During the 2025 Annual General Meeting held on April 10, the SHS leadership attributed the Q1 performance to unfavorable market conditions. However, the company has already achieved 25% of its annual revenue target and 24% of its profit goal for the year.

As of March 31, 2025, SHS’s total loan balance stood at VND 4,600 billion, an 11% increase from the end of 2024. The company’s total assets also reached VND 15,200 billion, representing an 8.8% year-end growth.

SHS’s equity has grown to over VND 11,600 billion, a 3.8% increase from 2024. With a book value per share of VND 14,311 as of April 18, 2025, and a market price of VND 14,700, the company’s P/B ratio hovers around 1.0.

SHS Approves 20% Dividend Payout in Cash and Shares, Halts 1:1 Share Issuance

During the recent AGM, the company decided to halt its 1:1 share issuance plan to existing shareholders after carefully considering market dynamics and prioritizing financial flexibility and risk management.

In 2025, SHS is focused not only on financial growth but also on operational efficiency. The company aims to invest significantly in technology and talent to become a leading investment and financial group.

According to the leadership, SHS will emphasize service branding to create genuine value for its clients and ensure sustainable competitive advantages. The company is currently dedicated to developing specialized investment advisory and asset management services.

Additionally, SHS is undergoing a comprehensive digital transformation, building a flexible operating foundation, and creating a smart, personalized investment ecosystem to cater to individual investors’ needs. The company is also exploring expansion into new areas, such as digital assets and carbon credits, to stay ahead of future market trends.

SSI Aims for Over VND 1,000 Billion in Pre-Tax Profit in Q1 2025, Sets Record with Outstanding Loan Balance

With an outstanding loan balance of over 27,000 billion, SSI has reached its highest lending level since its inception. This figure surpasses the peak lending period when the VN-Index climbed to 1,500 in late 2021 and early 2022.

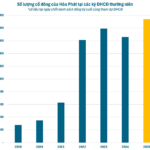

Record-Breaking Shareholder Numbers for Hoa Phat: The Company Needs 5 My Dinh Stadiums to Accommodate Them All

Chairman of the Board of Directors, Tran Dinh Long, revealed that Hoa Phat currently has over 194,000 shareholders, the highest number on the stock exchange and a record for the company. This impressive figure showcases the strong support and confidence that investors have in Hoa Phat’s business and its future prospects. With a diverse range of shareholders, the company is well-positioned to continue its growth trajectory and solidify its position as a leading enterprise in the industry.

“Eximbank Aims for Nearly VND 5.2 Trillion in Profit This Year, Elects New Board of Directors”

“The recently released minutes from the 2025 Annual General Meeting of Vietnam Export Import Commercial Joint Stock Bank (Eximbank) contained some notable revelations, as per the HoSE: EIB listing.”