On April 19, Dabaco Vietnam Joint Stock Company held its 2025 Annual General Meeting of Shareholders, during which several important matters were discussed and approved.

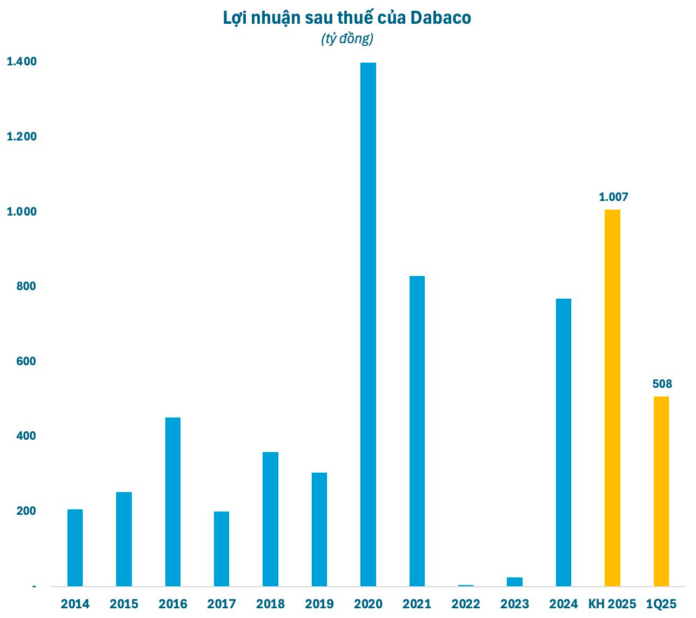

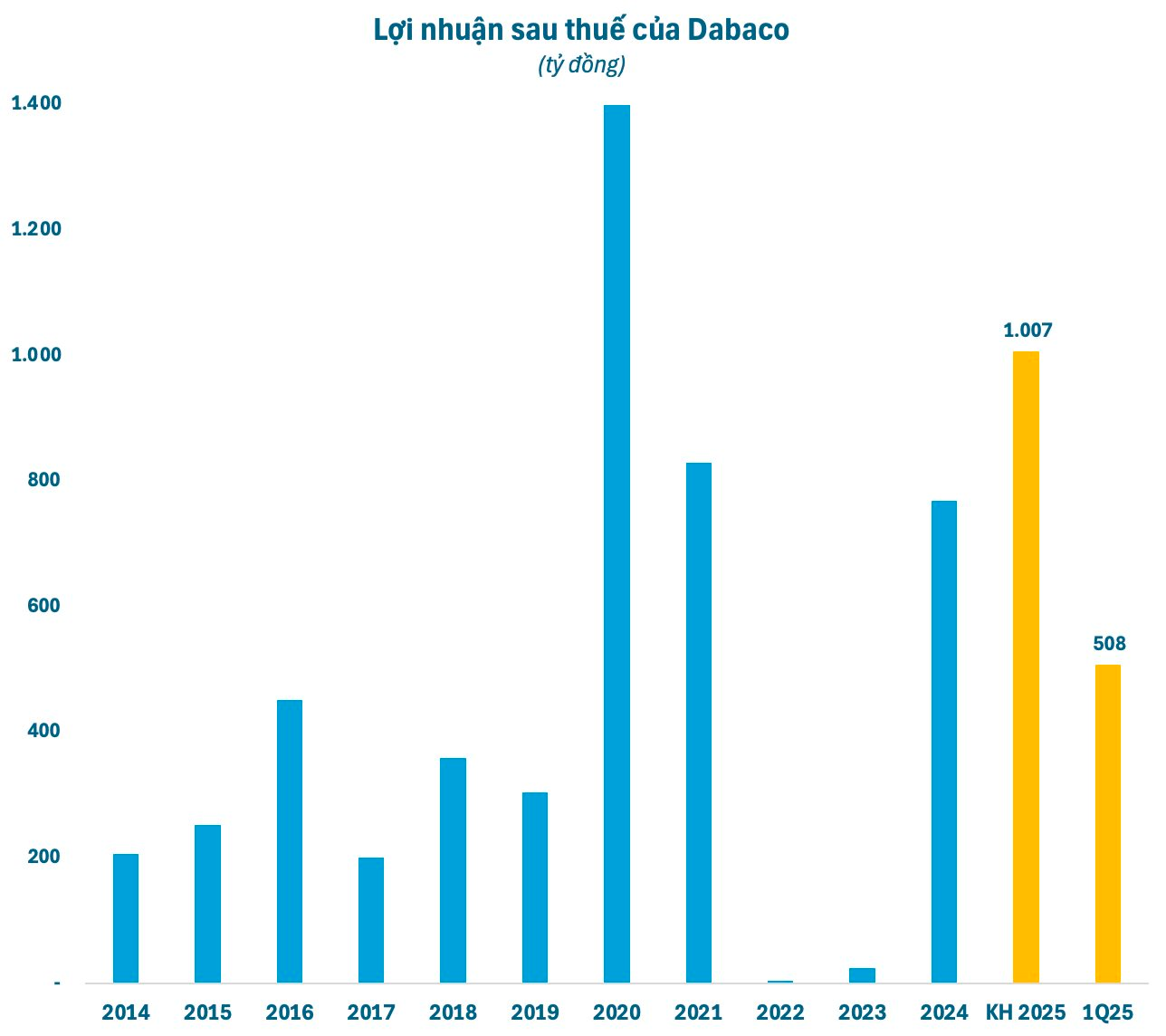

Regarding business plans for 2025, Dabaco aims to achieve a revenue of VND 28,759 billion and a profit after tax of VND 1,007 billion. Looking ahead to the long term, the company has set an ambitious goal to increase revenue to a record level of VND 38,000 – 40,000 billion by 2030, equivalent to 1.5 times that of 2024, with an average annual pre-tax profit increase of at least 7%.

This year, Dabaco is focusing on simultaneously implementing several strategic projects, including the Dacovet vaccine production factory, investing in high-tech pig farming zones in Lao Cai, Thanh Hoa, Quang Tri, Thai Nguyen, and Bac Kan, expanding the capacity of the oil press factory to 1,000 tons/day, and developing real estate and logistics projects such as Tan Chi Inland Container Depot, Van An Urban Area, and Dai Phuc Commercial Center (Bac Ninh)…

In response to a shareholder’s proposal to supplement the content of interim cash dividend payment for 2025, in addition to the 15% stock dividend for 2024, Chairman of the Board, Mr. Nguyen Nhu So, expressed his personal preference for cash dividends as he holds the largest number of shares. However, being an agricultural enterprise with typically narrow profit margins and constant market and disease risks, Dabaco tends to set very cautious and achievable targets.

Nevertheless, the Chairman shared that the after-tax profit for the first quarter is expected to exceed VND 500 billion, and the second quarter of 2025 is projected to reach approximately VND 400 billion. “Dabaco will seek shareholder approval to adjust the profit plan and interim cash dividend payment for 2025 when the production and business results for the first and second quarters of this year become clearer,” affirmed Mr. So.

Addressing a shareholder’s inquiry about the prospects of the vaccine business, the Chairman revealed that the ASF2 vaccine for African swine fever, developed by Dabaco, is currently being sold commercially at a price of VND 60,000 – 70,000 and is being prioritized for use within the group’s pig herd. Dabaco is actively working with the Philippines on vaccine exports, but the process takes a considerable amount of time, at least 4-6 months. Additionally, it takes two years for companies to import vaccines into Vietnam.

“I’ll sell when the share price matches my age”

During the meeting, a shareholder brought up the recent registration by Ms. Nguyen Thi Thu Huong, a member of the Board of Directors, Deputy General Director, and Chief Financial Officer, to sell her shares and questioned the Chairman about the prospects of DBC shares in the future.

Mr. So explained that Ms. Huong’s decision to sell her shares was due to personal financial needs, and the company does not intervene in such matters. As the largest shareholder himself, he prefers buying over selling. “I’ll sell when the share price matches my age,” emphasized the Chairman of Dabaco.

Regarding the stock price movement, Mr. So attributed it to the normal dynamics of the market, influenced by various factors impacting investor psychology. “Investors can be quite unpredictable,” he shared. “Sometimes, they sell when a company is performing poorly, but they may also sell even when a company is doing well.”

Mr. So affirmed that Dabaco is currently performing well and is in the process of rebranding. While the company’s profit plan for 2025 is VND 1,007 billion, Mr. So believes that with the current trajectory, the achievable profit could reach VND 1,500 billion. Thus, he remains optimistic about the prospects of Dabaco’s shares.

Another matter that garnered significant shareholder attention at this meeting was the proposal to “allocate VND 100 billion for the reward fund and VND 100 billion for the welfare fund” from the 2024 profit. The Chairman explained that with approximately 8,000 employees across the group, this allocation is not excessive.

He emphasized that those who have performed well, made worthy contributions, and remained dedicated to the company over the years deserve recognition and appreciation, especially as the company approaches its 30th anniversary. “If we allocate 20% of the total profit to employee rewards and still retain 80% for shareholders, I believe it is absolutely worth it,” asserted the Chairman of Dabaco.

Following the discussions, 100% of the attending shareholders unanimously approved the proposals and plans presented at the Dabaco Shareholders’ Meeting. The meeting also proceeded with the election of 11 members to the Board of Directors and 3 members to the Supervisory Board.

SHS Earns a Profit of Over 325 Billion VND in Q1 2025, Announces 20% Dividend Payout

As of March 31, 2025, SHS’s total loan balance stood at VND 4,600 billion, reflecting an impressive 11% growth compared to the end of 2024.

Record-Breaking Shareholder Numbers for Hoa Phat: The Company Needs 5 My Dinh Stadiums to Accommodate Them All

Chairman of the Board of Directors, Tran Dinh Long, revealed that Hoa Phat currently has over 194,000 shareholders, the highest number on the stock exchange and a record for the company. This impressive figure showcases the strong support and confidence that investors have in Hoa Phat’s business and its future prospects. With a diverse range of shareholders, the company is well-positioned to continue its growth trajectory and solidify its position as a leading enterprise in the industry.

“MB’s Strategic Initiatives: Divesting from MCredit and MBCambodia, Distributing 35% Dividends, and Investing up to VND 5,000 Billion in MBV”

At the 2025 Annual General Meeting, MB will propose a cash dividend plan of 3% and a stock dividend of 32%. The bank also seeks shareholder approval for a change in ownership structure, which will result in MBCambodia and MCredit no longer being subsidiaries of MB. Additionally, the bank plans to invest up to VND 5,000 billion in MBV.