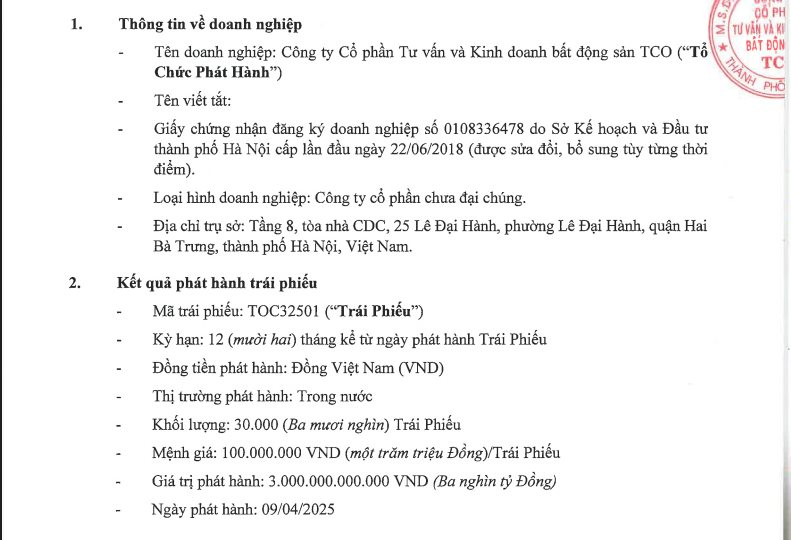

According to information from the Hanoi Stock Exchange (HNX), TCO Real Estate JSC (TCO Real Estate) has just completed the issuance of TOC32501 bonds with a total value of VND 3,000 billion.

Specifically, the TOC32501 bond batch was issued in the domestic market on April 09, 2025, and also completed on the same day. The bonds have a term of 12 months and will mature on April 09, 2026. The total issuance volume is 30,000 bonds, with a par value of VND 100 million/bond.

These are non-convertible bonds that do not come with warrants and are asset-backed in the form of a “payment guarantee”. The fixed interest rate for this bond batch is 8.2%/year, paid once at maturity. Techcom Securities JSC (TCBS) is the registrar for this bond issue.

Notably, TCO Real Estate is the first company in the real estate industry to successfully raise capital through bond issuance since the beginning of 2025. This is a positive signal for the real estate market in the context of capital-raising activities through bonds facing many challenges since the beginning of the year.

TOC32501 bond batch with a value of VND 3,000 billion was issued and completed within 24 hours.

Previously, on December 31, 2024, TCO Real Estate also successfully raised VND 2,500 billion through the TCO324001 bond batch, with an issuance interest rate of 9.6%/year and a maturity date at the end of 2025.

In terms of business results, in 2024, TCO Real Estate reported a post-tax profit of VND 76.8 billion, an increase of nearly 6 times compared to the previous year.

As of December 31, 2024, the company’s equity reached VND 1,209 billion, up 6.8%. This includes VND 1,000 billion in owner’s investment capital and over VND 209 billion in undistributed post-tax profits.

As of the end of 2024, the company’s total liabilities were VND 11,984 billion, up 135.3% compared to the beginning of the year, equivalent to an increase of nearly VND 7,000 billion. Of this, bonds payable were VND 2,464.6 billion, and other payables were over VND 9,519 billion.

Notably, this real estate company has an amount of VND 5,605 billion in prepayments from customers. This is a rare bright spot in the dark financial report of this real estate company.

Established in June 2018, TCO Real Estate mainly operates in the field of real estate business, with its head office located on the 8th floor, CDC Building, 25 Le Dai Hanh, Le Dai Hanh Ward, Hai Ba Trung District, Hanoi.

In terms of capital structure, the company started with a charter capital of VND 50 billion, then converted to a joint-stock company in November 2019 with a charter capital of VND 2,000 billion. In March 2022, the company adjusted its capital downward to VND 1,000 billion. Recently, in January 2025, TCO again increased its charter capital to VND 1,120 billion.

Currently, the Chairman of the Board of Directors of TCO Real Estate is Mr. Ngo Manh Trung, and the General Director is Mrs. Nguyen Linh Phuong.

SHS Earns a Profit of Over 325 Billion VND in Q1 2025, Announces 20% Dividend Payout

As of March 31, 2025, SHS’s total loan balance stood at VND 4,600 billion, reflecting an impressive 11% growth compared to the end of 2024.

The Secret Behind Eximbank’s Record Pre-Tax Profit of Over VND 4,000 Billion

“With a strategic focus on diversifying its revenue streams and financial services offerings, Eximbank has carefully structured its lending portfolio to prioritize safety and efficiency. This approach has been instrumental in driving impressive business results for the bank, setting it on a path towards a remarkable year in 2024.”

“TTC AgriS Reaps Results: On Track to Achieve Annual Profit Goals”

TTC AgriS (HoSE: SBT) has unveiled its impressive Q2 financial results for the 2024-2025 fiscal year, showcasing significant growth in both revenue and profit.