The Market is Offering us the Opportunity to Invest in Great Businesses at Historic Low Prices

According to SSI Research’s April 2025 strategic report, with the current US tax rate on Vietnamese goods at approximately 3.53%, the new 10% tax rate is unlikely to have a significantly negative impact as it is a common rate applied to all countries. In fact, this could slightly favor Vietnam as the tax differential between the US’s major trading partners is not too large.

However, if retaliatory tariffs are imposed, it could disrupt global trade as supply chains and demand cannot adjust quickly in the short term.

SSI Research believes that negative short-term impacts are inevitable. However, this bad news could also be good news in the long run, as it may lead to the development of a more balanced growth model, diversification of export markets, and incentives to build a more resilient economy.

Although the market may still have downward momentum in the short term, the recovery rate of the market after 1-3 months and 12 months is relatively high at 70% and 75%, with an average return of 16% after 12 months.

SGI Capital also believes that the risks from tariffs are being quickly reflected in stock prices and will gradually fade over the next two months as negotiations progress and conclude. In the second half of this year, foreign investment flows may turn to net buying due to attractive valuations and the process of upgrading to emerging market status.

The sharp drop in the VN-Index has brought the market’s valuation down to the cheap zone of the last 10 years, offering excellent long-term investment opportunities in many high-quality leading stocks. Even though tariffs will slow down growth, when all good and bad businesses are sold off equally to historical lows, many attractive long-term investment opportunities emerge.

According to SGI Capital, extreme price volatility in the coming days/weeks is still unpredictable, but once the peak of fear passes, a new order will gradually be established, and we will look back on this period as one of the best investment opportunities in the history of the Vietnamese stock market.

When the future is uncertain and prospects look bleak, it is also a good time to own stocks because the need to sell off and defend will make the valuation of all stocks more attractive, increasing long-term investment efficiency.

This is the time when the market is offering us the opportunity to invest in great businesses that are being sold off to historic low prices, which only exist for a short period during the peak of fear.

Industries Tend to Recover Better After Strong Market Corrections

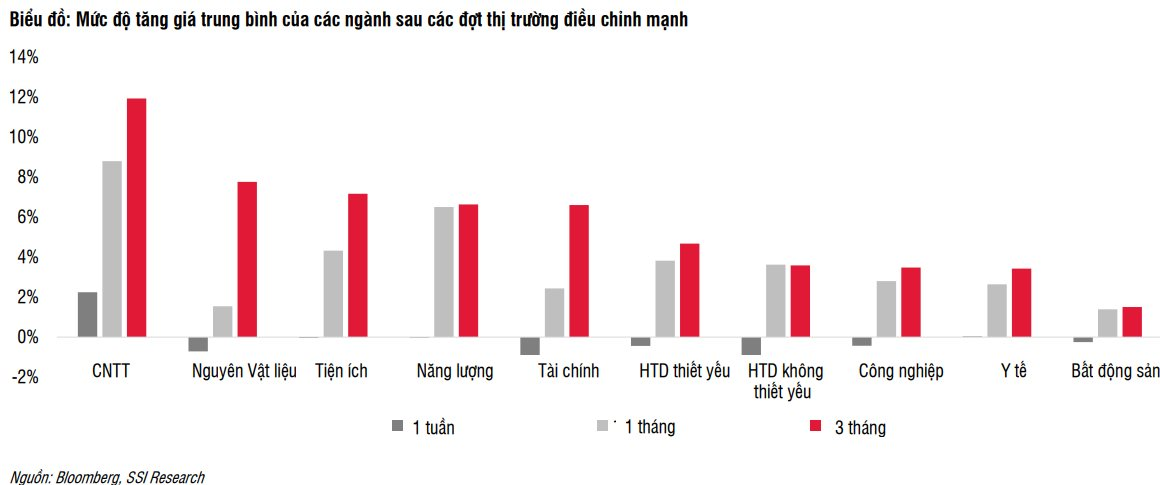

SSI Research believes that bad news can be good news for investors, especially in defensive sectors such as Essential Consumer Goods, Energy/Electricity, Information Technology, and industries related to domestic infrastructure such as Building Materials.

According to SSI Research, defensive sectors such as Information Technology, Energy, Utilities, Finance, and Essential Consumer Goods tend to recover better within 1-3 months after strong market corrections.

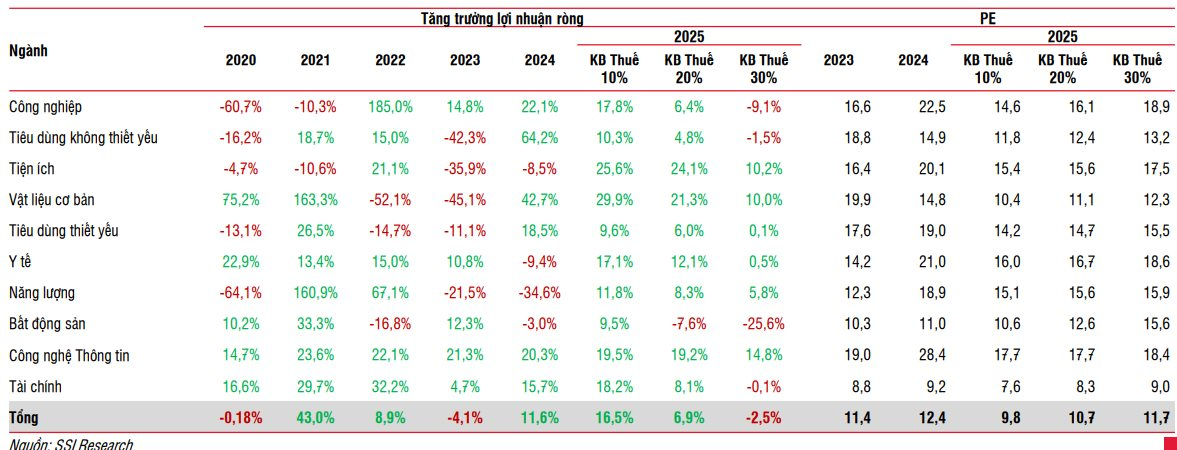

According to SSI Research’s preliminary estimates for over 80 monitored stocks, total corporate profits are expected to increase by 17% in the optimistic scenario with a 10% tax rate, and decline to single-digit growth if the average tax rate rises to 20%.

Business prospects depend on many variables and can be supported by government solutions to boost the domestic market.

SSI Research also provided assessments of several businesses.

Vietnam Construction and Import-Export Corporation (Vinaconex – VCG):

According to SSI Research, VCG is a leading infrastructure contractor and is expected to be one of the main beneficiaries of the accelerated public investment theme. In 2024, the profit margin reached 3.5%, reflecting a typical margin for infrastructure construction.

With 2025 being the last year of the 2021-2025 public investment cycle, SSI Research predicts that revenue and profits in the construction sector will continue to grow positively. Currently, VCG is the main contractor for several large-scale infrastructure projects, notably the Hanoi Ring Road 4 Project (~VND 1,100 billion over 3 years) and the Long Thanh International Airport. The total value of the packages that VCG and its joint venture members are implementing at the Long Thanh International Airport project exceeds VND 50,000 billion.

Profit expectations from the Cat Ba Amatina project include plans to transfer part of the project to other investors for further investment and/or collaborate with third parties for sales. For 2025, VCR (in which VCG owns 51% of shares) has set a business plan with total revenue of VND 1,793 billion and pre-tax profit of about VND 569 billion, indicating strong growth compared to revenue of VND 3 billion and a loss of nearly VND 22 billion in 2024.

Vietnam Apatite Phosphorus Joint Stock Company (PAT):

PAT is a leading producer of yellow phosphorus in Vietnam with a designed capacity of 20,000 tons/year. With its high competitive advantage in the region, PAT can expand its customer base, thereby increasing sales volume in 2025.

In addition, PAT offers an attractive dividend yield. The expected dividend for 2025 is 100% of par value (12% dividend yield) and the remaining unpaid dividend for 2024 is 25% of par value (3% dividend yield). High dividend stocks are especially suitable for defensive purposes in a declining market.

Binh Minh Plastic Joint Stock Company (BMP):

Consumption of plastic pipes may be supported by the recovery of the southern real estate market as well as the growth of public investment. The fact that the company’s output is sold only in the domestic market helps reduce the impact of global tariff fluctuations on the company’s consumption volume. Lower crude oil prices leading to lower plastic resin prices can also support the company’s profit margin. The dividend payout ratio is attractive at 10.5%.

Nhon Trach 2 Oil and Gas Power Joint Stock Company (NT2):

According to SSI Research, business results could improve as early as the first half of 2025. In the first quarter of 2024, NT2 was only allocated about 1 million kWh of contracted capacity (Qc), a very low level compared to the multi-year average, mainly due to the decline in gas sources in the Southeast region. However, SSI believes that the handover of the Phu My 3 BOT Power Plant (March 2024) and Phu My 2.2 (February 2025) to EVN will ease the gas shortage pressure and support NT2 in the first half of 2025, especially in the first quarter.

SSI also noted that the dry season peak (high electricity demand) in the year will mostly fall in the second quarter. Estimated net profit for the first half of 2025 is expected to reach VND 130-170 billion (compared to a loss of VND 36 billion in the same period last year).

Profit in 2025-2026 is expected to recover from the low level of 2024. SSI estimates that NT2’s electricity output will increase by 15% year-on-year. In addition, SSI expects that machinery and equipment will be fully depreciated by the end of 2025, continuing to support NT2’s profit from 2026 onwards.

The Seafood Savior: A Chairman’s Vow to Rescue Shareholders

“While Nam Viet has a presence in the US market, it does not consider it a primary focus. Instead, the company’s key markets lie in China, the Middle East, Brazil, Asia, Mexico, and other regions. These markets form the backbone of Nam Viet’s business, with a strong emphasis on international expansion and a diverse customer base.”

The Ultimate Headline: Short-Term Adjustment Risks Linger

The VN-Index declined with the emergence of a High Wave Candle pattern. The persistent low trading volume, below the 20-day average, indicates cautious trading among investors. Currently, the index is testing the Middle line of the Bollinger Bands. If this level is breached in upcoming sessions, the situation will turn more pessimistic, and a retreat to the old peak breached in June 2024 (1,290-1,310 points) is highly likely. Meanwhile, the Stochastic Oscillator and MACD continue their downward trajectory after issuing sell signals, suggesting that short-term correction risks persist.