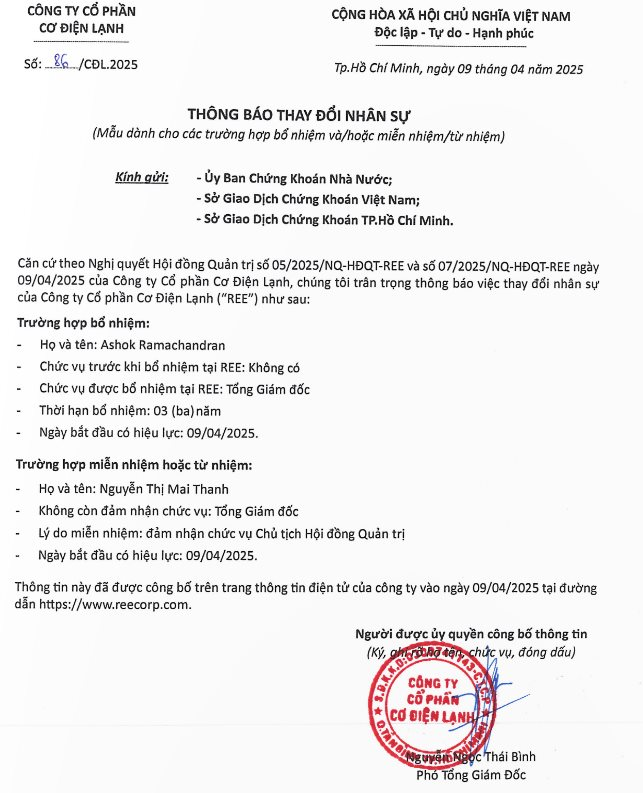

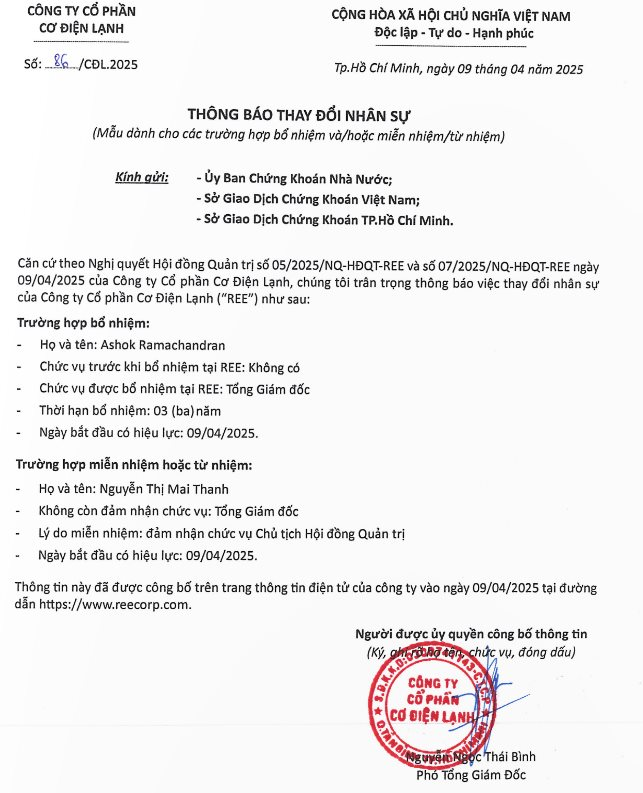

On April 9, REE Corporation (HOSE: REE) announced changes to its senior management team. The company has appointed Mr. Ashok Ramachandran as its new CEO, effective immediately, for a three-year term.

Concurrently, Ms. Nguyen Thi Mai Thanh has been relieved of her duties as CEO and will assume the role of Chairman of the Board of Directors, also effective April 9, 2025.

Prior to the annual general meeting in 2025, REE Corporation announced the addition of senior personnel to its Board of Directors and executive team. Mr. Ashok Ramachandran, an Australian national born in 1980, was nominated to replace Mr. Huynh Thanh Hai, who had submitted his resignation on February 12, 2025.

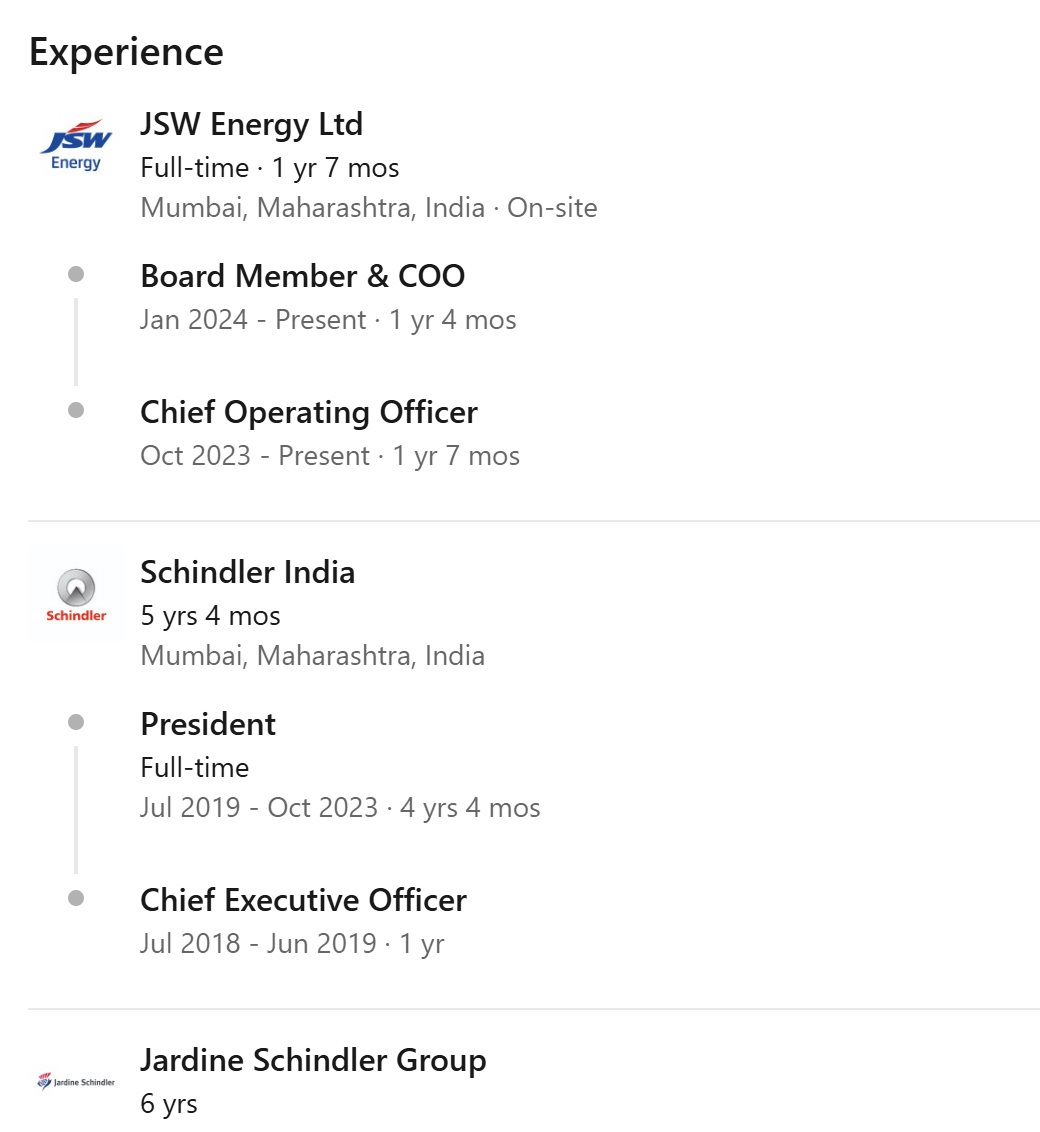

Mr. Ashok holds a master’s degree and has over 20 years of experience in the fields of engineering, management, and business operations in major markets such as Vietnam, Malaysia, India, and the Asian region. He currently serves as the Executive Director at JSW Energy, one of India’s leading energy companies.

Speaking at the annual general meeting, Ms. Thanh assured shareholders, “You may have had some concerns recently, but rest assured, everything is in order. In my conversations with Mr. Ashok, he has committed to working alongside our talented team to lead REE into a new phase of growth.”

With a clear growth strategy, innovative human resource policies, and a stable dividend policy, REE continues to solidify its position as one of the listed companies with a strong financial foundation and a long-term vision.

As one of the first companies to be listed on Vietnam’s stock exchange in 2000, REE has since expanded its operations into critical sectors such as energy, water and environment, and real estate.

According to the approved plan, REE aims to achieve a revenue of VND 10,248 billion in 2025, marking a 22% increase from the previous year and the first time the company has surpassed the VND 10,000 billion revenue threshold. The expected after-tax profit for the company’s parent unit is VND 2,427 billion, a nearly 22% increase, and only slightly lower than the historic peak recorded in 2022.

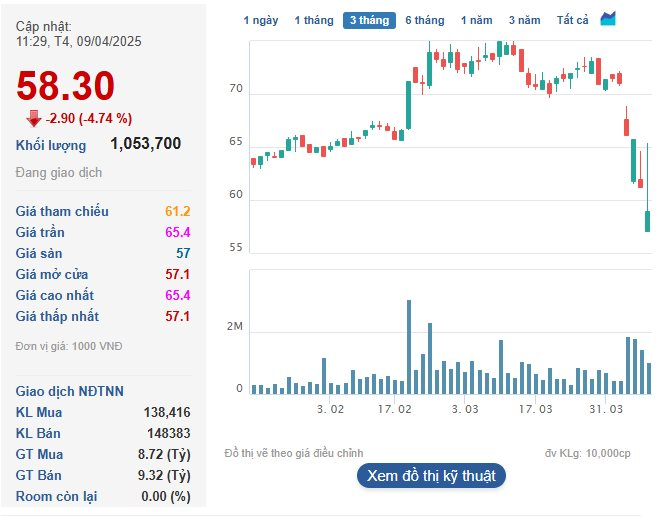

During the trading session on April 9, REE shares were priced at VND 58,300 per share.

“State Representative Nguyen Thanh Tung: Guardian of Vietcombank’s 30% State-Owned Capital”

On January 10, 2025, the State Bank of Vietnam (SBV) appointed a representative to manage the state capital at Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank, HOSE: VCB).

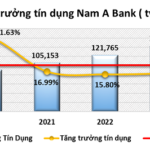

“Steady Growth and Effective Risk Management: Nam A Bank’s Path to Success in 2024”

As of the end of 2024, Nam A Bank (HOSE: NAB) reported impressive growth in its business performance. The bank witnessed a significant expansion in its scale of operations, coupled with enhanced asset quality. Notably, the bank’s indicators for mobilization and credit outstanding balances demonstrated remarkable effectiveness, reflecting the bank’s strong performance and strategic success.

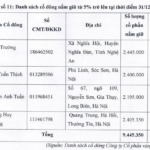

The Golden Exodus: A Mining Company’s Leadership Transition

Despite a challenging economic landscape, Vàng Lào Cai has persevered through difficult times. From 2020 onwards, the company experienced a hiatus in sales and service revenue, culminating in a challenging year in 2023, with a loss of nearly 14 billion VND. As of the end of 2023, the cumulative loss exceeded 113 billion VND.