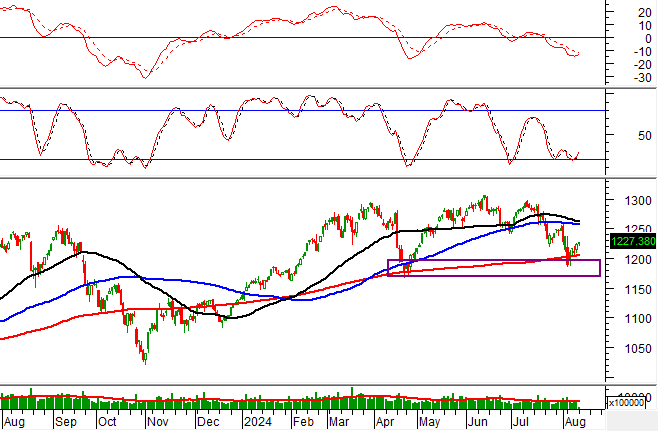

The Vietnamese stock market experienced a surprising trading session. After a sluggish start, the main index surged towards the end of the day as Bluechip stocks rallied. At the close of the April 17 session, the VN-Index rose nearly 7 points to 1,217.25. Liquidity was low, with a meager VND15,731 billion in matching value on HoSE.

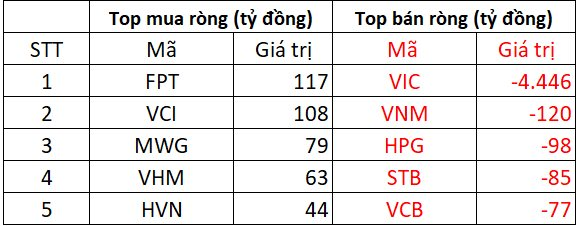

Foreign trading was a downside, with a strong net sell-off of VND4,585 billion in this session. Specifically:

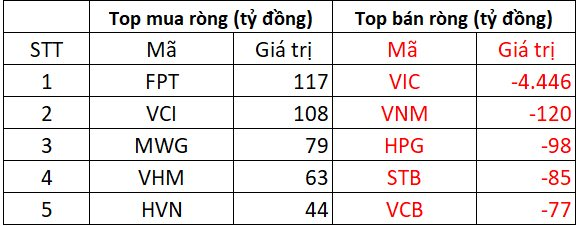

On HoSE, foreign investors net sold approximately VND4,550 billion

In the selling session, VIC shares witnessed a sudden net sell-off of VND4,446 billion, mostly through matching transactions. Following VIC, other stocks that were net sold in the range of tens to over a hundred billion VND included VNM (-VND120 billion), HPG (-VND98 billion), and STB (-VND85 billion).

Conversely, FPT was the most net bought stock in the market, with a value of up to VND117 billion. VCI was another stock that was net bought by over a hundred billion VND. MWG, VHM, and HVN were also net bought in the range of VND44 billion to VND79 billion.

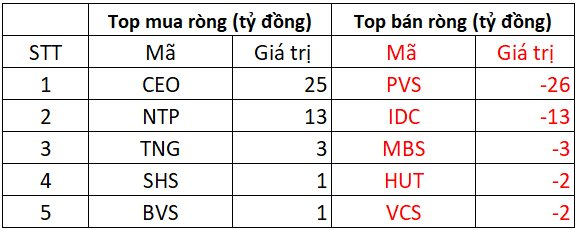

On HNX, foreign investors net sold about VND500 million

In terms of buying, CEO was net bought at around VND25 billion, while NTP was net bought at VND13 billion. TNG, SHS, and BVS also saw net buying in the range of a few billion VND each.

On the opposite side, PVS experienced a strong net sell-off of VND26 billion. IDC was also net sold at VND13 billion, followed by MBS, HUT, and VCS, which were net sold in the range of VND2 billion to VND3 billion.

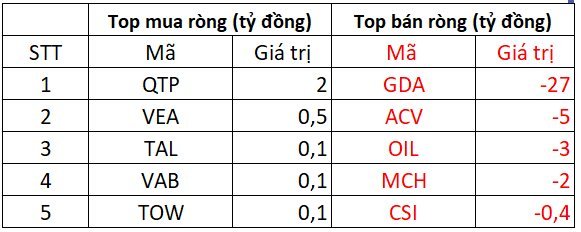

On UPCOM, foreign investors net sold VND34 billion

In terms of buying, QTP was net bought at around VND2 billion, followed by VEA, TAL, VAB, and TOW, although the values were not significant.

Conversely, GDA was heavily sold off at VND27 billion. ACV, OIL, and MCH were also net sold in the range of VND2-5 billion each, while CSI was net sold at around VND400 million.

The Power of Persuasive Writing: Crafting a Compelling Title

“BSC’s AGM: Record-breaking Profit Target of VND 560 Billion, 10% Dividend Payout”

The leadership team foresees a positive outlook for the stock market this year. They attribute this to the macroeconomic recovery and the low-interest-rate environment, which encourages capital inflows into the stock market. The potential market upgrade further enhances these favorable conditions.

The Big Cap Let Loose: VN-Index Loses Most of its Gains, Stocks Still Impressively Reverse

The trading session today witnessed a dramatic turnaround in the final 30 minutes of continuous trading, with leading large-cap stocks suddenly reversing course. The heavy selling pressure from these stocks dragged the VN-Index down from its intraday high of 17.4 points (+1.43%) to just above the breakeven point, eventually closing with a modest gain of 1.87 points (+0.15%).