“MB Receives Mandatory Transfer of OceanBank: A Step Towards a Modern Digital Bank”

On October 17, 2024, the State Bank of Vietnam (SBV) mandated the transfer of OceanBank to MB, a significant step in Vietnam’s banking industry.

At the time of the mandatory transfer, OceanBank met the requirements for scale of operations, registered charter capital, and the actual value of charter capital and reserve funds as per the resolution passed by the General Meeting of Shareholders on April 15, 2022. OceanBank had a network of 101 transaction offices (including 21 branches and 80 transaction offices) across 19 provinces and cities. Its total assets stood at VND 39,815 billion, with customer loans of VND 32,936 billion and customer deposits of VND 44,605 billion. However, the bank had accumulated losses of approximately VND 19,628 billion.

Following the mandatory transfer, MB’s Board of Directors organized and implemented the takeover of OceanBank, adhering to the approved plan and relevant resolutions, as well as legal provisions. This included changing the name and brand identity to MBV, amending the charter and operating license, reorganizing governance and management practices, and providing support to MBV as outlined in the transfer plan and legal framework.

As of December 31, 2024, MBV, operating as a limited liability company, maintained its network size while improving its financial position. Its total assets reached VND 46,232 billion, with customer loans of VND 34,795 billion and customer deposits of VND 46,958 billion. The accumulated losses were reduced to (VND 15,688) billion.

MB’s leadership aims to transform MBV into a modern digital bank with advanced risk management practices, high quality, and efficiency. They are focused on eliminating accumulated losses, ensuring the real value of charter capital exceeds the legal minimum, and complying with the limits and safety ratios stipulated in the Law on Credit Institutions.

Additionally, MB, along with other credit institutions, is working closely with the government and the SBV to propose and implement supplementary support measures as per Articles 182 and 185 of the 2024 Law on Credit Institutions. These efforts ensure the feasibility and timely completion of the mandatory transfer plan.

“MB’s Strategic Initiatives: Divesting from MCredit and MBCambodia, Distributing 35% Dividends, and Investing up to VND 5,000 Billion in MBV”

At the 2025 Annual General Meeting, MB will propose a cash dividend plan of 3% and a stock dividend of 32%. The bank also seeks shareholder approval for a change in ownership structure, which will result in MBCambodia and MCredit no longer being subsidiaries of MB. Additionally, the bank plans to invest up to VND 5,000 billion in MBV.

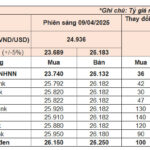

The Greenback’s Rally: Soaring USD in the Open Market and Banks’ Ceiling Rates

This morning’s trading session witnessed a scorching rally in the USD against both the banking and free market sectors.

Governor: The Banking Sector Will Provide Maximum Capital for Production, Business, Import-Export, and Priority Areas

Governor Nguyen Thi Hong affirmed that the SBV will continue to conduct flexible monetary policy management, closely following macroeconomic developments and inflation trends. At the same time, the banking industry will continue to accompany and provide maximum capital for production and business, import and export, priority areas, and strengths of each region and locality.

Extraordinary General Meeting of Eximbank: Awaiting State Bank Approval to Relocate Head Office and Elect Three New Supervisory Board Members

On February 26, 2025, the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Eximbank, HOSE: EIB) held an extraordinary general meeting to elect new members to its Supervisory Board and amend the bank’s charter.