On April 18th, SSI Joint Stock Company (SSI code) held its annual general meeting of shareholders for the year 2025.

The SSI Board of Directors presented a plan to achieve a revenue of 9,695 billion VND and pre-tax profits of 4,252 billion VND, an increase of 11% and 20% respectively from 2024. If realized, this would be a new record for the company. According to SSI, the plan is based on a scenario where the VN-Index fluctuates between 1,450 and 1,500 points with an average market liquidity of approximately 19,500 billion VND per session.

SSI’s Annual General Meeting of Shareholders held on the afternoon of April 18th.

When asked by a shareholder about the recent “bottom-calling” by the SSI Chairman and whether SSI would engage in proprietary trading, Mr. Nguyen Duy Hung stated that it was a personal opinion expressed on his Facebook account. “But we will never say one thing and do another,” said Mr. Hung.

One of the topics that attracted the interest of shareholders was SSI’s involvement in the field of digital assets. In response to this, Mr. Nguyen Duy Hung stated that at the present time, the company has no policy to operate a digital asset exchange and highlighted three considerations to find an answer.

“If we operate an exchange, will it bring benefits and profits to SSI? Are there any risks associated with this field, and thirdly, can we manage these risks with technology?” Mr. Hung posed these questions and emphasized that SSI would not engage in activities that could potentially cause financial loss for the masses.

However, SSI’s leadership recognizes that digital assets are an inevitable development trend. Some governments are considering adding digital currencies to their national reserves, similar to gold.

“Blockchain technology and digital technology are the future. As the future, they will bring profits and value to the economy,” said the SSI Chairman. He also mentioned that they have started researching and surveying the digital asset market but are still in the initial stages of exploration.

According to Mr. Hung, a leading financial institution cannot “lack understanding, knowledge, or interest” in this field, but they also cannot rush into it.

“We have established a subsidiary, which can be likened to an incubator for digital businesses, and we are waiting for the legal framework for digital assets to be established before developing our business further. Turning these projects into actual efficiency remains to be seen, as the legal framework is still unclear,” Mr. Hung shared.

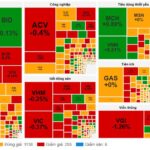

The Market Beat on December 24th: Strong Inflows in the Afternoon Session See VN-Index Recover to Near Reference.

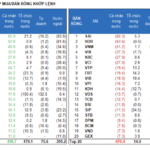

Despite a negative mid-session turn, the market recovered to close near reference levels today. The VN-Index ended at 1,260 points, a minor loss of 2.4 points, while the HNX-Index dipped 0.15 points to 228.36 points.

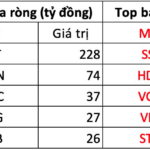

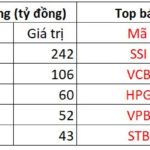

The Great Foreign Turnaround: Overseas Investors Go on a Buying Spree After 30 Sessions of Intense Selling, Spending 250 Billion on a Real Estate Stock

After 30 consecutive selling sessions, foreign investors finally turned net buyers, bringing some balance back to the market.