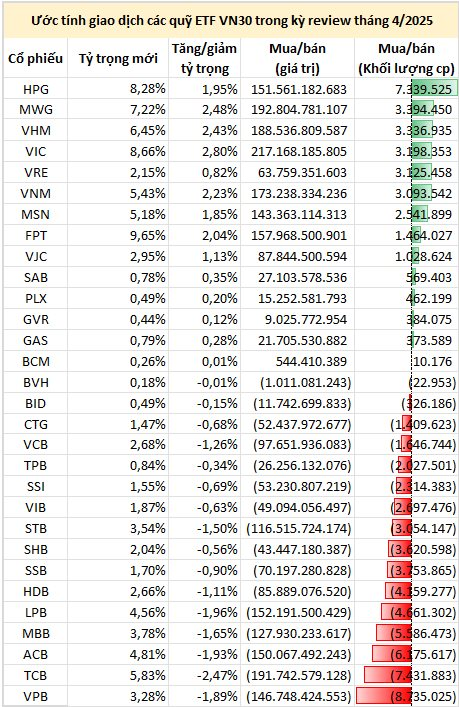

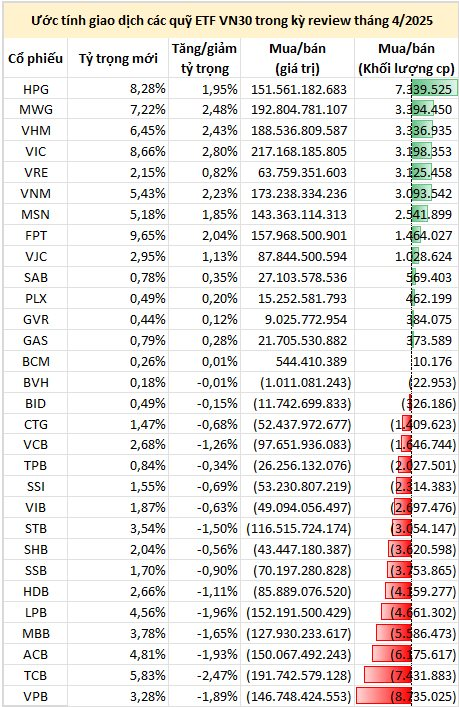

HoSE has announced an update to the HOSE-Index for April 2025. The changes will take effect from May 5, 2025, making April 28, 2025, the last day for ETF funds replicating these indexes to restructure their portfolios.

For the VN30 index basket, there are no changes to the stock list in this review. However, this restructuring marks the first application of the HOSE Index version 4.0 rules. One of the most notable changes is the adjustment of the “Same-sector group: calculated capitalization weight is 40%.” This will significantly reduce the weight of the financial sector, including banks and securities, as this group currently accounts for about 58% of the index’s capitalization under the old rules.

There are currently four ETFs referencing the VN30 index: DCVFMVN30 ETF, SSIAM VN30 ETF, KIM Growth VN30 ETF, and MAFM VN30 ETF. Their combined assets are estimated at nearly VND 7,800 billion as of April 16, 2025.

According to estimates, ETFs referencing the VN30 index may need to sell off all their bank and securities stocks to reduce the weight of this sector in their portfolios. Specifically, the funds may sell more than 8.7 million VPB shares, 7.4 million TCB shares, 6.1 million ACB shares, 5.6 million MBB shares, 4.7 million LPB shares, etc., to lower their weightings.

Conversely, some stocks may see significant buying to increase their weightings, such as HPG (7.3 million shares), MWG (3.4 million shares), VHM (3.3 million shares), and VIC (3.2 million shares)…

The Market Beat on Valentine’s Day: Finance Sector Falters but VN-Index Stays in the Green

The market ended the session on a positive note, with the VN-Index climbing 5.73 points (+0.45%) to reach 1,276.08, while the HNX-Index rose 1.7 points (+0.74%) to close at 231.22. The market breadth tilted in favor of gainers, with 473 advancing stocks against 300 decliners. The large-cap sector painted a bullish picture, as evidenced by the VN30 basket, which witnessed 16 gainers, 8 losers, and 6 stocks ending unchanged, favoring the bulls.

The Stock Market Sell-Off: A Whopping 1,756.1 Billion VND Net Selling by Individual Investors

The market is buzzing with liquidity as banks take the lead. Today’s trading volume across all three exchanges reached an impressive 19,000 billion VND, with foreign investors making a remarkable turnaround. They net bought an outstanding 738.1 billion VND, and their matched orders alone accounted for 588.2 billion VND in net purchases. It’s a clear sign of confidence in the market, and we can expect some exciting movements in the coming days.

The Looming Threat of ETF Sell-Off for Banking Stocks: A Precarious Scenario Unveiled

Estimates suggest that ETFs will purchase 15.1 million new LPB shares and offload 3.23 million POW shares entirely. Other stocks witnessed sell-offs without corresponding buy-ins, including TCB, which shed 1.38 million shares, ACB with 1.2 million shares sold, VPB at 1.3 million, and HPG, offloading 1 million shares.

Stock Market Blog: Trading for Quick Profits?

The persistent upward trend is causing a slight discomfort for investors who are holding cash and have not yet bought into the market. Many are waiting for a pullback to present a better buying opportunity, with the VNI index’s level around 1240 being keenly watched.