 19.7 billion VND. This significant sum showcases their commitment to rectifying any wrongdoings and taking responsibility for their actions.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)