Angimex, a prominent Vietnamese company specializing in rice production, processing, and trade, has recently encountered financial challenges, leading to the freezing of its bank accounts and a forced delisting from the Ho Chi Minh Stock Exchange (HoSE).

VietinBank, BIDV, and Vietcombank branches in An Giang Province have frozen Angimex’s bank accounts following a request from the civil execution agency in Long Xuyen City, An Giang Province. This development comes as a result of the company’s deteriorating financial situation.

HoSE’s decision to forcibly delist Angimex’s shares (stock code: AGM) was prompted by the company’s 2024 audited financial statements, which revealed a cumulative loss of over 425 billion VND, far exceeding its paid-up capital of 182 billion VND. Angimex’s equity also dipped into negative territory, with a deficit of nearly 243 billion VND.

Headquartered in Long Xuyen City, Angimex was once a leading rice exporter in Vietnam, generating over 2,000 billion VND in export revenue during its peak years from 2017 to 2021. However, the company’s fortunes took a turn for the worse starting in 2022, with annual losses of around 200 billion VND for three consecutive years. In 2024, Angimex’s net revenue plummeted to just 240 billion VND, a mere 30% of the previous year’s figure.

Angimex headquarters in Long Xuyen City, An Giang Province

In an attempt to rectify its financial situation, Angimex has been actively liquidating and leasing its unused warehouses and land, as well as planning to divest its remaining 49% stake in Angimex Furious, a motorcycle and spare parts business, to The Golden Group (UPCoM: TGG). Angimex also intends to sell 55% of its capital contribution in Angimex Food, a subsidiary engaged in the rice business, to transform it into a joint-stock company.

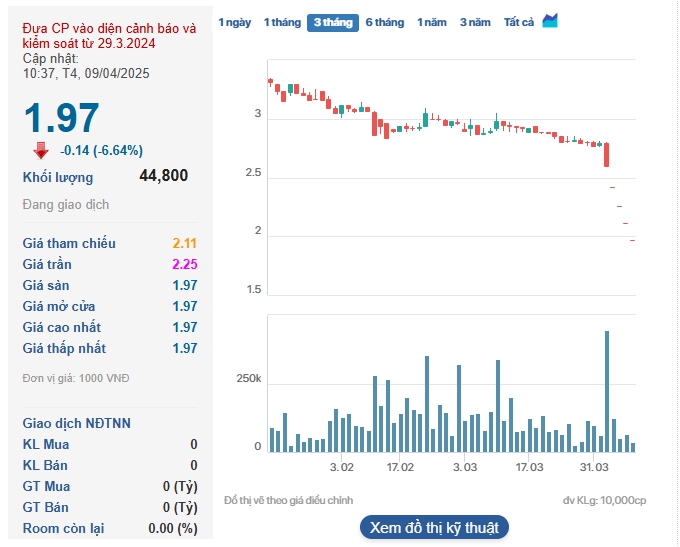

Angimex’s struggles have been reflected in the performance of its stock, which has witnessed a continuous downward trend, losing nearly 97% of its value compared to its historical peak in March 2022.

Angimex’s stock price has plummeted, losing nearly 97% of its value compared to its historical peak

The Birth of a Mega-Project: SGN Invests 250 Billion VND in a New Company for the Long Thanh Airport Development

With a capital contribution of nearly VND 250 billion, equivalent to 75% of the charter capital of Saigon-Long Thanh Ground Services Joint Stock Company, SGN authorized two representatives for its contributed capital portion.

The Smart Money Mystery: Unveiling the Near-Thousand Billion Buyout and the FPT Buying Spree

The proprietary trading arms of securities companies were net buyers to the tune of VND969 billion across the board.