Specifically, SHS will pay a cash dividend of 10% (VND 1,000 per share), equivalent to over VND 813 billion expected to be paid out. In addition, the company will issue bonus shares to pay dividends for 2023 with a ratio of 5% and issue bonus shares from equity capital with a ratio of 5%.

The latest date to be entitled to receive both cash and stock dividends is April 25, 2025. The cash dividend payment date is August 25, 2025.

This move comes as SHS successfully held its 2025 Annual General Meeting of Shareholders, where the meeting approved the suspension of the 1:1 stock issuance plan after carefully considering market conditions and taking into account shareholders’ wishes. Maintaining an attractive dividend policy demonstrates SHS’s commitment to maximizing shareholder interests in its long-term development strategy.

Nearly VND 1,400 billion profit plan for 2025, aiming for a leading position in service quality

Along with the dividend decision, the SHS AGM also approved the 2025 business plan with a target revenue of VND 2,261.9 billion and pre-tax profit of VND 1,369.1 billion, maintaining ROE among the industry leaders.

Sharing SHS’s strategic orientation, Chairman of the Board of Directors, Do Quang Vinh, said that the company does not aim to expand at all costs but focuses on improving operational efficiency, with service quality as the central factor.

“The SHS leadership is always concerned about the direction to create a difference for SHS. What SHS aims for is to build its brand based on leading service quality (service branding). This will be SHS’s core strategy.”

Accordingly, SHS focuses on developing specialized investment advisory and asset management services, combining them with technology applications to enhance user experience. The company is also researching and expanding new investment products, including digital assets and carbon credits.

Investing in technology and human resources – The key to enhancing competitiveness

As shared at the AGM, in the coming time, SHS will continue to improve operational efficiency through digitization, upgrade the trading platform, and perfect the internal risk management system. The company is developing an integrated investment application (app) that allows customers to access not only traditional securities products but also other asset investment types such as bonds, fund certificates, flexible savings products, and digital assets in the future.

Investing in technology infrastructure aims to meet investors’ increasingly high demands and prepare for the market upgrade and foreign capital inflow in the medium term.

A notable highlight is the long-term investment strategy for human resources. According to General Director Nguyen Chi Thanh, in 2024, contrary to the trend of downsizing in the securities industry, SHS recruited 50 new employees and added many senior experts, especially in investment advisory, analysis, and technology fields. In the future, SHS will continue to recruit many senior positions, including deputy general directors and block directors.

Maintaining an attractive dividend policy, along with a clear and flexible development orientation, demonstrates SHS’s efforts to balance growth objectives and shareholder interests, gradually realizing its vision of becoming a sustainable investment financial group.

Record-Breaking Shareholder Numbers for Hoa Phat: The Company Needs 5 My Dinh Stadiums to Accommodate Them All

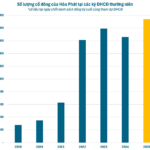

Chairman of the Board of Directors, Tran Dinh Long, revealed that Hoa Phat currently has over 194,000 shareholders, the highest number on the stock exchange and a record for the company. This impressive figure showcases the strong support and confidence that investors have in Hoa Phat’s business and its future prospects. With a diverse range of shareholders, the company is well-positioned to continue its growth trajectory and solidify its position as a leading enterprise in the industry.

The Stock Market Blog: Tread Carefully with the ‘Pump and Dump’ Scheme

Today’s session saw a mixed performance, with some leading stocks dragging down the index. However, the overall picture wasn’t too bleak. The question remains whether we can expect a better rotation of leading stocks in the coming days, as their weight can significantly pull down the VNI. A weak index could dampen overall sentiment…