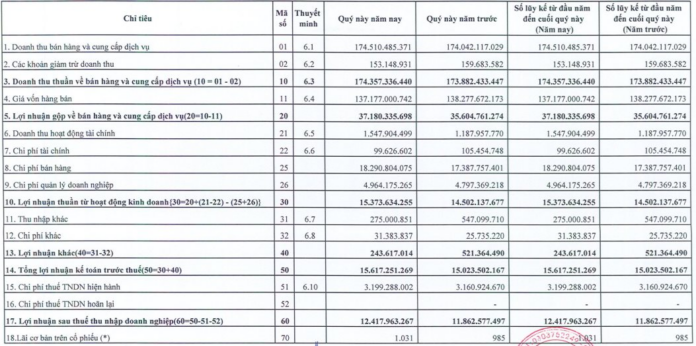

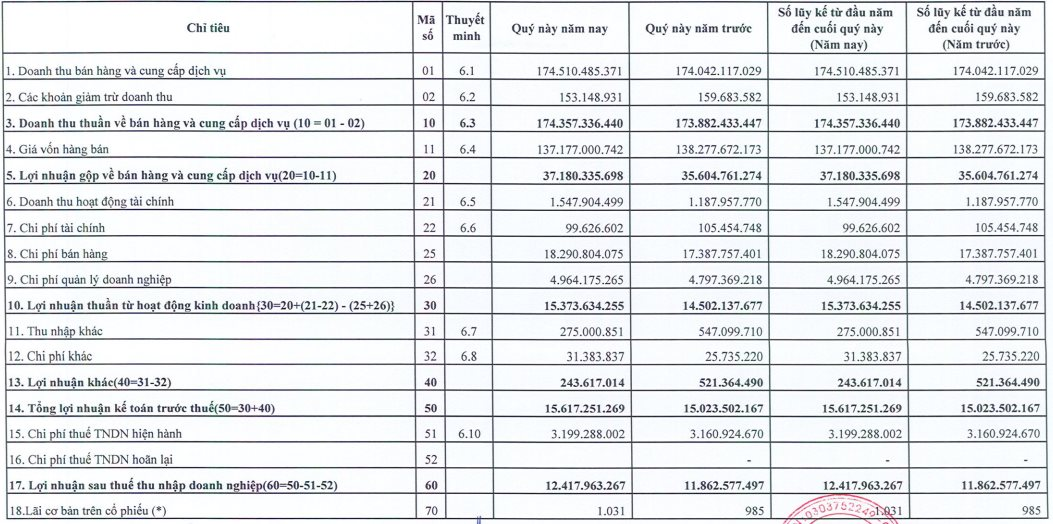

Safoco Food Joint Stock Company (code: SAF) has announced its first-quarter 2025 financial statements with a slight increase in net revenue of VND 500 million compared to the same period, reaching over VND 174 billion (averaging over VND 1.9 billion per day). The reduction in cost of goods sold helped to increase gross profit by more than 4% to over VND 37 billion, with a gross profit margin of 21.3%, a slight improvement from 20.5% in the previous year.

During this period, financial revenue was recorded at VND 1.5 billion, a 30% increase, while financial expenses were less than VND 100 million. Selling expenses and general and administrative expenses also increased slightly by 5% and 3%, respectively, compared to the same period.

As a result, Safoco reported an after-tax profit of over VND 12 billion, a 4.5% increase compared to the previous year.

In 2025, the company plans to achieve a total revenue of VND 780 billion and a pre-tax profit of VND 61 billion. After the first quarter, Safoco has accomplished 22.5% of its revenue target and nearly 26% of its profit goal.

According to our understanding, Safoco is a subsidiary of Southern Food Corporation (Vinafood II) and was formerly known as Foodstuff Store No. 4, established in 1995. The company officially commenced operations on May 1, 2005, with a charter capital of VND 22 billion.

Its primary business activities include manufacturing noodles, pasta, rice paper, and other starch- and wheat flour-based products; trading in foodstuffs, consumer goods, and other products under the Safoco brand. Notably, Safoco is well-known for its rice paper (spring roll wrappers), an essential ingredient in fried spring rolls, as well as its noodles, pasta, rice paper, and other starch- and wheat flour-based products.

Safoco is also recognized for its tradition of paying high dividends, even distributing all profits as dividends. Looking back at historical data over the past decade, the cash dividend rate has consistently remained around 30% annually. For 2024 and 2025, the expected dividend ratio is set to remain at 30% in cash (VND 3,000/share).

In the market, SAF shares experienced a significant correction, closing at VND 53,900 per share on April 16, 2025, representing a 17% decrease from its peak at the beginning of the year.

SSI Aims for Over VND 1,000 Billion in Pre-Tax Profit in Q1 2025, Sets Record with Outstanding Loan Balance

With an outstanding loan balance of over 27,000 billion, SSI has reached its highest lending level since its inception. This figure surpasses the peak lending period when the VN-Index climbed to 1,500 in late 2021 and early 2022.

The Surprising Secrets to Overcoming a Sharp Decline in Deferred Revenue

Deferred interest income plays a pivotal role in shaping a bank’s profit structure and can serve as a window into the bank’s asset quality. Moreover, it acts as a harbinger of profit quality. With the expiration of debt moratorium circulars, some banks have unveiled issues pertaining to this very item.

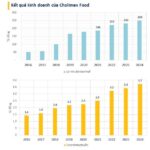

“Choosing Competition Over Compromise Pays Off: Cholimex Chili Sauce’s 15-Year Success Story of Consistent Growth, 50% Annual Dividends, and a Skyrocketing Stock Price to 330,000 VND – Quadruple the Price Once Offered by Masan”

This is Cholimex Food’s highest-ever financial result, marking a positive growth streak for 15 consecutive years.