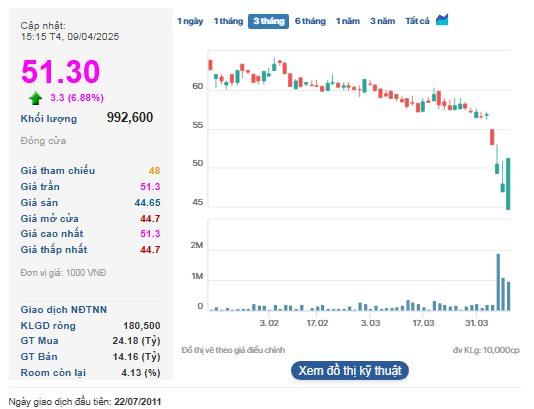

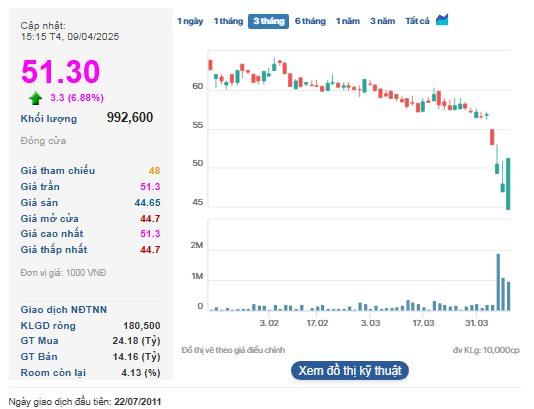

While the stock market has been in a downward spiral, with stocks of all sizes consistently hitting rock bottom, one particular code, PTB of Phu Tai JSC, has caught attention with its surprising surge.

Phu Tai is a prominent enterprise in the fields of wood exploitation, processing, and export, as well as construction stone material trading.

According to the 2024 financial report, with revenue exceeding VND 5,600 billion, Phu Tai’s export revenue accounted for 66% of the total.

Dragon Capital’s statistics highlight Phu Tai’s impressive export figures.

Dragon Capital’s statistics reveal that 39.9% of Phu Tai’s export revenue comes from the US market, placing them among the top exporters on the HOSE.

This counterintuitive performance of PTB is even more notable given the recent leadership changes within the company. At the upcoming Annual General Meeting, PTB is expected to propose the dismissal of Mr. Do Xuan Lap from his position as a member of the Board of Directors.

Prior to this, on the evening of December 17, 2024, Mr. Lap was arrested in a large-scale illegal gambling operation at the Diamond Club, operated by Vietnam Star Hotel Company (located at Ramana Hotel, 323 Le Van Sy Street, Ward 13, District 3, Ho Chi Minh City).

Mr. Lap, aged 67 and a resident of Quy Nhon, Binh Dinh, is well-known as the Chairman of the Vietnam Timber and Forest Products Association (Viforest). He often appeared in the media to provide insights into the challenges, trends, and opportunities in Vietnam’s wood industry.

In addition to his role at Viforest, Mr. Lap was also the legal representative of Tien Dat Wood Industry JSC and a member of PTB’s Board of Directors.

Following this incident, on January 22, PTB issued a response stating that Mr. Lap was an independent member of the Board of Directors and was not directly involved in the company’s management and operations. Therefore, the event would not impact the company’s business activities.

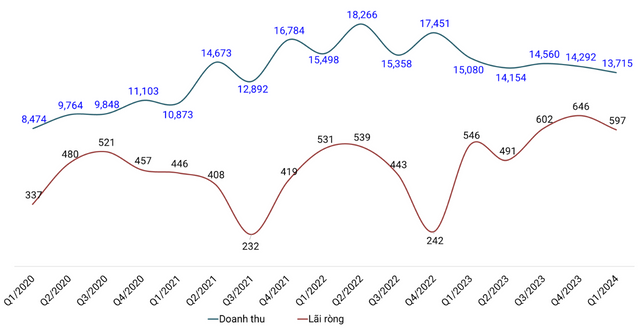

In terms of business performance, in 2024, PTB’s consolidated revenue reached VND 6,656 billion, a 17% increase compared to the previous year. After deducting all expenses, the company’s pre-tax profit was VND 471 billion, a 46% increase.

During the same year, PTB ceased the operations of several factories and branches, mainly in the stone exploitation and processing group, including a stone tile processing factory in Dong Nai, a Granite processing factory in Khanh Hoa, the Dien Tan stone tile factory in Khanh Hoa, and the Bazan and Granite processing factory in Dak Nong, all of which were shut down in April 2024. These closures were part of the company’s restructuring strategy.

For 2025, PTB has set a consolidated revenue target of VND 7,343 billion, a 10% increase, and a pre-tax profit goal of VND 528 billion, a 12% rise compared to the previous year.

As of September 30, 2024, PTB’s total assets amounted to VND 5,174 billion, with fixed assets and inventory accounting for the largest proportions, at VND 1,629 billion (31.5%) and VND 1,555 billion (30%), respectively.

In December 2024, PTB distributed an interim cash dividend for 2024 with a ratio of 10% per share, equivalent to VND 1,000 per share. With more than 66 million shares in circulation, the company planned to spend VND 66 billion on this interim dividend.

Dragon Capital’s Foreign Ownership in PVS Shares Rises Above 7%

Dragon Capital has bolstered its investment in PVS by acquiring an additional 1.42 million shares, elevating its ownership stake from 6.8054% to 7.1025%.

“Unleashing Dragon Capital’s Secrets: The 740,000 Đức Giang Chemical Shares Sale”

Dragon Capital, a prominent foreign investment fund, has recently offloaded 740,000 DGC shares through four of its member funds. This strategic move has resulted in a decrease in their ownership stake, now falling below the 8% threshold in Duc Giang Chemicals, a notable player in the chemical industry.

The Dragon Capital Group Slashes Ownership in DGC to Below 8%

Dragon Capital has reported the sale of 740,000 DGC shares during the November 26th trading session. This move brings their ownership stake in Duc Giang Chemical Group JSC (HOSE: DGC) below the 8% threshold.