As the dust settles on the US tariff shock, the market is seeking a new equilibrium, with the VN-Index fluctuating around the 1,200-point mark. The lack of supportive factors is making it challenging for investors to identify potential stocks and sectors for price appreciation.

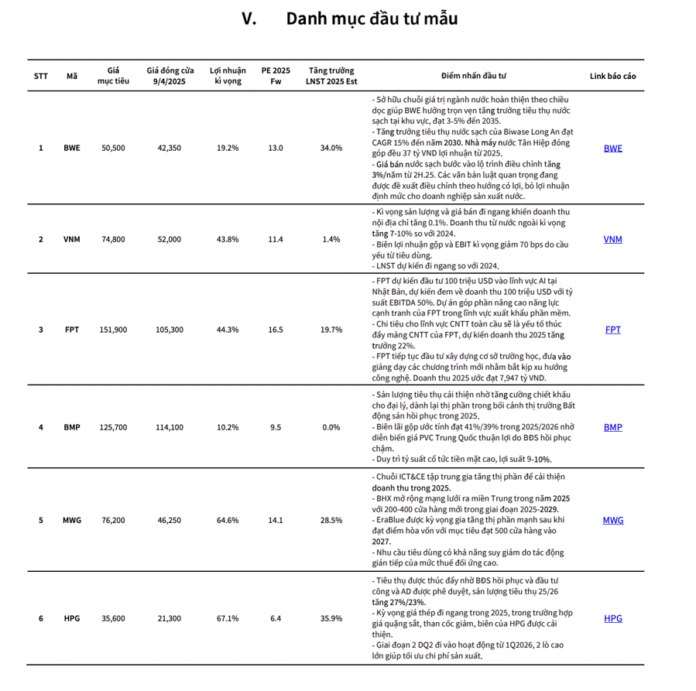

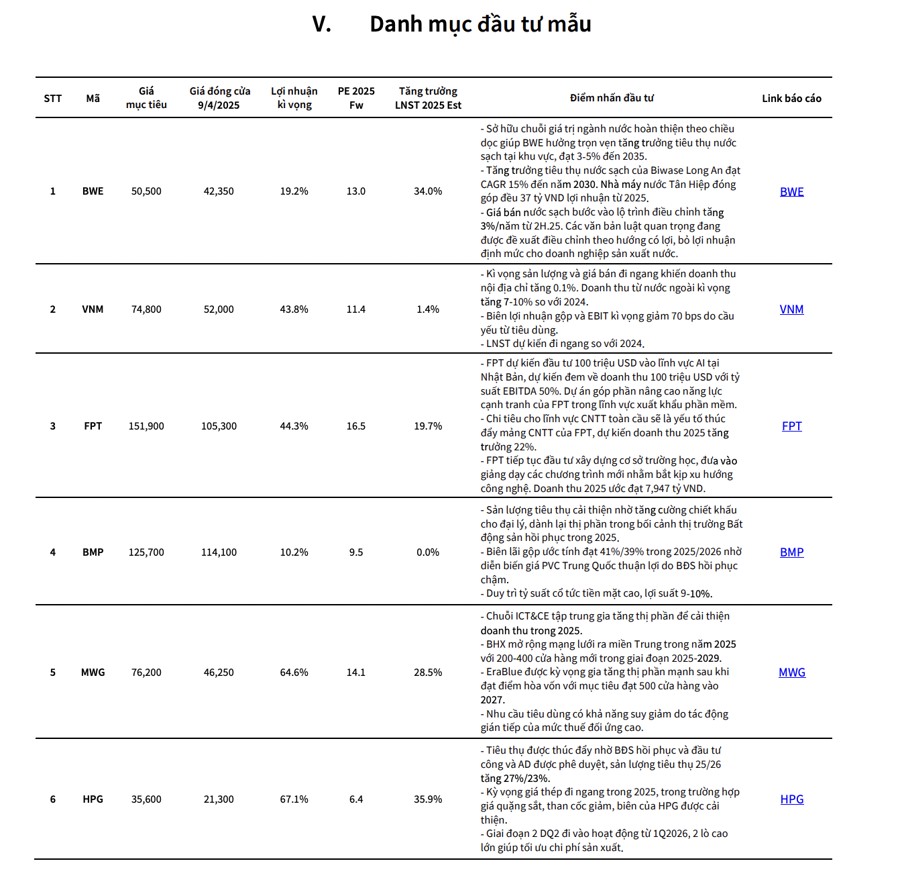

In a recent update, KBSV Securities has identified four promising investment themes for the coming period: Market Upgrade, Public Investment, Legal Facilitation, and Credit Easing.

According to KBSV, amidst the uncertain macroeconomic environment influenced by the global trade war, domestically-focused sectors such as the ones mentioned above will be prioritized to compensate for the shortfall in export surpluses. As a result, the corresponding stock groups are expected to witness positive price movements this year.

Firstly, regarding market upgrade prospects, KBSV maintains its positive outlook on Vietnam’s potential upgrade to the FTSE in September 2025 and the inflow of capital that this event may trigger. This long-awaited news could significantly impact the market.

The stock market is anticipated to benefit from new investment inflows before and after the official upgrade. Vietnam is expected to attract $800 million to $1 billion from passive investors using the FTSE index, excluding those using other passive indices. Additionally, active funds are likely to participate more actively in the market, with an estimated $4-6 billion flowing into Vietnam.

Consequently, large-cap stocks with potential for inclusion in the index include VCB, MSN, VNM, HPG, SAB, and others that meet the criteria for size and liquidity. Furthermore, a successful upgrade process could increase profits and trading fees for securities companies, particularly SSI, HCM, and VCI, which have the highest market share of foreign institutional clients.

Secondly, public investment acceleration: The government’s recent actions demonstrate its commitment to accelerating public investment disbursement. In addition to increasing the public investment plan to approximately $36 billion (compared to $31 billion at the end of last year), a series of laws have been amended to create a more favorable legal corridor for investment projects with state capital and FDI.

In the context of escalating trade tensions, Vietnam’s growth has largely depended on FDI and exports. Now, the government must focus its efforts on the public investment sector to shift the primary growth driver for GDP.

The estimated investment capital for the development of power sources and grids for the 2026-2030 period is approximately $137 billion, with $118 billion allocated for power sources and $19 billion for transmission grids. Therefore, KBSV positively assesses the prospects for the electricity industry, given the continuously increasing load demand and the foundation for new investment projects under Power Development Plan VIII. Moreover, with the removal of common risks across the industry, renewable energy producers and construction consultants like GEG, HDG, REE, PC1, and TV2 are highly regarded for their growth potential.

Determined to achieve the disbursement plan in the final year of the 2021-2025 public investment mid-term period and set the stage for the 2026-2030 period, the government will expedite the progress of key public investment projects in the strategic period of 2025-2026.

This bodes well for construction and contracting companies with experience in executing specific large-scale government projects, such as VCG, LCG, C4G, and HHV.

In the construction materials sector: According to the Ministry of Construction, the proportion of raw materials in the construction costs of public investment projects generally ranges from 60-70% of the total project implementation costs. Of this, construction sand and stone account for 20%, steel for 25%, and asphalt for 15%. Currently, the Southern region is facing a shortage of sand and stone supplies, so stocks that still possess significant stone reserves, such as DHA and VLB, will have the opportunity to increase profits.

Additionally, the consumption of construction steel, cement, and especially asphalt is expected to improve due to key projects like the Long Thanh Airport, the North-South Expressway Phase 2, and Ho Chi Minh City’s Ring Road 3, which are set to accelerate in the coming year. Therefore, HPG, HT1, and PLC are KBSV’s top picks to benefit from these factors.

Thirdly, legal facilitation: Resolution No. 192/2025/QH15 of the National Assembly adjusted the targets, focusing on boosting GDP growth to reach 8% and above.

To realize this goal, all resources have been mobilized, including a loose monetary policy (promoting credit growth and maintaining interest rates), an expansionary fiscal policy (increasing public investment), and the government’s efforts to revive the real estate market, which plays a crucial role in the economy.

KBSV expects a healthy recovery in the real estate market, creating economic growth momentum and positively impacting related sectors and fields. As a result, the real estate and public investment groups are anticipated to be stimulated by legal facilitation, offering significant growth potential in the coming period.

Lastly, credit easing: In 2025, the banking sector was assigned a credit growth target of 16%, with a focus on providing capital to key economic sectors, notably consumer credit, production credit, and housing loans.

The State Bank of Vietnam has demonstrated its intention to maintain a loose monetary policy to stimulate the economy by controlling low-interest rates and providing liquidity support to the entire system. The net injection through OMO has been maintained, along with the extension of the lending period for collateralized paper and the reduction of treasury bill interest rates, which has helped reduce the pressure on the interbank market and, consequently, the pass-through effect on lending rates.

According to KBSV, the easing and promotion of credit growth typically have a direct impact on stock groups closely related to bank lending, production expansion investments, or consumption stimulation. Most sectors in the economy are expected to benefit, with the highest expectations for the banking and real estate industries.

The Stock Market Blog: Tread Carefully with the ‘Pump and Dump’ Scheme

Today’s session saw a mixed performance, with some leading stocks dragging down the index. However, the overall picture wasn’t too bleak. The question remains whether we can expect a better rotation of leading stocks in the coming days, as their weight can significantly pull down the VNI. A weak index could dampen overall sentiment…

The Big Cap Let Loose: VN-Index Loses Most of its Gains, Stocks Still Impressively Reverse

The trading session today witnessed a dramatic turnaround in the final 30 minutes of continuous trading, with leading large-cap stocks suddenly reversing course. The heavy selling pressure from these stocks dragged the VN-Index down from its intraday high of 17.4 points (+1.43%) to just above the breakeven point, eventually closing with a modest gain of 1.87 points (+0.15%).

The Stock Market Soars: Over 80 Billion Bank Shares Surge as Vietnam Breathes a Sigh of Relief with the US Tariff Delay

On the morning of April 10, all 27 banking codes with over 80 billion shares reached the ceiling price. The industry’s liquidity was extremely low, with a series of “white” codes on the sell side and a surplus of tens of millions of units on the buy side.