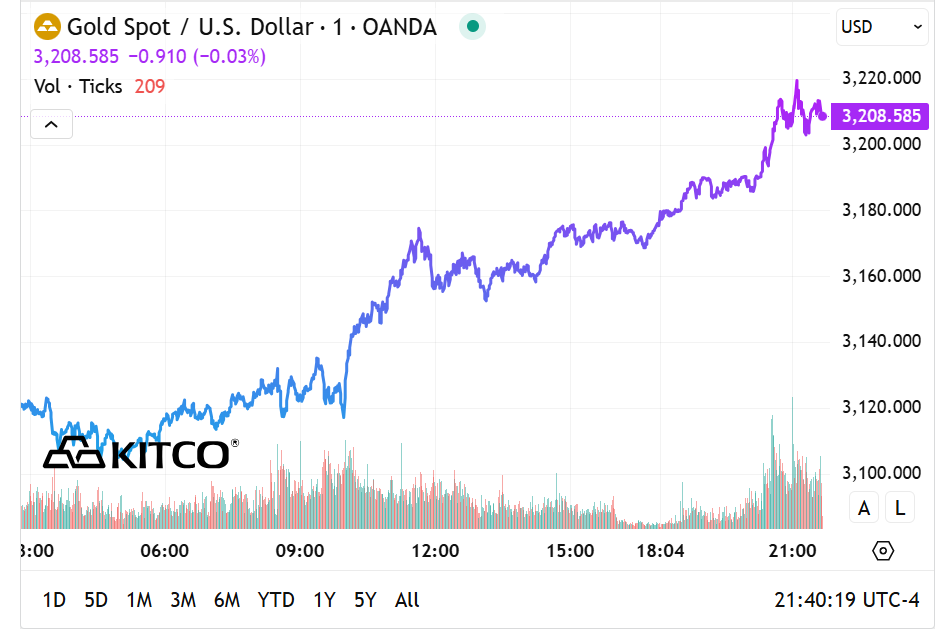

As of 8:30 am, the spot gold price surpassed the $3,200/ounce mark. The precious metal went on to reach a new record high of $3,221/ounce.

——————-

In the early hours of April 11, Vietnam time, the spot gold price on the international market officially peaked at $3,194/ounce. Within a day, the precious metal had surged by approximately $120/ounce.

The need for safe-haven assets continued to strengthen as US stock markets plummeted once again. Gold’s surge to new highs came amidst global economic turmoil caused by trade tensions. The White House recently announced that, following the latest tariff hike on China of 125%, in addition to the previous 20%, the current tariff rate on Chinese goods stands at 145%.

Specifically, after China imposed an 84% retaliatory tariff, President Donald Trump increased the countervailing duty from 84% to 125% on imports from China. This figure was announced on April 9 via the Truth Social media platform and took immediate effect. However, the White House confirmed that this number does not include the 20% tariff related to fentanyl that Trump had previously imposed on China.

According to the latest research from the World Gold Council (WGC), the growing concerns about a potential economic slowdown and rising inflation in the US have prompted investors to actively shift their capital into gold, abandoning their wait-and-see approach.

The gold market has witnessed significant inflows into gold-backed exchange-traded funds (ETFs) since the beginning of the year. Capital flow data for March from WGC showed a uniform increase across all major regions worldwide.

The report indicated that North American-listed funds accounted for 61% of the total inflows, while the European market contributed about 22%, and Asian markets made up 16% of the global demand.

Demand from Europe has long been considered the “missing piece,” as it lagged compared to other regions in the past few months. However, WGC noted that funds in this region are starting to gain momentum.

Gold Prices Surge Amid Buying Frenzy from China on April 9th

Today, gold prices surged as investors sought safe-haven assets amid concerns over the US Treasury bond market. Notably, a report suggests that gold is also being bolstered by a wave of buying from China, driven by fears of renminbi depreciation.

The Golden Rush: Prices Surge

This morning (January 8th), domestic gold prices rebounded in line with global trends. Gold jewelry prices continued to surge, outpacing the increase in SJC gold bullion prices.