The Rise of Vietnam’s Healthcare Industry: Attracting Global Giants

The rise of the middle class and increased health awareness, particularly post-COVID-19, have propelled the healthcare industry to be one of the fastest-growing sectors in Vietnam today.

According to the World Bank, Vietnam is expected to maintain its position in the top 20 most stable and sustainable medical equipment markets globally.

This explains why more and more global giants are investing heavily in the country’s healthcare market.

The Pharmaceutical Sector Attracts a Host of “Big Players”

In the latest development, the French pharmaceutical group Biocodex has declared Vietnam a strategic market with the official launch of its subsidiary, Biocodex Vietnam Co., Ltd., in Ho Chi Minh City. Biocodex, a 70-year-old company, is known for its pioneering work in developing healthcare solutions based on beneficial microorganisms, particularly the specific yeast strain Saccharomyces boulardii CNCM I-745, a probiotic.

“The Biocodex Group has decided to choose Vietnam – the first country in the Asia-Pacific region – as the destination for establishing a member company. Vietnam is a market full of potential for the Company’s products. Biocodex Vietnam aims to triple its turnover within the next five years,” shared Nicolas Coudurier, CEO of the Biocodex Group.

With this launch, Biocodex’s management affirms its commitment to actively collaborate with Vietnam’s healthcare sector in community health improvement initiatives. Biocodex Vietnam will provide solutions in three key healthcare areas: microbiota care, women’s health, and initial care and pain management.

Image: The French pharmaceutical group Biocodex declares Vietnam a strategic market with the launch of Biocodex Vietnam Co., Ltd. in Ho Chi Minh City.

Prior to Biocodex, another pharmaceutical giant, AstraZeneca from the UK, has been deeply engaged in Vietnam. During a meeting with Prime Minister Pham Minh Chinh earlier this year, Nitin Kapoor, Chairman and General Director of AstraZeneca Vietnam, expressed that he considers “Vietnam as his second home country.”

AstraZeneca has also announced significant investments in Vietnam’s healthcare sector. The company currently employs 700 people and is investing $360 million from 2020 to 2030.

Sandoz, a global leader in generic medicines and biosimilars, has also officially inaugurated its operations in Vietnam as an independent company after completing its separation from Novartis. With this move, Sandoz has officially launched its business in the country.

According to Sandoz, the Vietnamese market holds a special position in Southeast Asia and is the largest market in the region, expected to surpass Thailand in the coming year, with returns reaching billions of dollars.

During Prime Minister Pham Minh Chinh’s visit to the WEF’s Annual Meeting, a dialogue on “Vietnam’s Pharmaceutical Industry in the Digital Age: Future through Innovation and Technology” attracted 15 leading global pharmaceutical corporations and prominent Vietnamese pharmaceutical enterprises. At the event, it was revealed that the total value of Vietnam’s pharmaceutical market increased from $2.7 billion in 2015 to an expected $7 billion in 2025, and it is projected to reach $10 billion by 2026.

M&A Activities Also Flourish

In another development, the allure of Vietnam’s healthcare market is evident through a series of M&A deals by foreign investors with prominent pharmaceutical companies, large pharmacy chains, and hospitals.

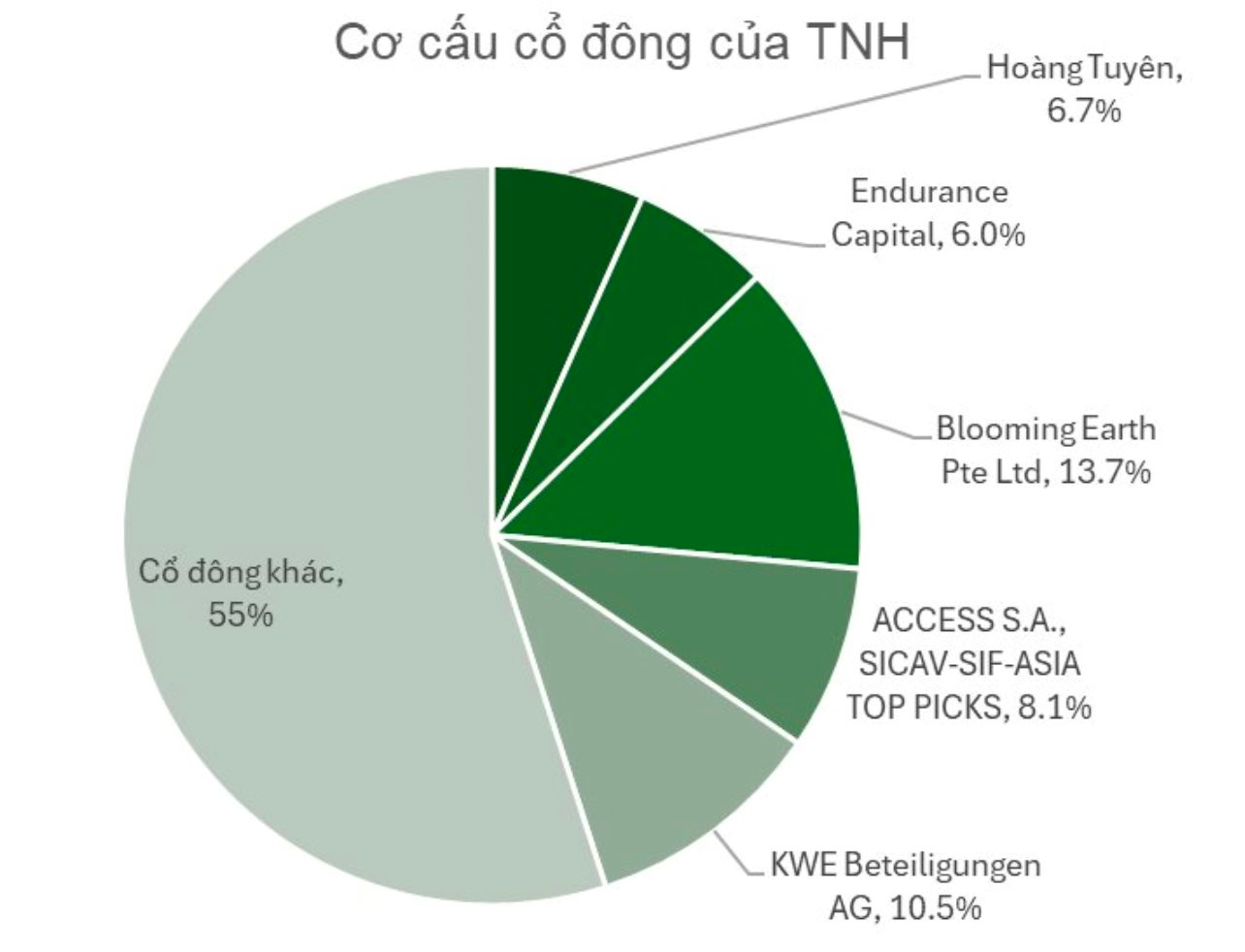

Most recently, Mekong Capital, a Vietnam-based private equity fund, acquired a 13.74% stake in TNH Hospital, a listed healthcare company, according to DeelstreetAsia. The investment was made through Mekong Enterprise Fund IV, a $246 million fund.

A look at TNH’s current shareholder structure reveals that more than half of the hospital’s capital is now in the hands of foreign investors. Since June 2024, TNH’s General Meeting of Shareholders has approved changing the company name from Thai Nguyen International Hospital JSC to TNH Hospital Group JSC and increasing the foreign ownership limit from 49% to 70%.

Mekong Capital’s previous investments in the healthcare sector include Entobel, LiveSpo, Gene Solutions, and Pharmacity.

Notably, Warburg Pincus has invested a total of $2 billion in Vietnam and announced its investment in the Cross Asia General Hospital System. Dongwha Pharm Group’s acquisition of a majority stake in the Trung Son pharmacy chain, and their plans to double its scale, is another significant development.

The purchase of controlling shares in FV Hospital by Singapore’s Thomson Medical Group for over $380 million is also worth mentioning. Raffles Medical Group’s acquisition of a majority stake in the American International Hospital (AIH) for $46 million is another example.

In early 2024, TVM Capital Healthcare, a Singapore-based private equity firm, invested in Alina Vision, an eye care company in Vietnam. Additionally, in April 2024, Singapore’s sovereign wealth fund, GIC, doubled its investment in the Nhi Dong 315 pediatric clinic and maternity care system in Vietnam….

Unlocking the Potential: Reviving Stalled Trillion-Dollar Projects to Spur Economic Growth

The Ministry of Construction will conduct a thorough review of wasteful and prolonged projects, and propose appropriate, timely, and effective mechanisms and policies for addressing them. This includes projects such as the second campus of Bach Mai Hospital, Viet Duc Hospital, and flood prevention measures in Ho Chi Minh City.

Will Merging Provinces Bring Dong Nai Land Prices Back to Their “Golden Age”?

“Experts believe that even with the opening of Long Thanh Airport and the completion of surrounding infrastructure, property prices will rise but not significantly. This is because many investors had already bought up land in the area 3-4 years ago, and as such, have already reaped the benefits of any potential price increases.”

The Capital’s Commitment: Commencing Construction on Two Affordable Housing Mega-Projects

The Hanoi People’s Committee has instructed relevant departments to expedite the development of two social housing projects, Tien Duong 1 and Tien Duong 2, in the Dong Anh district. Emphasizing the importance of efficient procedures, the committee has urged the implementation of a “green channel” approach to facilitate construction, aiming for a groundbreaking commencement in September.

The Industrial Array Pivot

Recognizing the challenging energy landscape ahead, the management of PC1 made a pivotal decision three years ago to diversify their strategy. With a keen eye on the post-COVID-19 world, they identified industrial real estate as a key long-term focus, alongside their ability to recover receivables from EVN. This strategic shift sets the company on a new path, one that holds promise in the face of challenges posed by Planning No. 8.