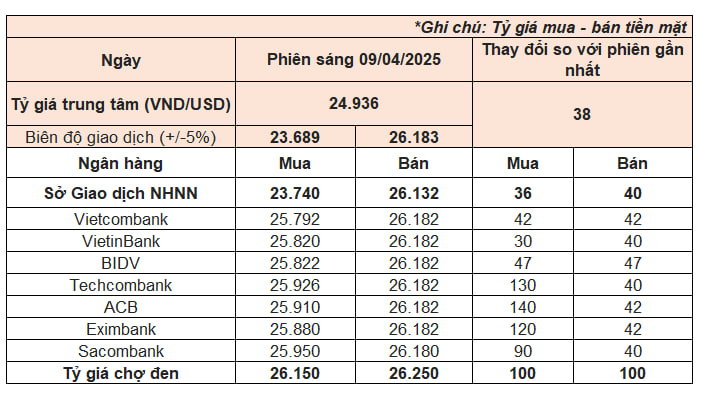

In the official market, the State Bank of Vietnam (SBV) has increased the daily reference exchange rate by 38 VND to a record high of 24,936 VND per USD. With a band of 5%, this means that commercial banks are allowed to trade the US dollar within a range of 23,689 – 26,183 VND/USD. This is the highest level the reference rate has reached since the SBV adopted this mechanism in early 2016. Since the beginning of the year, the reference rate has increased by a total of 601 VND, or 2.4%.

The buying and selling rates of the US dollar at the State Bank of Vietnam also increased by 36 – 40 VND, to 23,740 – 24,132 VND/USD.

Following the reference rate increase, commercial banks have raised their selling rates to just below the ceiling of 26,182 VND. Compared to the previous session, banks have increased their selling rates by 40 – 47 VND. Meanwhile, buying rates have been adjusted more significantly, rising by 30 – 120 VND.

Since the beginning of the year, the US dollar rate at commercial banks has increased by about 630 VND, or 2.5%. In particular, since the beginning of April, the US dollar rate at these banks has risen by more than 1.7%, equivalent to an increase of 443 VND.

USD/VND exchange rates as of 9:30 am on April 9

In the unofficial market, most foreign exchange outlets this morning quoted the buying and selling rates of the US dollar at 26,150 VND and 26,250 VND, respectively, an increase of about 100 VND in both directions compared to the rates surveyed yesterday morning. Since the beginning of the year, the unofficial US dollar rate has increased by a total of about 400 VND, or 1.5%. In particular, since the beginning of April, it has risen by nearly 300 VND.

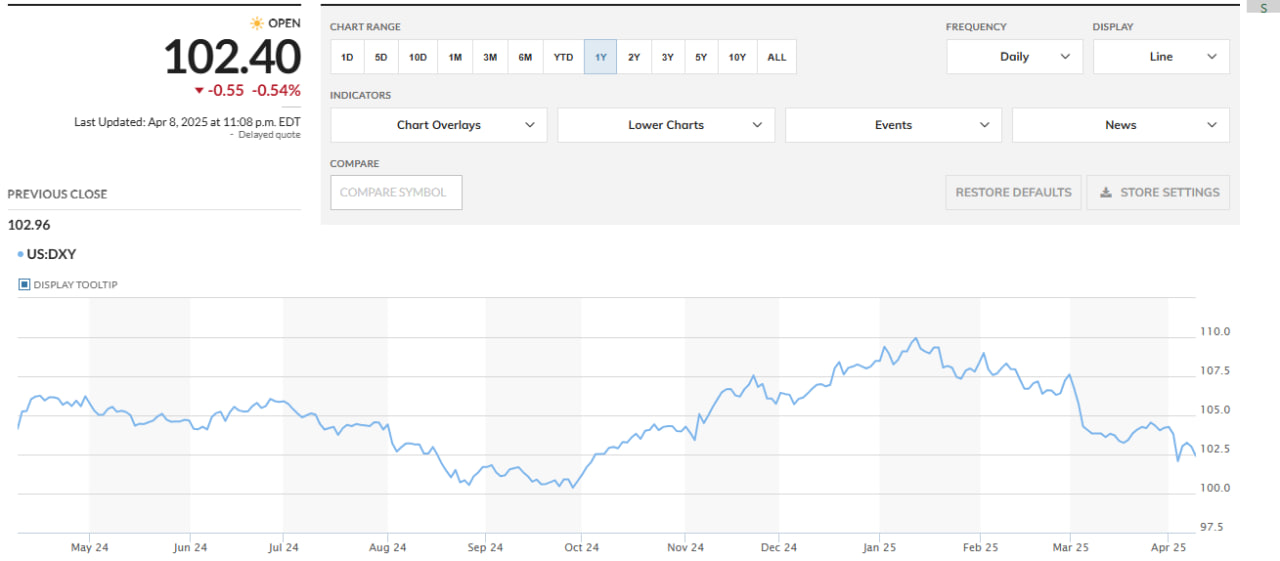

The strong increase in the domestic US dollar rate in recent sessions goes against the weakening of the greenback in the international market. Accordingly, since the beginning of April, the DXY Index has decreased by nearly 3.4% and by 5.5% since the beginning of the year.

DXY Index Movement (Source: MarketWatch)

The USD/VND exchange rate surged after April 2, when President Donald Trump announced a 10% tariff on all goods from all countries, effective April 5, 2025. In addition, the US will impose countervailing duties, effective April 9, on goods from countries/territories with which it has a large trade deficit, ranging from 10% to 50%. Vietnam is among the group of countries subject to the highest rate of 46%.

According to analysts, concerns about tariff risks could slow down foreign investment registration and disbursement. In addition, export activities (especially to the US market) may slow down and even suffer losses. Meanwhile, Vietnam’s foreign exchange reserves are currently quite limited. This puts pressure on the exchange rate.

“In the context of uncertainties and no final results on tariff decisions, the exchange rate will fluctuate more in the short term,” said Viet Capital Securities (VCSC).

ACB’s market research department also believes that the pressure on the exchange rate remains very high as the domestic market’s trading psychology is heavily influenced by global trade instability.

“It is forecast that the interbank exchange rate target for April may be 26,000,” said ACB’s market research department.

At the regular Government meeting in March 2025, Governor Nguyen Thi Hong stated that the exchange rate is an issue of great concern to all enterprises after President Donald Trump’s tariff announcement. The SBV has been closely monitoring the situation and has noticed differences compared to previous tariff announcements. Specifically, this time, the tariffs are based on the trade surplus of 57 countries, without mentioning currency issues. The SBV finds that the trade solutions put forth by the Government and the Prime Minister are very much in line with President Trump’s spirit.

Governor Nguyen Thi Hong assessed that the exchange rate situation is complex and unpredictable, especially after President Trump’s tariff announcement, with the rate increasing by 0.6% on the first day. As trading partners apply retaliatory measures, the financial and monetary market will undoubtedly face complexities on a daily and hourly basis.

“The SBV will closely monitor market developments to manage tools and solutions with appropriate timing and dosage, especially considering the trade-off between exchange rate stability and the goal of reducing interest rates,” shared Governor Nguyen Thi Hong regarding the management orientation.

The Greenback and the Yuan: A Dynamic Duo on the Rise

The State Bank of Vietnam has set the reference exchange rate at 24,831 VND per USD, an increase of 18 VND from the previous day’s morning session. With a allowed band of +/- 5%, the ceiling and floor rates for the day are 26,073 VND and 23,589 VND per USD, respectively.

Governor: The Banking Sector Will Provide Maximum Capital for Production, Business, Import-Export, and Priority Areas

Governor Nguyen Thi Hong affirmed that the SBV will continue to conduct flexible monetary policy management, closely following macroeconomic developments and inflation trends. At the same time, the banking industry will continue to accompany and provide maximum capital for production and business, import and export, priority areas, and strengths of each region and locality.