Today’s session saw a mixed performance, with the index mostly holding its ground despite some fluctuations in a few large-cap stocks. The question now is whether we can expect better rotation in the coming days, as the weight of these stocks could potentially cause a significant drop in the VNI. A weak index can influence overall market sentiment.

The VNI closed with a modest gain of less than 2 points, and the market breadth was positive with 321 gainers and 136 losers. For investors, it’s reassuring that most stocks are still in the green, and the likelihood of portfolio damage today is low. Many stocks have pulled back within their uptrends, and only a few have been pressured to close near their reference levels.

Total matched volume on the two exchanges surged to nearly VND 22,400 billion, excluding negotiated deals. On the HSX, 50 stocks traded over VND 100 billion, with only 12 in the red, indicating that fund allocation remains positive and focused on green stocks. There was some selling pressure, as evidenced by the sharp intraday spikes in volume and retreating stock prices, but it wasn’t aggressive or indiscriminate.

The sudden selling of VIC and VHM at very high prices is a concern and raises questions about the recent sharp rallies. Meanwhile, other large caps like VCB, CTG, TCB, BID, and HPG have shown weakness this week. The most optimistic scenario is for these large caps to consolidate, preventing VIC and VHM from a sharp correction. However, we can’t rule out the possibility of these stocks pressuring the index to test supply levels again.

It’s likely that the VNI will continue to be volatile in the coming sessions and may even widen its range. What’s important is the performance of individual stocks in your portfolio. The ability of many stocks to maintain their gains this week, following the positive momentum from the “tax bottom,” indicates their underlying strength. If stock prices can decouple from or be less influenced by index movements, that would be an additional positive signal.

Now is the time to focus on the specific stocks you hold. Short-term trades are less of a concern if supportive fund flows persist. In the absence of shocking news, sharp index-driven declines can present opportunities to increase allocations. Remember, the index reflects the story of large caps, but investment opportunities lie in individual stocks.

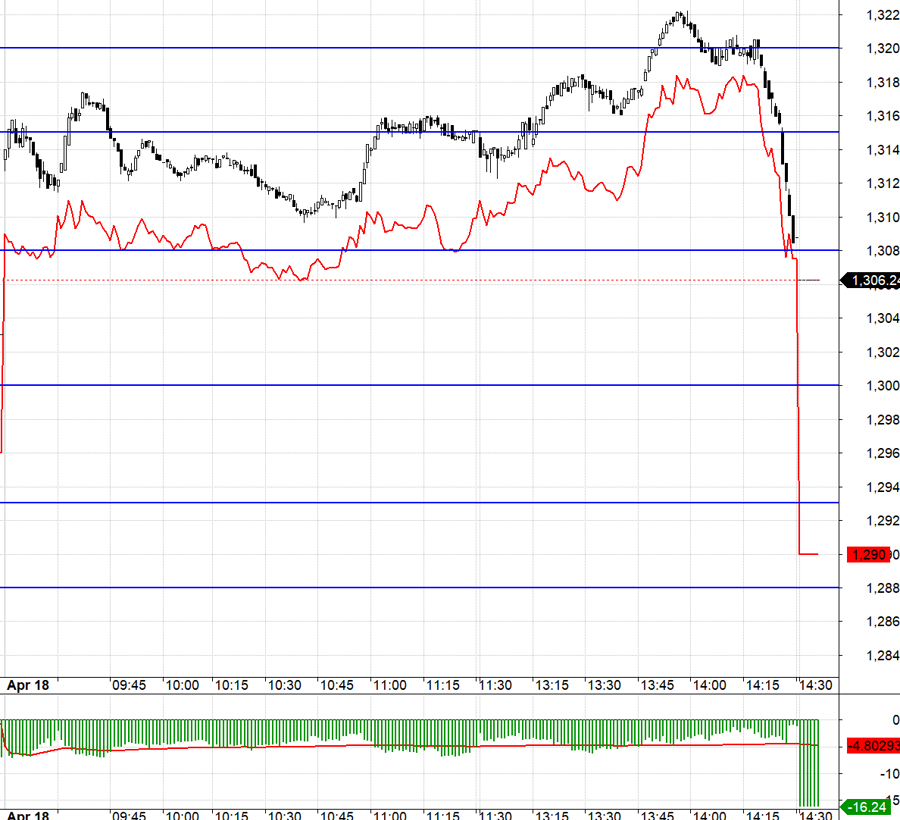

Today’s derivatives market saw an unusual development in the ATC session, with nearly 9,800 contracts closing their positions, causing the F1 to drop 13.4 points and the basis to widen to -16.2 points. Interestingly, the basis remained normal during the last 15 minutes of the session, despite the sharp decline in VIC and VHM. This could suggest the presence of a large-scale position closure or a bet on the impact of these two stocks in the coming sessions.

In the next session, keep an eye on whether the basis narrows, especially in the first 15 minutes as we await the VN30. A sharp move in the underlying market is unlikely unless there’s some unexpectedly negative news. The strategy is to look for buying opportunities in stocks and consider going long in derivatives.

The VN30 closed today at 1306.24. Near-term resistance levels to watch for tomorrow are 1315, 1321, 1327, 1332, and 1339, with further resistance at 1346. Support levels are 1303, 1292, 1279, 1269, and 1263.

Disclaimer: This “Stock Market Blog” reflects the personal views and opinions of the author and does not represent the views of VnEconomy. The opinions and views expressed are those of the individual author, and VnEconomy respects the author’s style and perspective. VnEconomy and the author are not responsible for any issues arising from the opinions and views expressed in this blog.

The Golden Rush: Soaring Prices of Gold Rings and SJC Gold

Late in the afternoon of April 8th, domestic gold prices rebounded, surging back above the 100 million VND per tael mark after a sharp decline earlier in the day. This dramatic turnaround saw the price of gold jewelry and SJC gold reclaim their lofty perch, offering a glimmer of hope to investors and enthusiasts alike.

Financial Investment Strategies: Manulife Vietnam’s Profitable Path in 2024

Manulife Vietnam has just released its 2024 financial report, boasting impressive figures from its financial investment activities.

“Great Businesses Are on Sale at Historic Low Valuations”

In uncertain times, when the outlook is bleak, it is also a good time to own stocks. According to SGI Capital, a flight to safety can make valuations across the board more attractive, enhancing long-term investment performance. This strategy can prove beneficial for investors looking to capitalize on potential gains during volatile market conditions.

![[IR AWARDS] June 2025 Disclosure Calendar: Mark Your Dates](https://xe.today/wp-content/uploads/2025/06/HinhT6_01-218x150.png)