The stock market witnessed a strong recovery during the trading week of April 14-18, climbing to the 1,240-point region. Short-term profit-taking pressure started to build up as many stocks had already made significant gains, and the VN-Index faced resistance around the 1,220-1,230 threshold, retreating to the strong psychological support level of 1,200. By the end of the week, the VN-Index had shed 3.34 points (-0.23%), closing at 1,219.12.

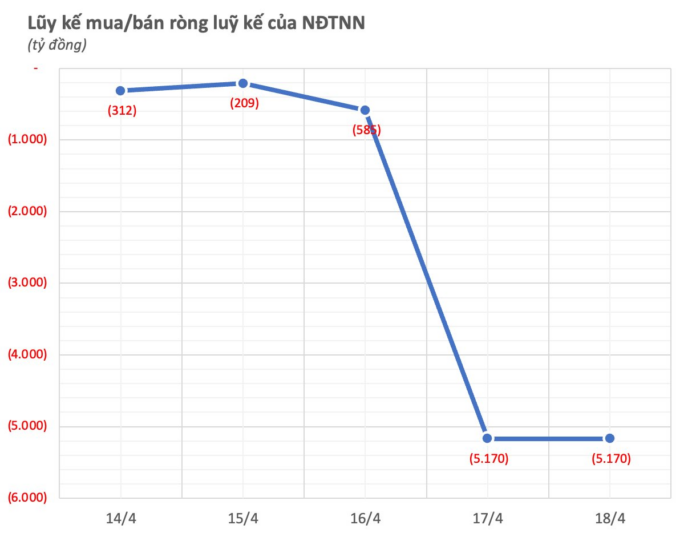

Foreign investment flows were a downside during the week, with a sudden spike in net selling. Overall, foreign investors sold a net of VND 5,170 billion across all markets, with a focus on selling more than VND 4,500 billion in the Thursday session.

Breaking down the activity by exchange , foreign investors sold a net of VND 4,722 billion on the HoSE, bought a net of VND 253 billion on the HNX, and sold a net of VND 194 billion on the UPCoM.

Looking at individual stock performance , the focus of net selling was on VIC shares, with a value of VND 4,394 billion. The peak of net selling occurred on April 17, when foreign investors offloaded VIC shares worth VND 4,446 billion, making it the most heavily sold stock across all markets on that day.

In a related development, according to the 2024 annual report, the SK Group (South Korea’s third-largest chaebol) is categorizing its investment in Vingroup’s shares as held for sale. This move is part of SK’s strategy to restructure its international investment portfolio, suggesting that the transaction could be interpreted as SK divesting from Vingroup.

Meanwhile, HCM and FPT also experienced net selling, with values of VND 371 billion and VND 339 billion, respectively. VNM shares were also net sold to the tune of VND 292 billion. Other stocks that made it to the foreign net selling list for the week included IDC, GMD, CTG, KBC, and others, with net selling values exceeding VND 100 billion each.

On the flip side, HPG, a banking stock, unexpectedly attracted strong foreign buying, with a net purchase value of VND 535 billion. Foreign capital also flowed into MWG and ACB, with net buying of VND 381 billion and VND 299 billion, respectively, over the week. Other stocks that witnessed net buying during the week included VCI, VHM, HVN, VCG, BMP, and more.

The Power of Persuasive Writing: Crafting a Compelling Title

“BSC’s AGM: Record-breaking Profit Target of VND 560 Billion, 10% Dividend Payout”

The leadership team foresees a positive outlook for the stock market this year. They attribute this to the macroeconomic recovery and the low-interest-rate environment, which encourages capital inflows into the stock market. The potential market upgrade further enhances these favorable conditions.

The Stock Market Blog: Tread Carefully with the ‘Pump and Dump’ Scheme

Today’s session saw a mixed performance, with some leading stocks dragging down the index. However, the overall picture wasn’t too bleak. The question remains whether we can expect a better rotation of leading stocks in the coming days, as their weight can significantly pull down the VNI. A weak index could dampen overall sentiment…

The Big Cap Let Loose: VN-Index Loses Most of its Gains, Stocks Still Impressively Reverse

The trading session today witnessed a dramatic turnaround in the final 30 minutes of continuous trading, with leading large-cap stocks suddenly reversing course. The heavy selling pressure from these stocks dragged the VN-Index down from its intraday high of 17.4 points (+1.43%) to just above the breakeven point, eventually closing with a modest gain of 1.87 points (+0.15%).

The Golden Rush: Soaring Prices of Gold Rings and SJC Gold

Late in the afternoon of April 8th, domestic gold prices rebounded, surging back above the 100 million VND per tael mark after a sharp decline earlier in the day. This dramatic turnaround saw the price of gold jewelry and SJC gold reclaim their lofty perch, offering a glimmer of hope to investors and enthusiasts alike.