Illustrative image

In the report on Vietnam’s economic growth in Q1 2025, the Market and Global Economics Research team of UOB Bank stated that the State Bank of Vietnam (SBV) has more room to loosen monetary policy, as both headline and core inflation remained below the 4.5% target in Q1 and most of 2024.

However, market volatility has made exchange rates a concern, especially after the US tariff policy caused a new wave of instability in the market. At present, the research team expects the SBV to maintain its policy interest rate, with the refinancing rate remaining at 4.50%. However, the risk trend is tilting towards a rate cut due to downward pressure from business and export activities, as the 46% tax from the US could shock the Vietnamese economy.

“If domestic business conditions and the labor market deteriorate significantly in the next 1-2 quarters, we see a possibility that the SBV could lower the policy rate to the COVID-19 low of 4.00%, followed by a further 50 basis points cut to 3.50%, provided foreign exchange market stability and the Fed delivering rate cuts as expected,” the Market and Global Economics Research team of UOB Bank forecasted.

As of now, the base scenario of the Market and Global Economics Research team of UOB Bank remains that the SBV will keep interest rates unchanged.

According to the research team, Asian currencies will enter a new phase of weakness after the Trump administration imposed a series of tariffs on Asian economies. Export volumes will almost certainly decline, weakening the growth prospects and currencies of the region’s economies.

The VND has fallen to a new record low of around 25,800 VND/USD, immediately after the US announced a 46% countervailing duty on Vietnamese goods – one of the highest tariffs imposed by the Trump administration on global trading partners on April 2. This exorbitant tariff erodes the price competitiveness of Vietnamese goods in the US market, which is Vietnam’s largest export market. This new trade measure could derail Vietnam’s 8% GDP growth target for this year.

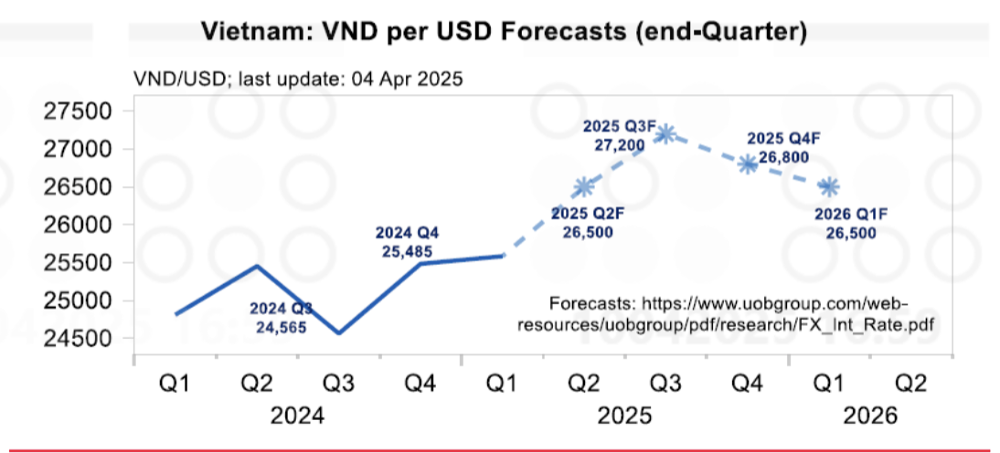

“As uncertainty rises, pressure on the VND exchange rate will continue to mount. We maintain the view that the VND will continue to weaken, with an updated forecast for the USD/VND exchange rate as follows: 26,500 in Q2 2025, 27,200 in Q3 2025, 26,800 in Q4 2025, 26,500 in Q1 2026,” the report by the Market and Global Economics Research team of UOB Bank said.

The Billionaire’s Daughter: A $41 Million Rescue Mission for Her Father’s Struggling Empire

“With an astute eye for investment, Ms. Hoang Anh has just made a significant move in the stock market. She has purchased an impressive 4 million HAG shares, a bold decision that has caught the attention of the financial world.”

The Struggle is Real: Businesses Navigate a Treacherous Path to Banking

Many banks have lowered interest rates to support businesses in accessing capital. However, businesses claim that interest rates are still high, and accessing capital is difficult due to a lack of collateral.

The New Interest Rate Cuts: A Strategic Move by Banks to Boost Their Economy.

As per the State Bank of Vietnam’s (SBV) update on deposit interest rate movements at commercial banks from February 25 to March 18, 2025, a significant 23 banks adjusted their deposit interest rates, with reductions ranging from 0.1% to 1% per annum, depending on the term. Notably, the SBV also recorded up to six instances of banks lowering their interest rates within this period.