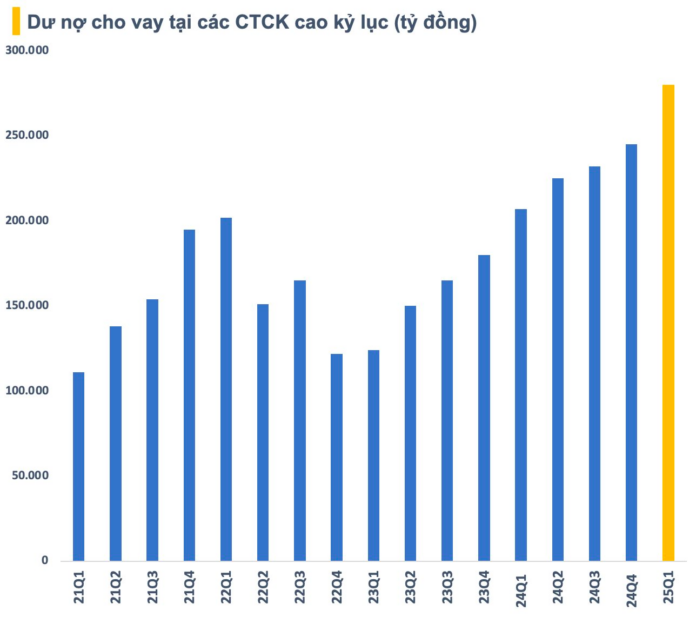

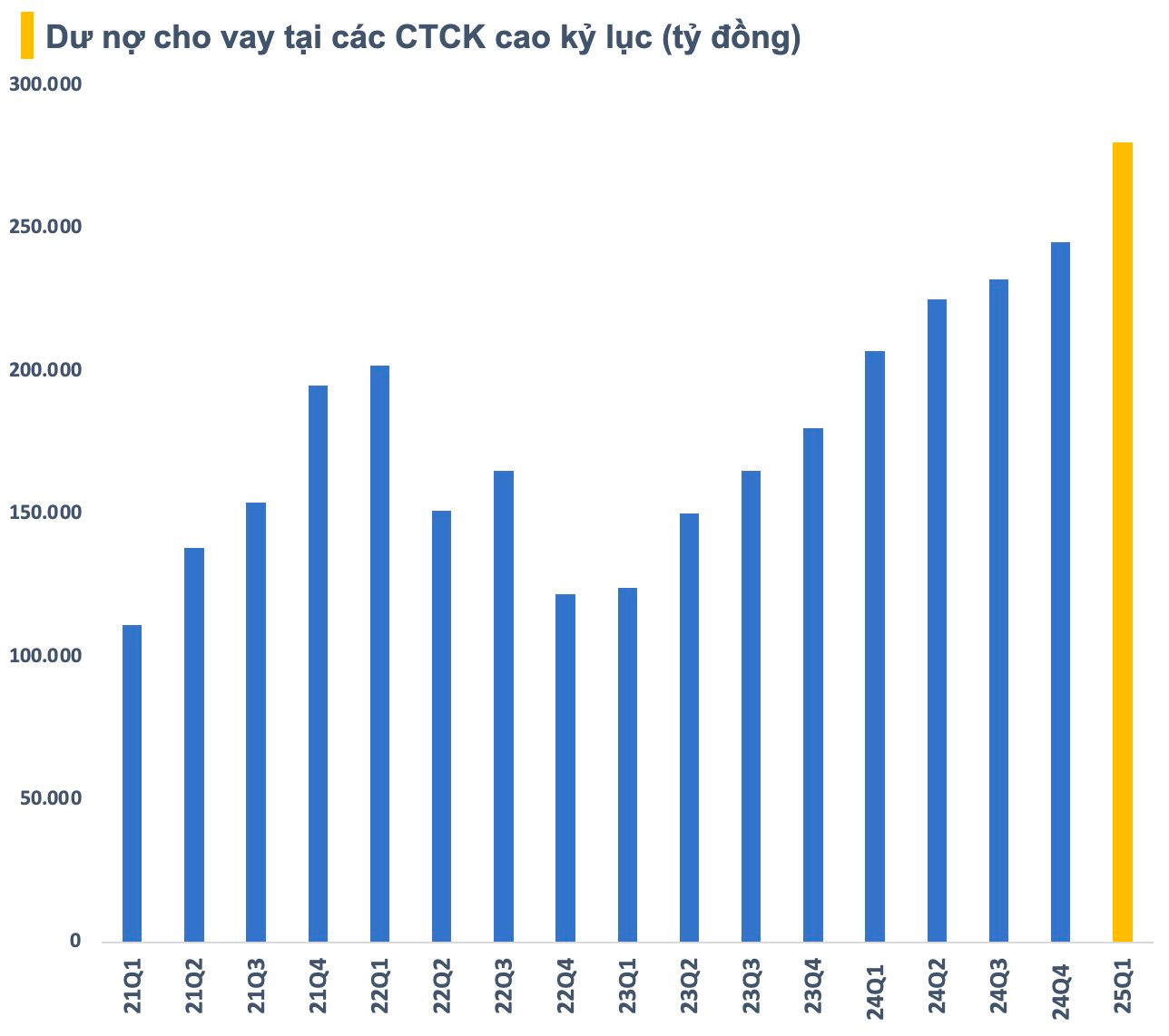

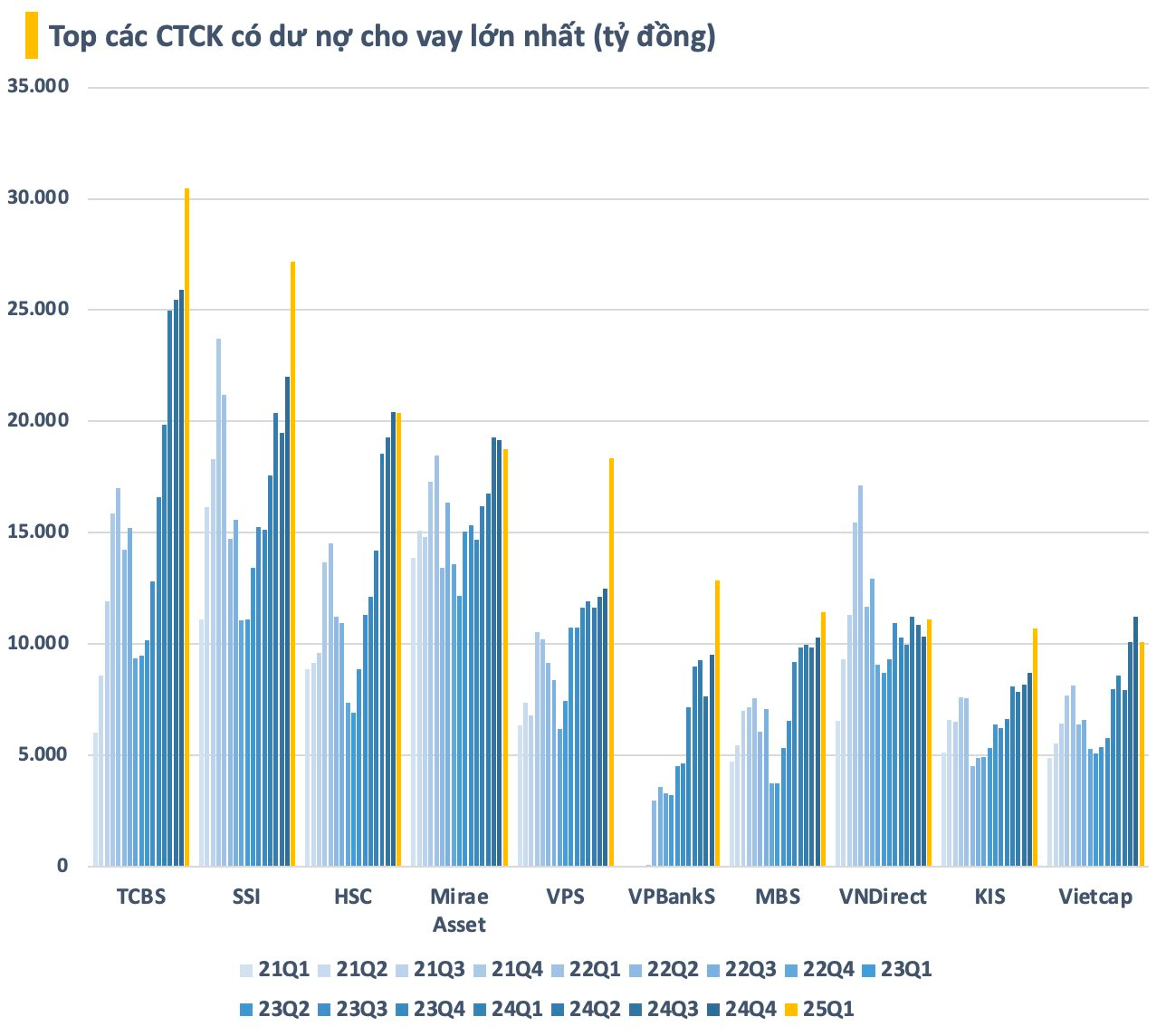

According to statistics, as of Q1 2025, the estimated total lending balance at securities companies was approximately VND 280,000 billion (~USD 11 billion), an increase of VND 35,000 billion compared to the previous year, and a record high. Of this, margin debt was estimated at VND 273,000 billion, an increase of VND 33,000 billion compared to the end of 2024, also a record high for the Vietnamese stock market.

Many top securities companies in lending activities recorded higher lending balances compared to the same period last year and the previous quarter. Some companies even set new records, including TCBS, SSI, VPS, VPBankS, MBS, and KIS VN, surpassing the market boom when the VN-Index was at its peak of 1,500 in late 2021 and early 2022.

VPS had the strongest quarter-on-quarter increase in lending balance, ending Q1 with over VND 18,300 billion, an increase of VND 5,800 billion compared to the end of 2024. SSI, TCBS, VPBankS, and KIS VN also recorded significant increases in lending balances, amounting to thousands of billions. In contrast, Vietcap, Mirae Asset, and HSC saw a contraction in lending activities after the first quarter of 2025.

The market had ten securities companies with lending balances exceeding VND 10,000 billion, two more than at the end of 2024. Notably, TCBS and SSI were the first securities companies to surpass the VND 30,000 billion and USD 1 billion thresholds, respectively, in lending balances.

Recently, securities companies have been actively increasing their capital to strengthen their resources for lending activities and meet the Non-Pre-funding demands of foreign organizations. With the wave of capital increases that have taken place and will continue, it is likely that Vietnam will soon have more securities companies with billion-dollar lending balances.

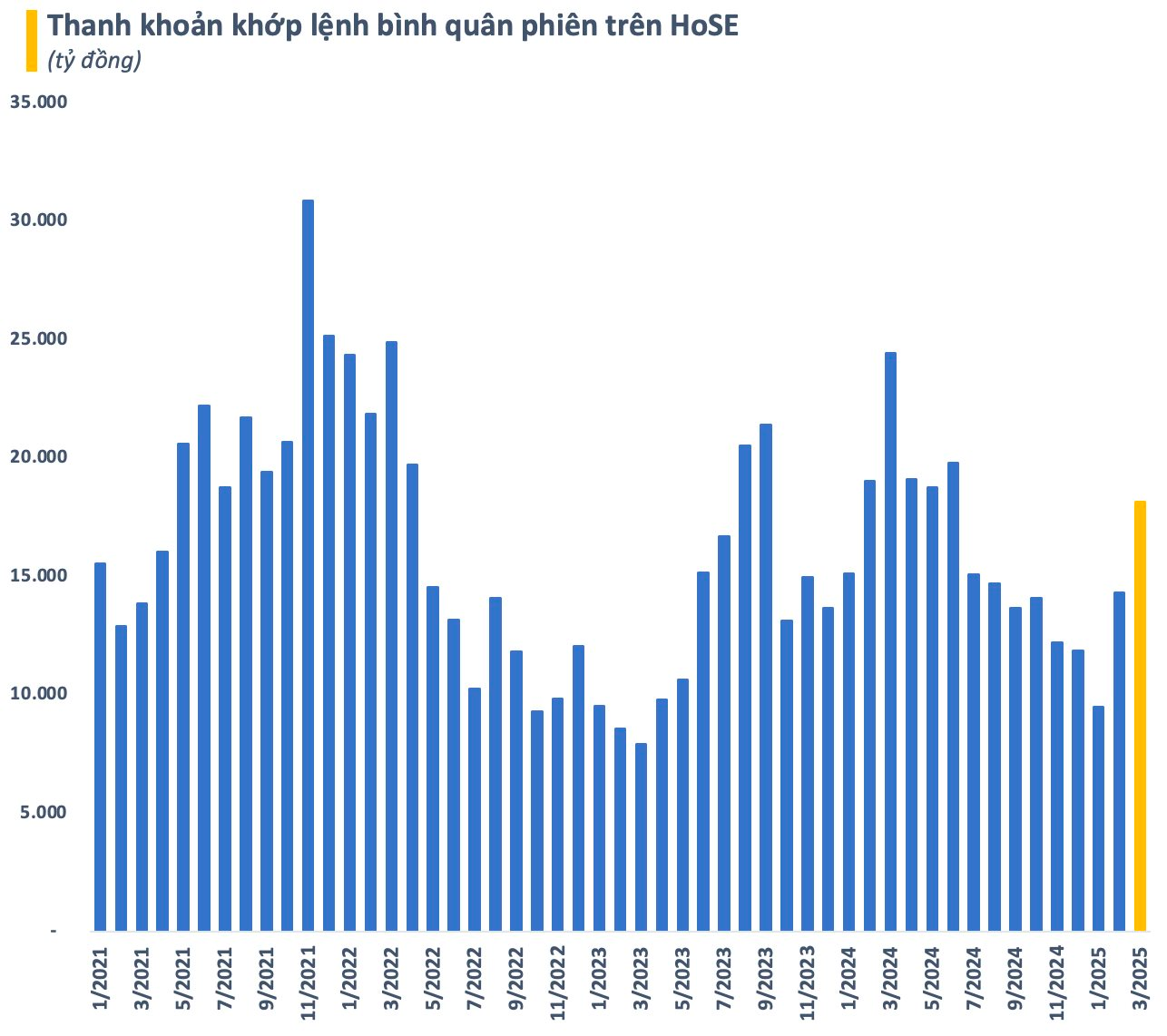

Notably, margin debt hit a record high just before the market’s deep correction in early April. The VN-Index lost more than 220 points, falling below the 1,100-point level, and the market capitalization plummeted by VND 1.2 quadrillion at one point. The widespread force-sell situation caused many stocks to hit their daily limit losses. However, bottom-fishing demand later helped the market recover.

The surge in margin debt in the first quarter contributed to improved market liquidity. The average matching value on HoSE continuously increased to over VND 18,000 billion per session in March. This trend continued and even intensified in April when the market experienced significant fluctuations.

In reality, the lending balance at securities companies not only comes from individual investors’ leverage demands but also from large shareholders’ and executives’ loan deals to raise capital when facing challenges in bank credit and corporate bond channels. Pledging stocks for loans is much more accessible than mortgaging other assets to borrow from banks or issuing bonds, promoting the “bankization” of securities companies.

According to experts, the rising lending balance among individual investors is only part of the story, with a significant portion coming from organizations and market heavyweights. Some of this capital may not be entirely invested in the market but used for other purposes. This situation increases the risk of force-sell events during unfavorable market conditions.

The Dragon’s Soaring Success: Unveiling Rồng Việt’s Q1/2025 Financial Results, Laying the Foundation for Long-term Growth

Dragon Vietnam Securities JSC has announced its Q1/2025 financial results, reporting impressive figures with revenue reaching VND 169.1 billion and pre-tax profit touching VND 21.6 billion.

The Capital Conundrum: How Do Banks Bolster Their Capital During the Festival Season?

The season of shareholder meetings is upon us, and with it, a flurry of announcements from commercial banks regarding their plans to issue stock dividends to boost their chartered capital. This year, banks are offering stock dividends at rates ranging from 15% to 35%, providing ample opportunity for credit institutions to shore up their financial cushions.

“VISecurities Rebrands as OCBS, Announces Capital Increase to 1,200 Billion”

Vietnam International Securities Joint Stock Company (VISecurities) is gearing up for its upcoming 2025 Annual General Meeting of Shareholders, scheduled for March 14. The company has ambitious plans on the agenda, including a proposed name change and a move to relocate its headquarters from Hanoi to Ho Chi Minh City. VISecurities is also setting its sights on achieving record-high revenue and profit targets, aiming to make this fiscal year the most successful in the company’s 16-year history.

VCBS Ranks in the Top 10 Brokerage Firms by Market Share in 2024

Recently, the Ho Chi Minh City Stock Exchange (HOSE) unveiled the top 10 securities companies with the largest brokerage market share in Vietnam. This list showcases the leading firms in the industry, commanding a significant portion of the market and playing a pivotal role in shaping Vietnam’s burgeoning investment landscape.