On April 17, 2025, Hoa Phat Group Joint Stock Company (code: HPG) held its 2025 Annual General Meeting of Shareholders.

Right before the meeting, Hoa Phat proposed a change to its 2024 dividend payment plan, opting for an all-stock dividend with a 20% ratio instead of the initial plan of 5% in cash and 15% in stock.

The company attributed this adjustment to the developments in the Trump administration’s import tax policies and a cautious approach to ensuring cash flow.

Addressing the shareholders, Chairman Tran Dinh Long sought support for the decision to forgo cash dividends. Mr. Long assured that, barring any extraordinary circumstances, Hoa Phat would resume cash dividend payments from 2026 onwards. He emphasized that maintaining a dividend policy is a tradition that the company wishes to uphold as it has been instrumental in their journey to becoming a household name.

For 2025, Hoa Phat aims to achieve a revenue of VND 170,000 billion, marking a 21% increase. If accomplished, this will be the company’s highest revenue to date. The target after-tax profit is set at VND 15,000 billion, reflecting a nearly 25% surge compared to the previous year’s performance.

According to Chairman Tran Dinh Long, in the first quarter of the year, Hoa Phat is estimated to have achieved VND 37,000 billion in revenue and VND 3,300 billion in after-tax profit, representing a 19% and 15% year-on-year increase, respectively.

“We have ambitiously set very high business targets. To achieve them, each of the remaining quarters must yield a profit of VND 4,000 billion. This presents both a challenge and an opportunity,” affirmed Chairman Tran Dinh Long, underscoring that the company will not adjust its business plan.

In the market, HPG shares closed at VND 25,500/share on April 16, 2025.

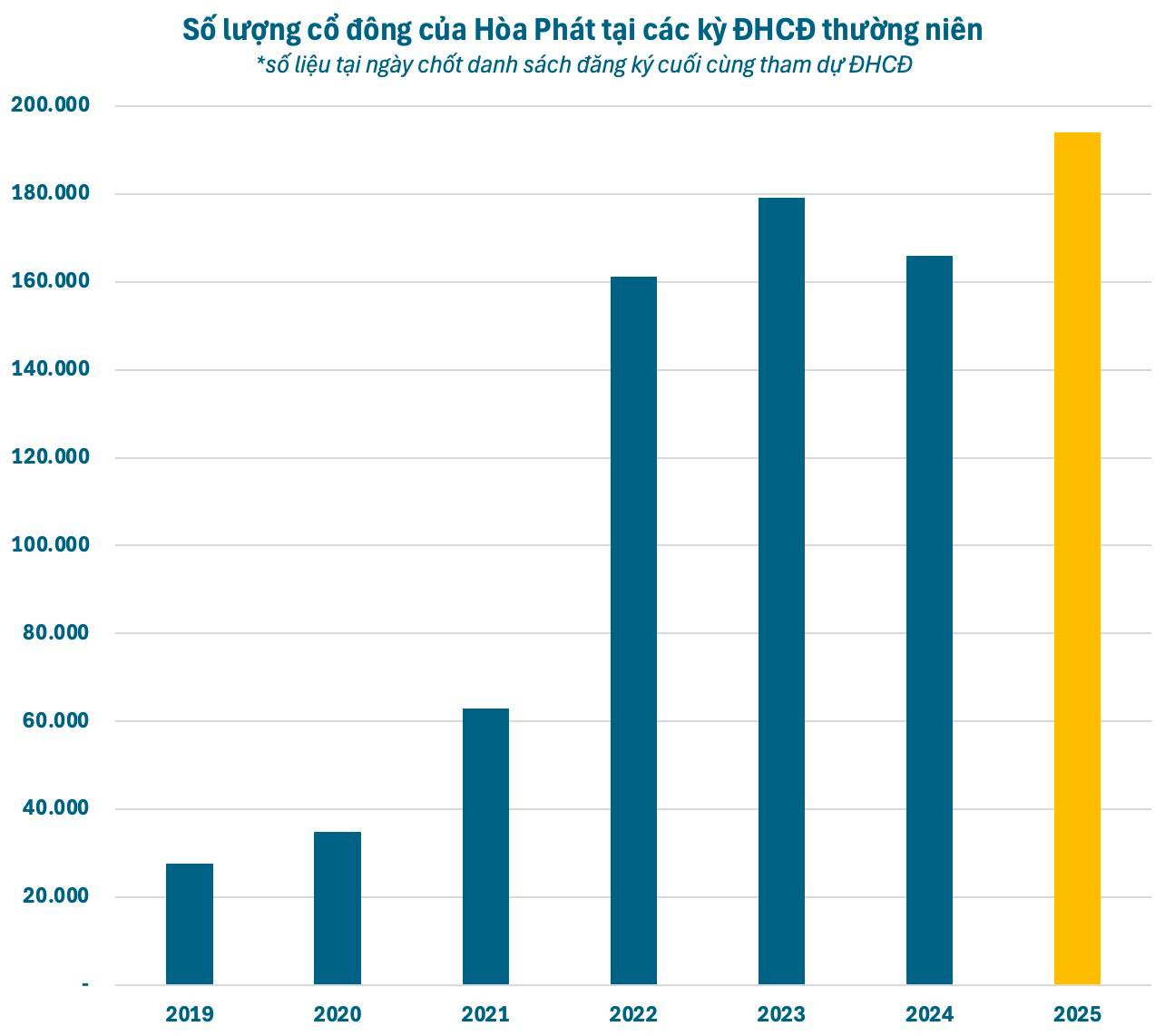

Record-Breaking Shareholder Numbers for Hoa Phat: The Company Needs 5 My Dinh Stadiums to Accommodate Them All

Chairman of the Board of Directors, Tran Dinh Long, revealed that Hoa Phat currently has over 194,000 shareholders, the highest number on the stock exchange and a record for the company. This impressive figure showcases the strong support and confidence that investors have in Hoa Phat’s business and its future prospects. With a diverse range of shareholders, the company is well-positioned to continue its growth trajectory and solidify its position as a leading enterprise in the industry.

“MB’s Strategic Initiatives: Divesting from MCredit and MBCambodia, Distributing 35% Dividends, and Investing up to VND 5,000 Billion in MBV”

At the 2025 Annual General Meeting, MB will propose a cash dividend plan of 3% and a stock dividend of 32%. The bank also seeks shareholder approval for a change in ownership structure, which will result in MBCambodia and MCredit no longer being subsidiaries of MB. Additionally, the bank plans to invest up to VND 5,000 billion in MBV.

The Stock Market Wrestler: How Mai Phương Thúy Turned a Tidy Profit of 1.5 Billion VND Overnight by Grappling with Billionaire Trần Đình Long’s Shares.

Yesterday, former Miss Vietnam Mai Phương Thúy took to Facebook to share her recent investment move. In her post, she revealed that she had purchased one million shares of Hoa Phat Group (HPG) at the floor price. Her exact words were: “Struggled all day just to buy one million HPG shares at the floor price.”