SSI Joint Stock Securities Company (SSI code) has just announced its Q1/2025 financial statements with a total revenue and pre-tax profit of VND 2,128 billion and VND 1,017 billion, respectively.

SSI’s consolidated revenue for Q1 is estimated at VND 2,186 billion, with pre-tax profit reaching VND 1,035 billion, completing 22.5% and 24.3% of the plan approved by the 2025 General Meeting of Shareholders.

As of March 31, 2025, SSI’s total assets reached VND 83,608 billion, and equity reached VND 26,812 billion, up 14.5% and 3.25%, respectively, compared to the end of 2024.

For the last four quarters, the return on equity (ROE) and return on total assets (ROA) as of Q1/2025 stood at 11% and 3.8%, respectively.

The Securities Services segment recorded revenue of over VND 956 billion, accounting for 45% of the total.

Brokerage, custody, investment advisory, and other services generated VND 328 billion in revenue, a 2% decrease from the previous quarter. Market liquidity on the Ho Chi Minh Stock Exchange (HoSE) in Q1 was VND 16,363 billion, up 9.2% from Q4/2024.

SSI’s market share in brokerage services for stocks, fund certificates, and covered warrants on HoSE in Q1 improved to 9.93%, an increase of 0.74 percentage points from the previous quarter, maintaining its position in the top two in the market.

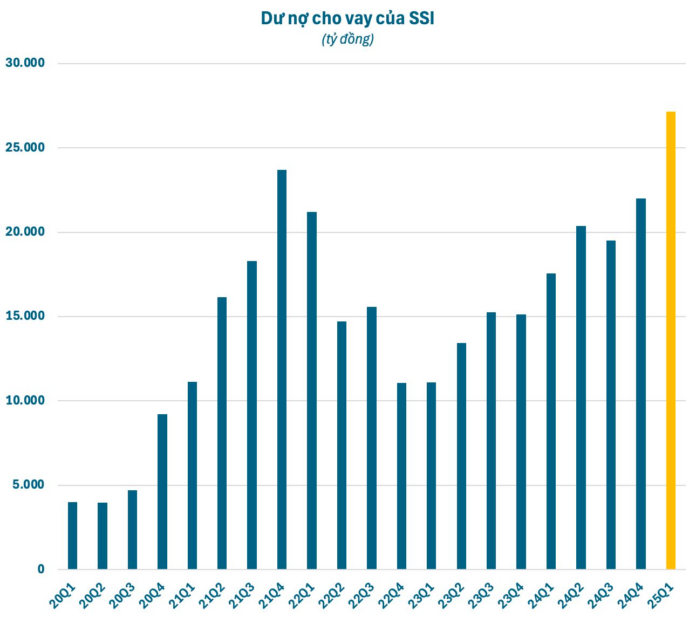

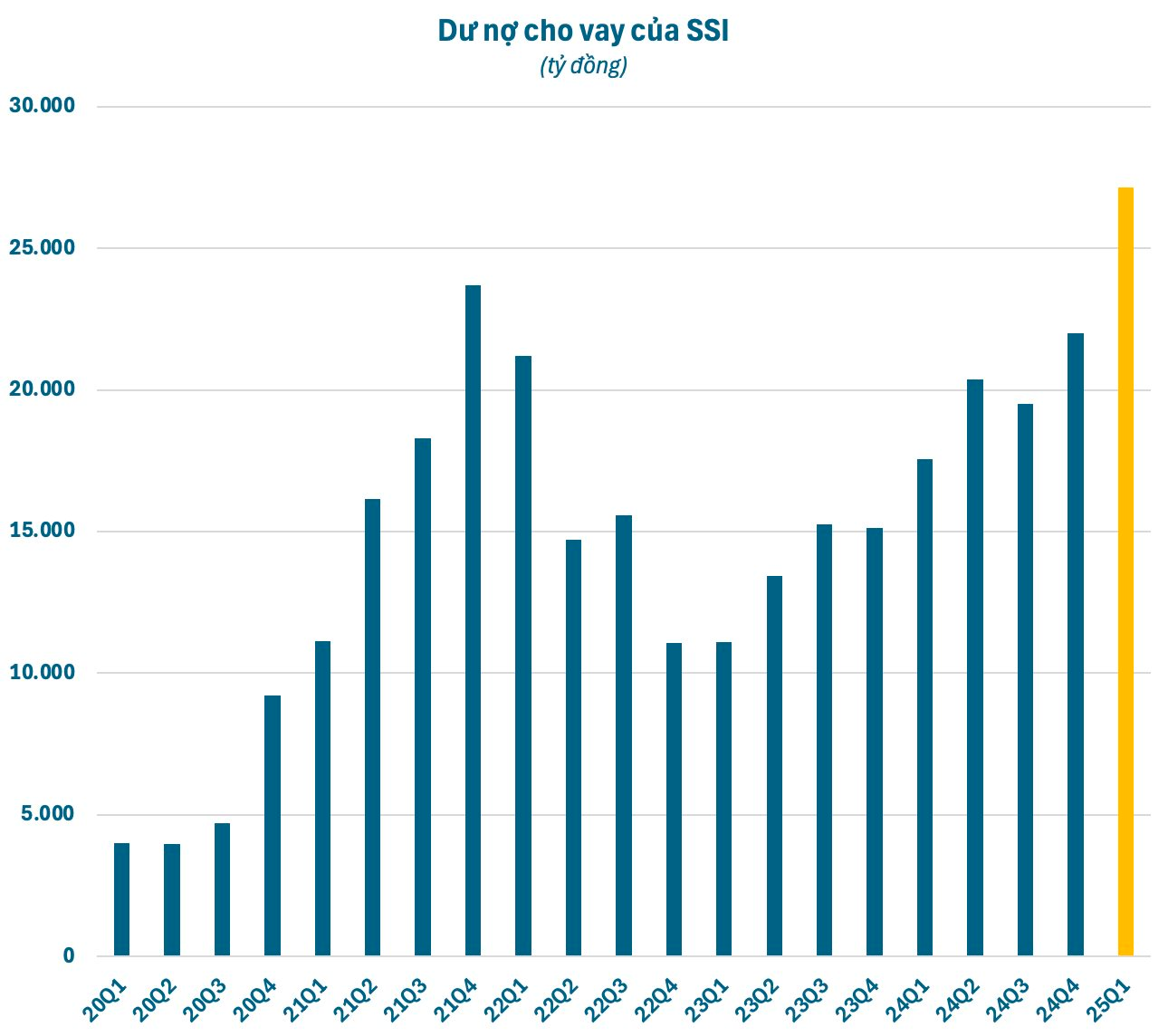

Revenue from lending and advance payment against sale reached nearly VND 628 billion, up 10% from the previous quarter. SSI’s outstanding margin and advance loans exceeded VND 27,167 billion, a 23.5% increase compared to the end of 2024. In Q1, SSI launched several programs to promote margin lending to customers.

Investment activities generated VND 1,040 billion in revenue, contributing 50% to total operating revenue. The investment portfolio expanded in scale, focusing on fixed-income assets issued by credit institutions.

Revenue from Capital & Financial Investments recorded VND 122 billion, a 10% increase from the previous quarter, accounting for 6% of total revenue. This traditional business relies on the scale of total assets, relationships with financial institutions, and the interest rate environment at any given time.

For the Investment Banking and Other Services segment, SSI recorded VND 10 billion in revenue. The company is advising on multiple capital-raising and listing transactions for large enterprises across various sectors. Revenue is expected to be recognized in the following quarters.

Record-Breaking Shareholder Numbers for Hoa Phat: The Company Needs 5 My Dinh Stadiums to Accommodate Them All

Chairman of the Board of Directors, Tran Dinh Long, revealed that Hoa Phat currently has over 194,000 shareholders, the highest number on the stock exchange and a record for the company. This impressive figure showcases the strong support and confidence that investors have in Hoa Phat’s business and its future prospects. With a diverse range of shareholders, the company is well-positioned to continue its growth trajectory and solidify its position as a leading enterprise in the industry.

“OCB Aims for 33% Surge in 2025 Pre-Tax Profits to VND 5.338 Trillion”

The Board of Directors of Orient Commercial Joint Stock Bank (HOSE: OCB) has approved an ambitious business plan for 2025, targeting a 33% increase in pre-tax profits.

The Surprising Secrets to Overcoming a Sharp Decline in Deferred Revenue

Deferred interest income plays a pivotal role in shaping a bank’s profit structure and can serve as a window into the bank’s asset quality. Moreover, it acts as a harbinger of profit quality. With the expiration of debt moratorium circulars, some banks have unveiled issues pertaining to this very item.