Despite macroeconomic challenges, Rong Viet remains steadfast in its chosen path, confident in the positive prospects of the market, and determined to achieve its annual business plan goals.

Q1/2025 Business Results

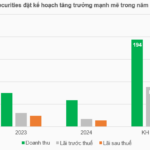

According to the recently published financial report, Rong Viet recorded a total revenue of VND 169.1 billion in Q1/2025, a 40.4% decrease compared to the same period last year. Total expenses were VND 147.5 billion. As a result, Rong Viet’s pre-tax and after-tax profits for the first quarter of 2025 were VND 21.6 billion and VND 17.9 billion, respectively. Thus, with a revenue target of VND 1,080 billion and an after-tax profit target of VND 288 billion, Rong Viet has accomplished 15.7% and 6.2% of its 2025 business plan, respectively.

Although brokerage activities witnessed a decline compared to Q1/2024, lending remained a bright spot, contributing VND 93.9 billion to Rong Viet’s total revenue in Q1 and growing by 2.3% year-on-year.

Investment revenue decreased compared to the previous year but grew compared to the previous quarter. With a cautious investment strategy, adherence to discipline, and a focus on risk management, Rong Viet expects its investment portfolio to grow positively by prioritizing well-founded companies with high growth potential, reasonable valuations, and positive narratives.

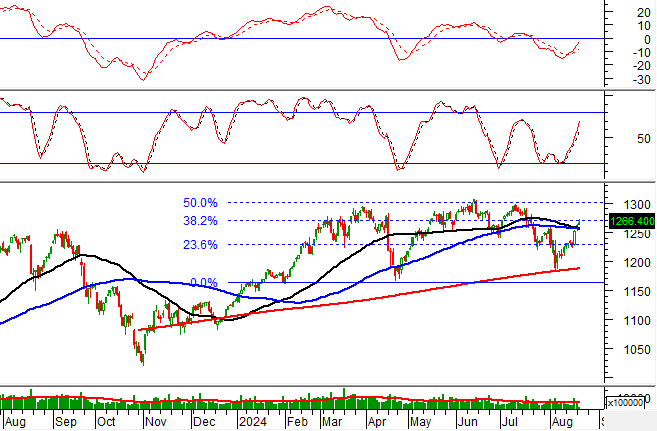

Assessing that the Vietnamese stock market in 2025 will present opportunities alongside challenges, including support from economic growth, reform policies, and the implementation of the KRX trading system, Rong Viet will continue to closely monitor market developments, seize opportunities, and strive to accomplish the 2025 business plan as assigned by the General Meeting of Shareholders.

As of March 31, 2025, Rong Viet’s total assets exceeded VND 6,315 billion, and equity surpassed VND 2,810 billion, a slight increase of 1.4% compared to the end of 2024. Financial indicators such as the debt-to-equity ratio (1.25 times), margin lending ratio (1.08 times), and financial safety ratio (536.4%) were all maintained at safe levels, far exceeding regulatory requirements.

In Q1/2025, Rong Viet also launched various promotional programs and introduced new products for its customers. Notably, the “Breakthrough” Combo offered new customers at Rong Viet an attractive margin interest rate of just 6.88% per year and free equity trading for six months. This program is valid until June 30, 2025.

Additionally, Rong Viet Fund Management Company (VDAM) successfully completed the initial public offering (IPO) of the Rong Viet Prosperity Investment Fund (RVPIF), attracting 564 investors and raising over VND 58.4 billion. RVPIF is an equity fund that focuses on listed companies with healthy finances, efficient business models, and long-term growth potential. The launch of the RVPIF open-ended fund is expected to contribute to the completion of Rong Viet’s investment product ecosystem while providing individual investors with more options and access to the capital market.

Closely following the direction of “Putting Customers at the Center,” Rong Viet will continue to invest in, research, develop, and perfect its ecosystem of diverse financial and investment services based on digital platforms. At the same time, the company will also promote the application of technology and digital transformation in governance, management, and business operations to optimize efficiency and enhance competitiveness in the market.

Enhancing Financial Capacity with Capital Increase and Bond Issuance Plans

Given the stock market’s proximity to potential upgrade opportunities, improving liquidity, and investors’ increasing demand for financial leverage, Rong Viet recognizes that a capital increase is a necessary step to promptly enhance financial resources and competitiveness. It will also proactively source capital to seize investment opportunities in the market.

Recently, Rong Viet’s General Meeting of Shareholders approved a plan to issue a maximum of 77 million shares to increase its charter capital to VND 3,200 billion in 2025.

Specifically, in Phase 1, Rong Viet will issue 24.3 million shares as a dividend payment for 2024 and 4.7 million ESOP shares (a ratio of 1.93%) at a price of VND 10,000 per share. In Phase 2, Rong Viet plans to offer a maximum of 48 million shares in a private placement to strategic investors and/or professional securities investors.

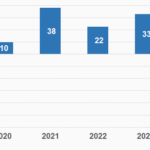

Also, in Q1/2025, Rong Viet successfully affirmed its credibility and the trust and accompaniment of domestic and foreign customers and investors by issuing a private bond worth VND 500 billion with a fixed interest rate of 8.2% per annum to supplement capital for its business activities. Previously, in 2024, Rong Viet had issued four bond batches totaling more than VND 3,089 billion, achieving a success rate of 99.6%.

With a desire to create the best value for customers, partners, shareholders, employees, and the community, Rong Viet is committed to continuing its efforts, maximizing resources, improving operational efficiency, and striving for sustainable development.

The Capital Conundrum: How Do Banks Bolster Their Capital During the Festival Season?

The season of shareholder meetings is upon us, and with it, a flurry of announcements from commercial banks regarding their plans to issue stock dividends to boost their chartered capital. This year, banks are offering stock dividends at rates ranging from 15% to 35%, providing ample opportunity for credit institutions to shore up their financial cushions.

“VISecurities Rebrands as OCBS, Announces Capital Increase to 1,200 Billion”

Vietnam International Securities Joint Stock Company (VISecurities) is gearing up for its upcoming 2025 Annual General Meeting of Shareholders, scheduled for March 14. The company has ambitious plans on the agenda, including a proposed name change and a move to relocate its headquarters from Hanoi to Ho Chi Minh City. VISecurities is also setting its sights on achieving record-high revenue and profit targets, aiming to make this fiscal year the most successful in the company’s 16-year history.

Bond Leverage at The Maris Vung Tau Project

“As 2024 drew to a close, Allgreen Vuong Thanh Trung Duong Ltd. successfully raised an additional 535 billion VND through bond issuances, bringing their total capital raised via this route to 2,270 billion VND within just one month. This injection of funds is dedicated to expediting the development of their premium resort project, The Maris Vung Tau.”

The Foreign Securities Firm on the Verge of a Thousand Billion Capital Increase

On December 6, the Ministry of Finance granted a certificate of registration for public offering of shares to Guotai Junan Securities Joint Stock Company (Vietnam) (HNX: IVS). The offering entails the issuance of 69.35 million new shares, maintaining a 1:1 ratio, thus increasing the company’s capital to VND 1,387 billion.