Illustrative image

Military Commercial Joint Stock Bank (MB – Code: MBB) has just announced the documents for the 2025 Annual General Meeting of Shareholders (AGM). The meeting is expected to be held on April 26 at the National Convention Center, 57 Pham Hung, Me Tri, Nam Tu Liem, Hanoi.

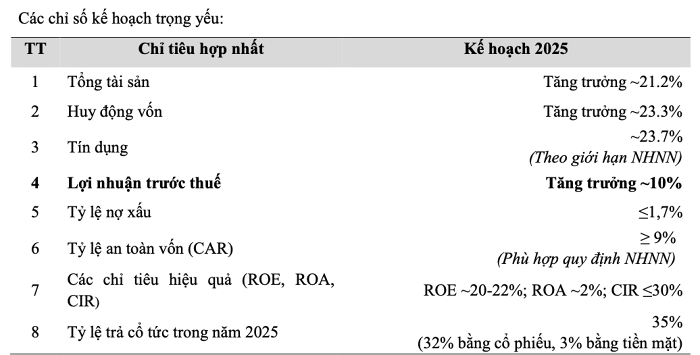

Profit target increases by 10%

At this year’s AGM, the Bank’s management is expected to present to shareholders the 2025 business plan with a profit before tax increase of approximately 10% over the previous year. In 2024, the bank recorded a consolidated pre-tax profit of VND 28,829 billion. Thus, MB’s estimated consolidated pre-tax profit in 2025 is expected to reach approximately VND 31,712 billion.

In terms of total asset target, the bank aims to increase by 21.2%, reaching nearly VND 1,370,000 billion by the end of 2025. Capital mobilization in 2025 is expected to grow by 23.3% while credit is forecast to grow by approximately 23.7% in 2025, depending on the limit set by the State Bank of Vietnam (SBV)

In 2025, the non-performing loan ratio will be controlled below 1.7%, and the CAR ratio will comply with Base II at a minimum of 9%. In terms of indicators such as ROE (approximately 20-22%), ROA (approximately 2%), or CIR below 30%, MB is among the top in the banking industry.

By the end of 2025, MB aims to have 34-35 million customers and will reach the milestone of 40 million customers by 2029.

Dividend payout in both cash and shares with a ratio of 35%

At the AGM, the Board of Directors (BOD) of MB will also seek shareholders’ approval on the profit distribution plan for 2024. Specifically, after making provisions to various funds, the total post-tax profit for 2024 retained by MB reached VND 15,426 billion. The total accumulated undistributed profit was VND 23,752 billion.

In 2025, the bank plans to use VND 21,556 billion to pay dividends to shareholders, with a total ratio of 35% consisting of two components.

Accordingly, MB will allocate VND 1,831 billion for cash dividend payment with a ratio of 3%.

At the same time, MB also allocates VND 19,726 billion for dividend payment in shares, thereby increasing its charter capital accordingly. Specifically, the bank plans to issue more than 1.97 billion shares to pay dividends to existing shareholders with a ratio of 32%. The timeline for implementing the above plan is within 2025, subject to approval from the competent authorities.

In addition to increasing capital through dividend payment in shares, MB also plans to privately issue an additional 62 million shares, equivalent to a charter capital increase of VND 620 billion. This plan was approved by the 2024 AGM.

Previously, MB had increased its capital to more than VND 61,022 billion after completing the 2023 dividend payment with a ratio of 15%. If both capital increase plans are completed, MB’s charter capital is expected to increase from more than VND 61,022 billion to VND 81,368 billion.

The bank stated that the additional capital will be used to supplement investment capital of VND 7.7 billion (including investment in MB’s headquarters in the Southern region, Central region and/or other regions with a total investment of less than 20% of the bank’s capital); and supplement working capital of VND 12.6 billion (for new business models and activities)

Investing VND 5,000 billion in MBV, divesting from MBCambodia and MCredit

At this AGM, the BOD will also present to the AGM for approval the receipt of compulsory transfer (CGT) and the implementation of the contents in the CGT plan (including any amendments and supplements) that have been approved.

Specifically, MB will contribute capital to MBV up to VND 5,000 billion. Based on the approved plan, MBV can be converted into a joint-stock commercial bank with two or more members, a joint-venture bank, a joint-stock commercial bank, a 100% foreign-owned bank, merged into MB, or in another form in accordance with the law.

In addition, the BOD will present to the AGM the plan to change the legal form of MB (Cambodia) Plc. to a joint venture/joint-stock/other form in accordance with Cambodian law; and to change the legal form of MB Shinsei Consumer Finance Company Limited to a single-member limited liability company/joint-stock company.

At the same time, MB plans to contribute capital, purchase, sell, transfer, and change the ownership ratio of shares and capital contributions in MBCambodia and MCredit, resulting in these entities no longer being subsidiaries of MB.

MB also plans to establish a subsidiary bank in Laos (based on the conversion of the MB Laos Branch) and to establish branches and representative offices in potential countries with favorable business environments and/or where MB has opportunities to expand its network (such as South Korea, Japan, China, Singapore, and Taiwan)

In addition to the above, the MB management will also submit to shareholders for approval several other matters within the competence of the AGM, such as: Amending and supplementing the Financial Management Regulations in accordance with the law, MB’s Charter, governance requirements at MB, and authorizing the BOD to approve and issue; Implementing solutions to address significant financial fluctuations of MB (if any) in accordance with the law and MB’s actual situation; Offering, issuing, registering for listing and trading non-convertible bonds without warrants on the securities trading system in Vietnam and abroad after completing the offering and issuing procedures, in accordance with the law and the guidance of the competent authority; Deciding to establish, buy back organizations, subsidiaries, associated companies, and funds operating in the fields of science, technology, innovation, digital industry, digital business, and digital assets, and related activities, in cases where it is prescribed by law or oriented/directed by the competent authority;…

The Stock Market Wrestler: How Mai Phương Thúy Turned a Tidy Profit of 1.5 Billion VND Overnight by Grappling with Billionaire Trần Đình Long’s Shares.

Yesterday, former Miss Vietnam Mai Phương Thúy took to Facebook to share her recent investment move. In her post, she revealed that she had purchased one million shares of Hoa Phat Group (HPG) at the floor price. Her exact words were: “Struggled all day just to buy one million HPG shares at the floor price.”

The Seafood Savior: A Chairman’s Vow to Rescue Shareholders

“While Nam Viet has a presence in the US market, it does not consider it a primary focus. Instead, the company’s key markets lie in China, the Middle East, Brazil, Asia, Mexico, and other regions. These markets form the backbone of Nam Viet’s business, with a strong emphasis on international expansion and a diverse customer base.”

“Choosing Competition Over Compromise Pays Off: Cholimex Chili Sauce’s 15-Year Success Story of Consistent Growth, 50% Annual Dividends, and a Skyrocketing Stock Price to 330,000 VND – Quadruple the Price Once Offered by Masan”

This is Cholimex Food’s highest-ever financial result, marking a positive growth streak for 15 consecutive years.