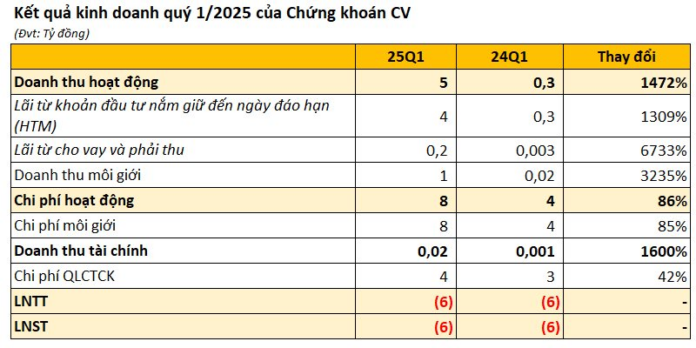

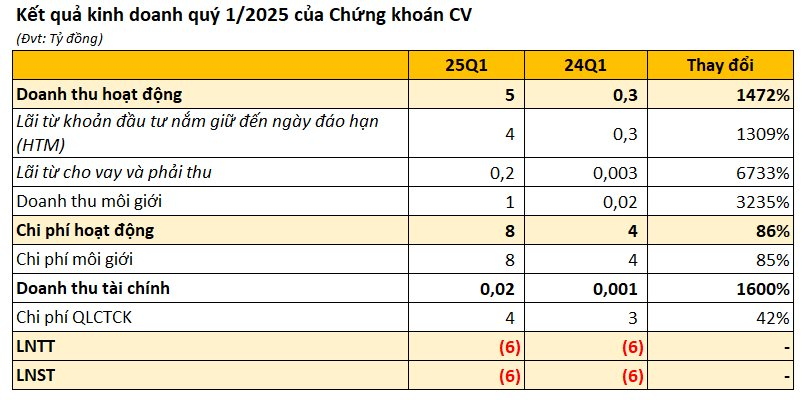

Securities Joint Stock Company CV (CVS) has announced its Q1 2025 financial statements, reporting operating revenue of nearly VND 5 billion, a remarkable 1,472% surge compared to the same period last year. CVS’s revenue primarily comprises profits from held-to-maturity (HTM) investments, totaling over VND 4 billion, along with more than VND 200 million in loan and receivable interests and nearly VND 600 million in brokerage revenue.

However, operating expenses soared to nearly VND 8 billion, largely attributed to brokerage costs. Coupled with approximately VND 4 billion in securities company management expenses, CVS incurred a pre-tax loss of over VND 6 billion in the first quarter – marking the eleventh consecutive quarter of operating losses.

For 2025, CVS targets nearly VND 55 billion in revenue, nearly five times the previous year’s performance. However, the company plans for a post-tax loss of VND 34.7 billion, an increase from the VND 27 billion loss in 2023. Thus, the securities firm has accomplished 9% of its revenue target while already reaching about 17% of its projected loss.

As of January 31, 2025, CVS’s total assets stood at VND 334 billion, a decrease of roughly VND 6 billion from the beginning of the year. HTM investments amounted to VND 105 billion, a sharp decline of nearly 60% over three months. These comprise entirely of fixed-term deposits in banks.

Conversely, cash equivalents witnessed a substantial increase to VND 181 billion, per the financial statements, comprising short-term bank deposits or deposits with maturities of 1-3 months remaining. The company commenced margin lending after Q1 2025, with margin loans and UTTB reaching nearly VND 5 billion. As of the end of 2024, accumulated losses totaled nearly VND 128 billion.

The Securities Company Associated with MoMo e-Wallet

CV Securities, formerly known as Hong Bang Securities, was established in 2009. The company changed its name to Hung Thinh Securities in 2015 and subsequently to CV Securities in 2018.

On June 9, 2022, M_Service Joint Stock Company, the owner of the MoMo e-wallet, acquired over 4.4 million CVS shares, equivalent to a 49% stake, from two shareholders: Vice Chairman Jiang Wen and CEO Nguyen Kim Hau. This move signaled a new investment direction for M_Service amid the unprofitable performance of the MoMo e-wallet business. While MoMo’s revenue grew steadily each year, its losses also expanded. In 2022 and 2023, MoMo recorded consecutive net losses of VND 1,150 billion and VND 287 billion, respectively.

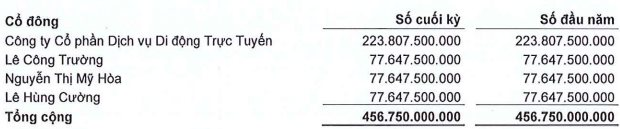

Following the capital increases, as of Q1 2025, M_Service held nearly 22.4 million CVS shares, maintaining its 49% ownership in CVS. Additionally, three individuals collectively owned nearly 7.8 million shares (17% stake): Mr. Le Cong Truong, Ms. Nguyen Thi My Hoa, and Mr. Le Hung Cuong, unchanged from the beginning of the year.

Source: CVS’s Q1 2025 Financial Statements