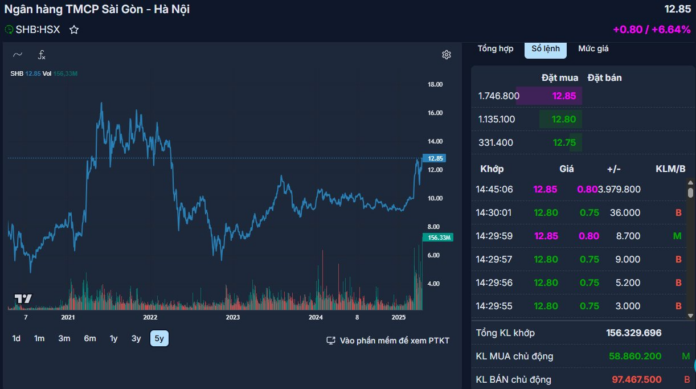

The April 18 session witnessed a volatile market. Notably, the shares of Saigon-Hanoi Commercial Joint Stock Bank (coded SHB) soared with abnormal liquidity.

Specifically, a massive influx of cash pushed the trading volume of SHB to over 156 million units, with a transaction value of nearly VND 2,000 billion – setting a record in the history of the bank’s listing. The SHB share price also traded positively, surging to the “blank” ceiling at VND 12,850/cp, the highest in nearly 3 years.

In reality, it is uncommon for a stock to have such a massive match of over 100 million units in the Vietnamese stock market. This is the third time SHB has achieved this feat.

In terms of business performance in 2024, SHB recorded a pre-tax profit of VND 11,543 billion, up 25% compared to 2023 and exceeding the plan approved by the AGM. The cost-to-income ratio (CIR) stood at 24.5%. Total assets by the end of 2024 exceeded VND 747,000 billion, an increase of 18.5% compared to the end of 2023.

SHB is expected to hold its 2025 AGM on April 22 at the Melia Hotel, 44B Ly Thuong Kiet, Hanoi. The record date for shareholders to attend the AGM was March 14, 2025.

According to the published proposal, SHB plans to present to shareholders a 2025 target of over VND 832,000 billion in total assets, a 16% growth in total credit balance. The non-performing loan ratio is tightly controlled below 2%. Pre-tax profit target is set at VND 14,500 billion, an increase of 25%.

Furthermore, the bank also aims to raise its charter capital to VND 45,942 billion to strengthen its financial foundation and maintain its position as one of the TOP5 largest private banks in Vietnam. SHB expects to pay a dividend of 18% for 2024, including 13% in shares and 5% in cash. In 2025, the dividend rate is expected to remain at 18%.

The Big Cap Let Loose: VN-Index Loses Most of its Gains, Stocks Still Impressively Reverse

The trading session today witnessed a dramatic turnaround in the final 30 minutes of continuous trading, with leading large-cap stocks suddenly reversing course. The heavy selling pressure from these stocks dragged the VN-Index down from its intraday high of 17.4 points (+1.43%) to just above the breakeven point, eventually closing with a modest gain of 1.87 points (+0.15%).

“A Bank Disburses 700 Billion VND in Loans to Young Homebuyers”

On the morning of April 8, Asia Commercial Joint Stock Bank (ACB) held its 2025 Annual General Meeting, sharing a host of positive updates and financial insights with shareholders and stakeholders alike.