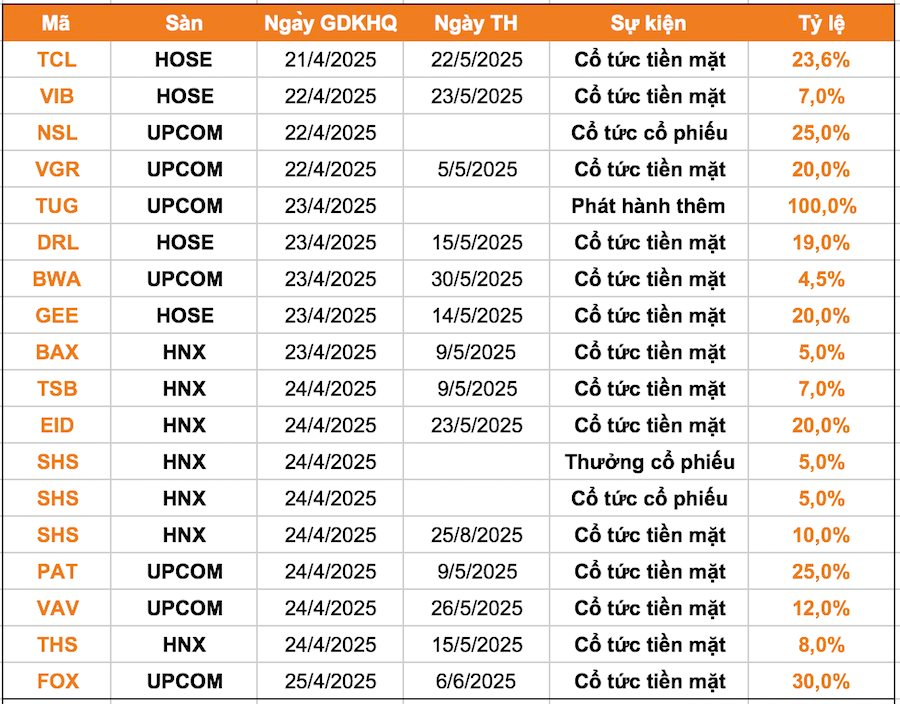

According to statistics, 16 businesses announced dividend lock-in during the week of April 21-25, with 13 companies paying cash dividends, ranging from a high of 30% to a low of 4.5%.

On April 25,

Saigon-Hanoi Securities (SHS)

will finalize the list of shareholders to distribute a 10% cash dividend (VND 1,000 per share) for 2024. The total expected payout exceeds VND 830 billion.

Additionally, the company will issue bonus shares as dividends for 2023 at a 5% rate and issue new shares from equity capital at the same ratio. The cash dividend payment date is set for August 25, 2025.

FPT Telecom (UPCoM: FOX),

a subsidiary of FPT Corporation, has announced the payment of the second cash dividend for 2024 at VND 3,000 per share. The record date for shareholders eligible for this dividend is April 28, 2025, and the expected payment date is June 6.

Previously, FPT Telecom disclosed a plan to pay an interim cash dividend for 2024 of VND 2,000 per share on May 30, based on the shareholder list finalized on March 17.

With over 492.5 million shares in circulation, FPT Telecom is expected to distribute nearly VND 1,500 billion for this dividend and a combined VND 2,500 billion for both installments.

GELEX Electric (HoSE: GEE)

, a subsidiary of GELEX Group, has announced the payment of the remaining 2024 cash dividend at a rate of 20% per share, equivalent to VND 2,000 per share. The record date for shareholders is set as April 24, and the expected payment date is May 14, 2025.

With 305 million shares in circulation, the company will pay out VND 610 billion in dividends. GELEX Group, the majority shareholder, currently holds nearly 80% of GELEX Electric’s capital and is expected to receive approximately VND 480 billion in dividends.

Vietnam International Bank (VIB)

has announced that April 22 is the ex-dividend date for a 7% cash dividend for 2024.

Specifically, VIB will pay a 2024 cash dividend to existing shareholders from retained earnings after allocating funds to various reserves. The total amount corresponds to over VND 2,085 billion, and the dividend rate is 7% (VND 700 per share). The payment date is set for May 23.

On April 22,

Tan Cang Cargo Service Corporation (TCL)

will finalize the list of shareholders to distribute 2024 dividends.

Accordingly, the company will pay cash dividends at a rate of 23.64%, meaning that for each share held, shareholders will receive VND 2,364. The total expected payout is approximately VND 71.3 billion. The payment date is tentatively set for May 22. Thus, the dividend rate has slightly increased compared to the previously approved plan of 23.23%.

Mastering the Art of Persuasion: The Ultimate Guide to Writing Compelling Copy and Captivating Customers

SHS Hanoi-Saigon Securities Corporation (HNX: SHS) has announced that April 25th is the deadline for shareholders to register to receive a substantial 20% dividend payout in cash and stocks. This announcement underscores SHS’s unwavering commitment to protecting shareholders’ interests and enhancing their investment value.

“A Plea for Understanding: Tran Dinh Long Appeals to Hoa Phat Shareholders Regarding the Decision to Forego Cash Dividends”

According to Mr. Long, unless there are any extraordinary circumstances, Hoa Phat will continue to pay cash dividends from 2026 onwards.

Record-Breaking Shareholder Numbers for Hoa Phat: The Company Needs 5 My Dinh Stadiums to Accommodate Them All

Chairman of the Board of Directors, Tran Dinh Long, revealed that Hoa Phat currently has over 194,000 shareholders, the highest number on the stock exchange and a record for the company. This impressive figure showcases the strong support and confidence that investors have in Hoa Phat’s business and its future prospects. With a diverse range of shareholders, the company is well-positioned to continue its growth trajectory and solidify its position as a leading enterprise in the industry.

“MB’s Strategic Initiatives: Divesting from MCredit and MBCambodia, Distributing 35% Dividends, and Investing up to VND 5,000 Billion in MBV”

At the 2025 Annual General Meeting, MB will propose a cash dividend plan of 3% and a stock dividend of 32%. The bank also seeks shareholder approval for a change in ownership structure, which will result in MBCambodia and MCredit no longer being subsidiaries of MB. Additionally, the bank plans to invest up to VND 5,000 billion in MBV.

The Stock Market Wrestler: How Mai Phương Thúy Turned a Tidy Profit of 1.5 Billion VND Overnight by Grappling with Billionaire Trần Đình Long’s Shares.

Yesterday, former Miss Vietnam Mai Phương Thúy took to Facebook to share her recent investment move. In her post, she revealed that she had purchased one million shares of Hoa Phat Group (HPG) at the floor price. Her exact words were: “Struggled all day just to buy one million HPG shares at the floor price.”