Vietnamese Enterprises Dominate 1/3 of Global Export Output

Duc Giang Chemical Joint Stock Company (stock code DGC – HoSE) is currently the largest exporter of yellow phosphorus (P4) in Asia. With China no longer exporting yellow phosphorus, Duc Giang now controls nearly 1/3 of the total global yellow phosphorus export volume.

Yellow phosphorus is an important raw material widely used in various industries such as fertilizers, pesticides, food, and especially in the production of electronic chips, semiconductors, and lithium batteries.

Notably, the corporation owns exclusive powder-form apatite ore smelting technology, allowing for cost reduction and maximum utilization of low-grade apatite ore.

Duc Giang Chemical Group’s major clients include Mitsubishi (Japan), KS-International (UK), and UNID Global Corp (South Korea)…

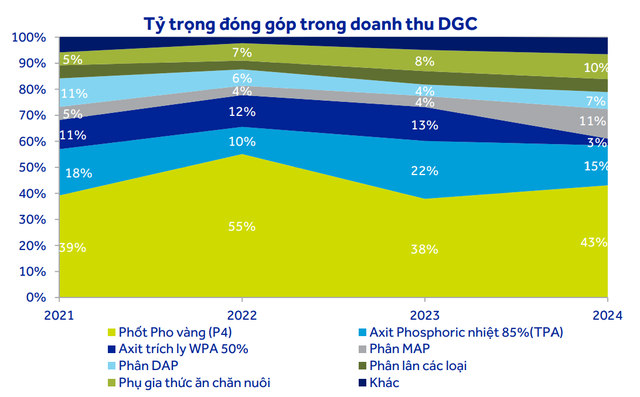

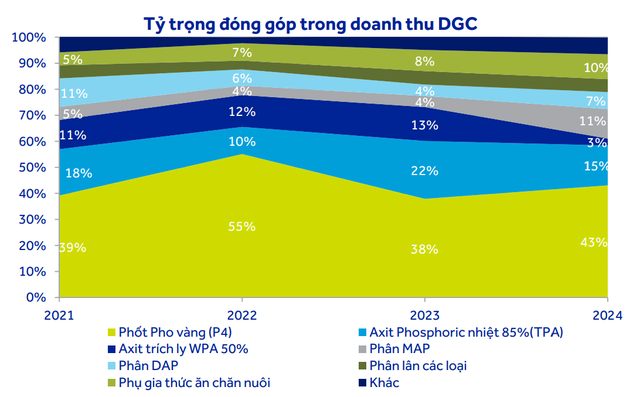

In 2024, DGC recorded revenue of 9,865 billion VND and net profit of 3,109 billion VND. During this period, DGC focused on yellow phosphorus and fertilizer segments (DAP/MAP) while reducing operations in other segments such as food-grade phosphoric acid (TPA) and WPA acid.

A 27% increase in yellow phosphorus sales volume compared to the previous year significantly contributed to DGC’s revenue, despite a 9.5% decrease in average P4 prices during 2024.

For the year 2025, DGC sets a revenue target of 10,385 billion VND (up 5.2%) and net profit of 3,000 billion VND (down 3.4%).

According to the Annual General Meeting, in the first quarter of 2025, DGC estimated revenue of 2,700 billion VND (up 13% year-on-year) and net profit of 800 billion VND (up 13.6% year-on-year). With these results, DGC has achieved 26.7% of its annual plan.

What’s Next for P4 Prices?

In a recently published report by ACB Securities Company (ACBS), the company assessed that fluctuations in China’s P4 market influence global and Vietnamese P4 prices.

This is because China is the world’s largest producer and consumer of P4. However, from late 2021 to 2022, drought conditions and rising coal prices led to increased operating costs for power plants in China. To ensure electricity supply for domestic needs, the country had to restrict the operations of certain industries, including yellow phosphorus production. Limited supply and higher production costs resulted in increased P4 prices.

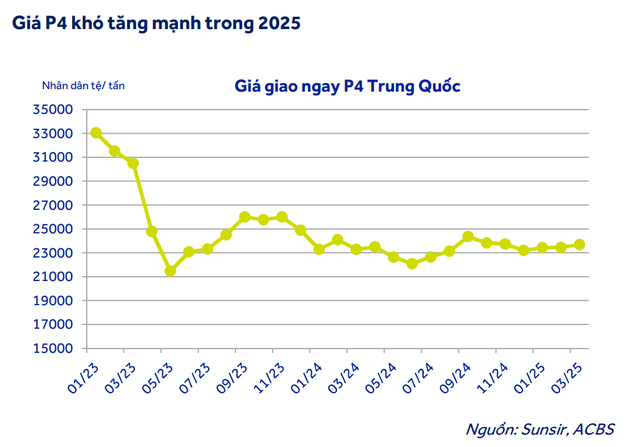

Subsequently, P4 prices plummeted by 35% in 2023-2024 but remained 50% higher than the average during 2015-2020 as China gradually lifted restrictions on P4 production to meet the growing demand from the electric vehicle industry.

Regarding the outlook for 2025, ACBS believes that P4 prices in China are unlikely to surge significantly due to reduced production input costs. Electricity costs, a crucial input for P4 production in China, have benefited from the low production costs of hydropower due to the La Nina phenomenon in the first four months and neutral weather conditions for the remainder of 2025, compared to the previous El Nino conditions. Moreover, Yunnan Province, the largest P4-producing region in China (accounting for 46% of capacity), also relies primarily on hydropower for its energy needs.

Additionally, coke prices, another essential input in China, have decreased by 16% in the first three months of 2025 compared to the 2024 average. This trend is expected to continue due to the country’s sluggish economic recovery, high inventory levels, and plans to reduce steel production, which will further decrease coke demand.

Chinese factories are currently operating at only 50% of their P4 production capacity and can ramp up production when demand increases, thereby curbing the potential for sharp price increases.

Furthermore, while the semiconductor sector is currently exempt from Trump’s retaliatory tariffs, there are indications that it may be subject to a separate tariff regime that the US is expected to announce soon as part of its efforts to bring semiconductor manufacturing and technology industries back to American shores. This could lead to delays or reductions in investment plans for producing electronic equipment and components or constructing data centers and advanced artificial intelligence models outside the US. Consequently, the potential for substantial price increases for inputs in this sector, such as P4, may remain limited until tax policies become clearer and more stable.

In 2025, Duc Giang’s yellow phosphorus segment is anticipated to continue thriving due to the acceleration of the global chip manufacturing industry and the operation of numerous new semiconductor factories in Asia.

ACBS forecasts a slight 3% increase in P4 prices compared to the previous year, driven by demand from the semiconductor industry. According to the World Semiconductor Trade Statistics (WSTS), the semiconductor market in the Asia-Pacific region is projected to grow by 10.4% in 2025.

“We estimate DGC to attain revenue of 11,388 billion VND (up 15.4% year-on-year) and net profit of 3,353 billion VND (up 7.8% year-on-year) in 2025,” the ACBS report states.

Is Vietnam’s Goal of 50,000 Semiconductor Engineers and a Chip Manufacturing Plant Still a Pipe Dream?

SSI Research expresses concern over the high capital investment and skilled workforce required for semiconductor talent training and chip fabrication, which could pose significant challenges in the medium term.

“Vietnam’s Strategic Advantage: Prime Minister Vows to Develop Semiconductor Industry”

“Prime Minister Pham Minh Chinh emphasized the development of the semiconductor industry as a strategic breakthrough and a key focus area. He underscored that it is not only a possibility but also a determination, leveraging Vietnam’s unique potential, prominent opportunities, competitive advantages, and strategic direction.”