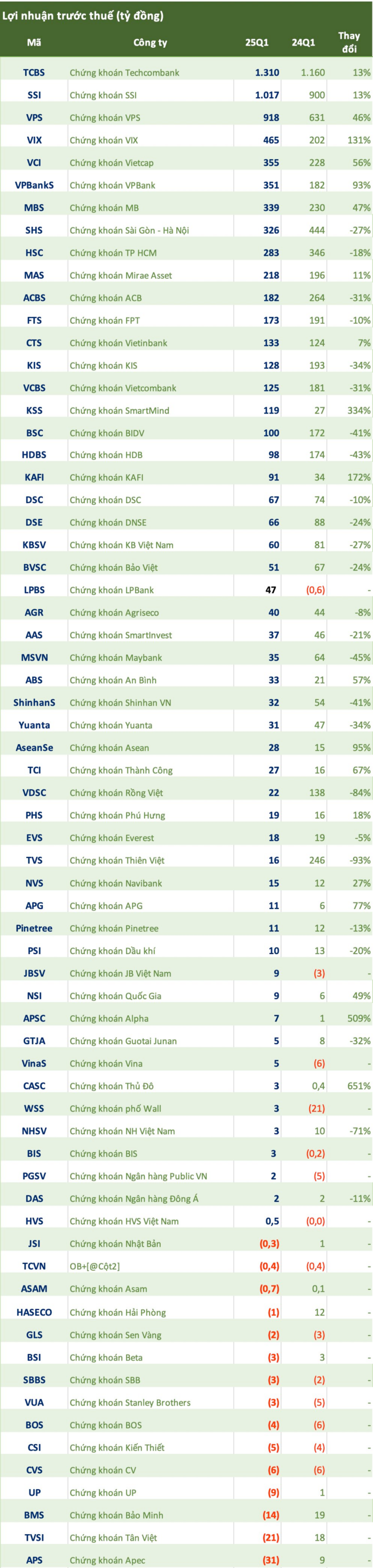

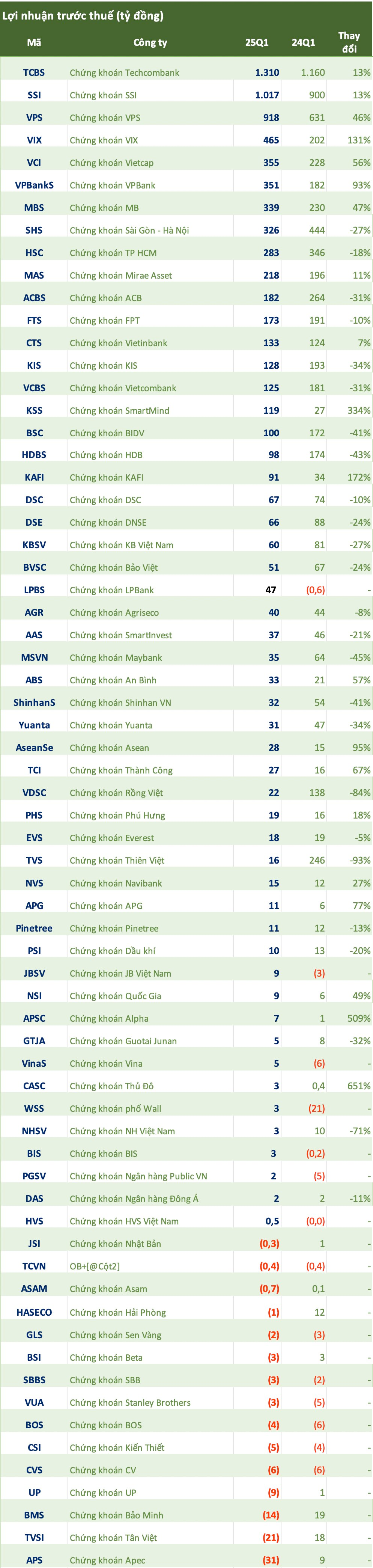

Leading the pack, VIX Securities reported impressive figures with operating revenue for the first three months reaching VND 980 billion, a 2.7-fold increase compared to the same period last year. This remarkable growth propelled their pre-tax profit to VND 465 billion, a 2.3-fold surge year-on-year.

This outstanding performance places VIX Securities at the forefront of the industry’s growth in Q1/2025.

Vietcap Securities also had a strong showing in the first quarter, with operating revenue reaching VND 851 billion. While profits from FVTPL assets remained stable at VND 355 billion, the company saw a significant 43% increase in lending and receivables, amounting to VND 257 billion. Conversely, brokerage revenue witnessed an 18% dip, landing at VND 149 billion.

As a result, Vietcap posted a pre-tax profit of VND 355 billion, reflecting a remarkable 56% year-on-year growth.

Another standout performer, VPBank Securities, joined the billion-dollar profit club. Their operating revenue climbed to nearly VND 704 billion, marking a 21% increase compared to the previous year. Interestingly, operating expenses for Q1/2025 unexpectedly dropped by 45% to VND 149 billion. This combination of factors resulted in a pre-tax profit of VND 351 billion, a substantial 93% increase year-on-year. Their after-tax profit stood at VND 280 billion.

On the other hand, APEC Securities faced challenges in the first quarter of 2025, becoming the securities company with the highest loss in the industry during this period. Their operating revenue barely moved, hovering around VND 24 billion, while operating expenses soared to nearly VND 5 billion. Additionally, the company incurred nearly VND 4 billion in securities management expenses. Consequently, APEC Securities reported a loss of VND 31 billion in Q1/2025, in stark contrast to the VND 9 billion profit they enjoyed in the same quarter of the previous year.

Similarly, Thien Viet Securities (TVS) experienced a downturn, reporting a pre-tax loss of VND 21 billion. This marks a significant shift from their performance in Q1/2024, when they posted a profit of VND 18 billion.

The VIX Securities Boosts Ownership in Viglacera’s Subsidiary to Nearly 18.4%

After successfully purchasing 2.13 million VIT shares, VIX Securities has increased its ownership stake in Viglacera Tien Son to 18.39%, up from 14.13%.

VPBank Tops the List as Vietnam’s Best Enterprise Financial Services Workplace

On November 19, 2024, VPBank was honored with two prestigious awards: Top 1 Best Companies to Work for in Vietnam in the Medium-sized Enterprise Financial Services Sector and Top 100 Best Medium-sized Enterprises to Work for in Vietnam. These accolades were presented at the “Best Companies to Work for in Vietnam 2024” event, recognizing VPBank’s commitment to creating an exceptional workplace culture and environment for its employees.

“Seamless Trading of Dragon Capital’s Fund Certificates via VPBank’s NEO Invest Platform.”

“The partnership between VPBankS and Dragon Capital is a powerful alliance that will elevate the customer experience and maximize the strengths of both entities. VPBankS investors will now have access to an expanded range of financial products directly through the NEO Invest app, eliminating the need for platform switching and streamlining their investment journey.”