—

Gold prices remain below the $3,000 per ounce mark amid heightened turmoil across global financial markets and geopolitical tensions in Ukraine and the Middle East.

Inflationary pressures are mounting, and gold is predicted to remain a strong draw for investors throughout 2025. However, gold, the precious metal, still faces near-term adjustment risks as US and global stock markets, along with various commodities, could see sharp declines, forcing institutional and individual investors to sell gold to cover losses in other markets.

According to senior market analyst Nikos Tzabouras of Tradu.com, gold prices fell as investors sought cash and other safe-haven assets amid market chaos, creating the potential for deeper corrections.

Gold prices continue their downward trend. (Photo: Minh Đức).

Bart Melek, TD Securities’ commodity strategy, states that the gold market is under pressure due to liquidity concerns and investors closing their positions.

Gold Price Movements Today

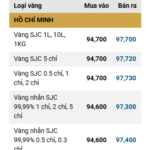

+ Domestic gold prices

As of 6 a.m. on April 9, gold bullion prices at Doji and SJC were listed at 97.7 – 100.2 million VND per tael (buying – selling), an increase of 600,000 – 100,000 VND per tael (buying – selling) compared to the previous morning.

Meanwhile, Doji’s gold ring prices are listed at 97.7 – 100.2 million VND per tael (buying – selling), up 1 million VND per tael (buying) and 100,000 VND per tael (selling).

+ International gold prices

International gold prices listed on Kitco were at $2,979 per ounce, down $8 per ounce from the previous afternoon. Gold futures last traded at $2,979 per ounce.

Gold Price Forecast

Rich Checkan, President and CEO of Asset Strategies International, predicts a rebound in gold prices in the coming period. According to him, the recent sell-off was a cash-raising move after the stock market plunge triggered by US tariff policies. Checkan believes that this gold price dip will attract new buyers to the market.

The US-China trade tensions, especially after President Donald Trump’s statement on not delaying tariffs, are also significant. Such uncertainties often boost safe-haven demand, supporting gold price increases.

However, downturns in stock, crypto, and commodity (oil, etc.) markets could drag gold prices lower.

Analysts suggest that, in the short term, gold prices could fluctuate within the range of $2,960 – $3,100 per ounce. Nonetheless, profit-taking by large investors may also trigger unexpected downward adjustments.

—

The Golden Pause: Expert Insights on Gold’s Price Plateau

Gold has maintained its price above the $3,000 mark, indicating potential for further record highs in the long term. Any price dips at this point are healthy and present a strong buying opportunity.

Selling a House at the Peak: A Golden Opportunity. A year on, gold profits soar by 60 million, while the old house appreciates from 3 billion to 5 billion, and the desired home now costs 7 billion.

The price of gold has been on a record-breaking rally, surging past 99 million VND per tael on March 18th, sparking frenzied discussions on social media. This surge has been a boon for early buyers, but it has also left many who attempted to ride the wave struggling. The rapid rise in gold prices pales in comparison to the skyrocketing housing prices, leaving some “peak chasers” in a precarious position.

The Highest Gold Price in History

The investor community remains vigilant in the face of ongoing uncertainties surrounding President Donald Trump’s tariff plans. The potential impact of these tariffs continues to loom large, heightening the focus on risk mitigation strategies. As the trade landscape evolves, investors are keenly aware of the need to navigate potential pitfalls and protect their portfolios. This heightened awareness underscores the critical importance of staying informed and proactive in today’s dynamic market environment.