Petrovietnam’s Impressive Performance in the Face of Global Challenges

Petrovietnam, Vietnam’s leading oil and gas group, has demonstrated remarkable resilience and dynamism in the face of complex and unpredictable global circumstances. Despite the challenges, the group has maintained positive business operations in the first few months of 2025.

March and the first quarter of 2025 witnessed impressive growth for Petrovietnam across various sectors, notably electricity, petroleum, gas, and NPK production. In March 2025, several key performance indicators showed significant increases compared to the previous month, including crude oil (up 12%), gas (up 24%), electricity (up 35%), petroleum products (up 87%), urea (up 10%), NPK (up 37%), LPG (up 20%), and condensate (up 17%).

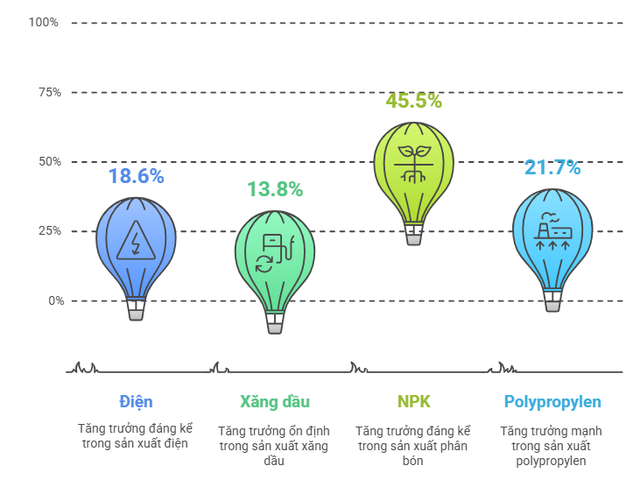

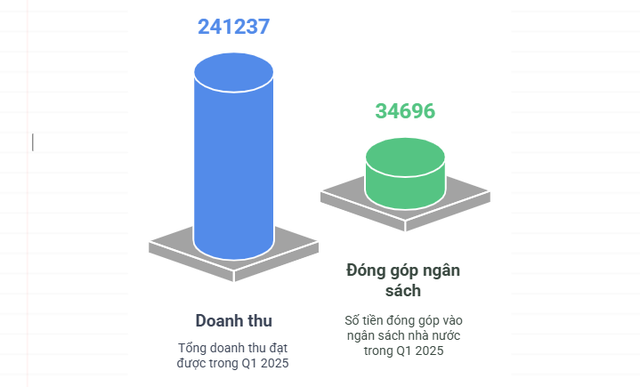

The first quarter of 2025 saw the group exceed most of its financial targets, with a remarkable performance in four key areas: electricity generation (up 18.6% year-on-year), petroleum products (up 13.8% year-on-year), NPK (up 45.5% year-on-year), and polypropylene (up 21.7% year-on-year). Petrovietnam’s financial performance in the first quarter of 2025 was outstanding, with total revenue estimated at VND 241,237 billion, reflecting a daily average revenue of over VND 2,680 billion. This represents a notable increase compared to the same period in 2024.

The group’s contribution to the state budget was estimated at VND 34,696 billion, a 10% increase year-on-year. Investment value in the first quarter was estimated at VND 7,387 billion, reflecting a significant 39% increase compared to the same period in 2024.

As the group moves into April and prepares for the second quarter of 2025, it has swiftly analyzed the impact of the US countervailing duty policy announced on April 2, devising responsive strategies and policy recommendations to ensure the fulfillment of its goals and plans. Petrovietnam has proactively adjusted its business strategies to optimize costs and maintain its development trajectory, including reviewing investment projects, optimizing oil and gas extraction costs, and increasing extraction output, as well as exploring new export markets.

Looking ahead, Petrovietnam will focus its resources on the Ninh Thuan 2 Nuclear Power Project, officially assigned to the group by the Prime Minister on April 1, 2025. The group will also pursue LNG business expansion, ensure sufficient gas supply for fertilizer production to increase capacity and output when market conditions are favorable, and implement measures to boost oil and gas extraction, while maintaining international trade.

In anticipation of financial and monetary fluctuations, Petrovietnam has developed strategies to secure cash flow, arrange financing for projects and business operations, optimize costs, and promote cost-saving and anti-waste measures.

For the month of April and the second quarter of 2025, Petrovietnam’s key blocks have defined specific orientations: the E&P block will accelerate the Dai Hung Phase 3 Project, while the gas-power block will expedite the Nhon Trach 3 and 4 Projects. The refining and petrochemical block will enhance its commercial activities, and all blocks will work to expedite projects such as the expansion of the Dung Quat Refinery, the increase in LNG storage capacity at Thi Vai, and various power projects.

In the long term, Petrovietnam is committed to market expansion, strengthened international cooperation, improved governance, and the adoption of advanced technology and digital transformation. The group will ensure sustainable growth through effective asset management, cost optimization, and a culture of innovation in its business operations.

A Shareholder Accumulated Over 4 Million TVS Shares in 10 Days

In just 10 days, Dinh Thi Hoa, a major shareholder, purchased shares of TVS four times on the Ho Chi Minh Stock Exchange (HOSE). Her transactions included 1.44 million shares on March 7th, followed by 950,000 on the 11th, an additional 945,000 on March 13th, and finally, 700,000 shares on March 17th, totaling over 4 million shares.

The Secret Behind Eximbank’s Record Pre-Tax Profit of Over VND 4,000 Billion

“With a strategic focus on diversifying its revenue streams and financial services offerings, Eximbank has carefully structured its lending portfolio to prioritize safety and efficiency. This approach has been instrumental in driving impressive business results for the bank, setting it on a path towards a remarkable year in 2024.”