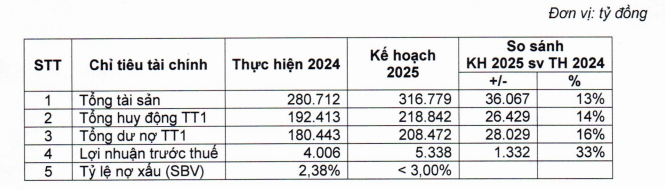

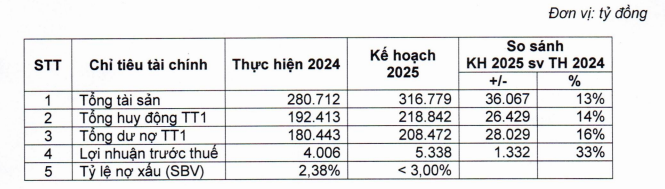

For 2025, OCB has set specific targets, including total assets of VND 316,779 billion by the end of the year, a 13% increase from the beginning of the year. The bank aims to achieve VND 218,842 billion in total market 1 funding, a 14% increase, and VND 208,472 billion in total market 1 loans, a 16% increase.

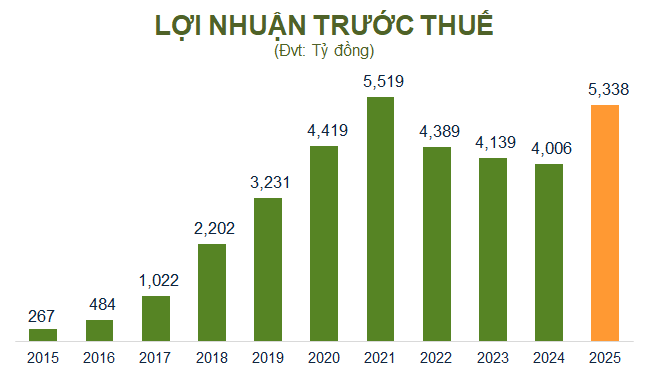

The bank’s projected pre-tax profit for 2025 is VND 5,338 billion, a 33% increase from the 2024 results, with a non-performing loan ratio of below 3%.

Source: VietstockFinance

|

According to Mr. Phạm Hồng Hải, CEO of OCB: “2025 is a crucial year for OCB as it marks the final phase of our 2021-2025 strategy and the transition to our new 2026-2030 vision. We are committed to executing our key actions to drive stable, transparent, and sustainable business growth, ultimately aiming to rank among the Top 5 private banks in ROE and ESG performance by 2030.”

In 2025, OCB continues to prioritize digitization as a key differentiator, along with expanding and optimizing its customer portfolio and providing comprehensive financial solutions for businesses. The bank will focus on implementing advanced technologies such as AI, Machine Learning, and Big Data to deeply analyze customer behavior, preferences, and needs, enabling personalized product offerings. OCB particularly highlights the potential of Open Banking as its most significant differentiator.

|

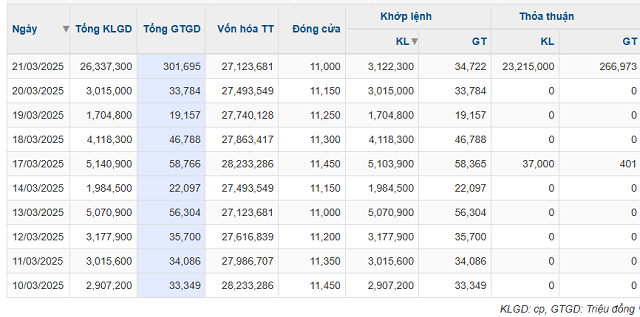

OCB stock trading from early March to date

Source: VietstockFinance

|

On the HOSE exchange, OCB recorded a trading volume of more than 23 million shares on March 21st, valued at nearly VND 267 billion, equivalent to VND 11,500 per share, higher than the closing price of VND 11,000 per share. The average daily trading volume of OCB shares since the beginning of the year has been over 2.6 million shares.

| OCB stock price movement since the beginning of the year |

– 09:30 22/03/2025

OCB Wins the Green and Sustainable Private Bank in Vietnam Award from The Asian Banker

The Asian Banker, Asia’s leading financial services publication for the banking industry, has recently awarded Orient Commercial Joint Stock Bank (OCB) the title of “Most Sustainable Private-Sector Bank in Vietnam.” This prestigious accolade recognizes OCB’s outstanding commitment to environmental sustainability and responsibility in the private banking sector in Vietnam. The award highlights OCB’s dedication to incorporating green initiatives and practices into its operations, setting a benchmark for other financial institutions in the country.

BAOVIET Bank: Accelerating Digital Transformation, Leveraging the Power of the Bao Viet Ecosystem

As per the recently published 2024 audited financial report, BAOVIET Bank has demonstrated impressive growth across key metrics, further cementing its position as a powerhouse in the Vietnamese banking sector. The bank has strategically leveraged its digital transformation journey and synergistic strengths within the Bao Viet ecosystem to drive this remarkable performance.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)