The VN-Index closed the week’s trading at 1,219.12 points, maintaining its position above the 1,200-point mark despite a 0.23% decline from the previous week. Meanwhile, the HNX Index dipped by 0.11% to 213.1 points.

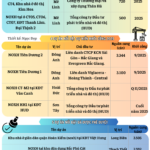

Many stocks rebounded after a sharp decline, with historical abnormal liquidity. Export-related sectors and those attracting foreign investment (FDI), such as industrial parks, seafood, textiles, ports, agriculture, and petroleum, recovered in the last sessions of the week. Foreign investors continued to net sell with a value of more than VND 4,800 billion on the HOSE.

According to the analysis team at Pinetree Securities Company, the VN-Index traded relatively stable last week as concerns over trade tensions eased somewhat, and the season for announcing Q1/2025 business results began.

Except for the unexpected trading at VIC (Vingroup), foreign selling pressure gradually subsided. Entering the new trading week, the market is expected to remain unpredictable due to the influence of many uncertain factors.

A series of domestic enterprises are preparing to announce their Q1/2025 business results. Cash flow is likely to be strongly differentiated, especially for stocks with solid fundamentals and positive profit growth…

Mr. Matthew Smith, Director of Research and Analysis for Institutional Clients at Yuanta Securities Vietnam, analyzed that in recent sessions, the VN-Index has been heavily impacted by news about the US’ countervailing duty policy.

In fact, many stock markets of other countries have also been affected. The impact on the Vietnamese stock market is relatively milder compared to other markets such as Thailand or even the US, where the market is trending downwards.

The stock market has been volatile lately due to news related to trade policies

“In the short term, investors should maintain a cautious asset allocation strategy as the market may trade sideways in the coming months, until we get an official outcome on trade policies on July 9 (related to the US’ 46% countervailing duty on exports from Vietnam).”

Once the official decision is announced, it will help reduce uncertainty, and the market may rebound. Investors should remain cautious and focus on companies with strong fundamentals, keeping some cash on hand to seize opportunities if there are unexpected developments from the US,” said Mr. Matthew Smith.

At the regional investment workshop on the theme “From Asia to Vietnam – Connecting Asian Vision, Creating an Era of Prosperity,” hosted by Yuanta Securities Vietnam, leading economic and financial experts in the region shared their optimistic outlook on the potential of Vietnam’s stock market. They highlighted that upgrading the stock market to emerging market status could be a significant attraction for international capital.

The experts forecast that the VN-Index will witness more positive developments in the second half of 2025. According to Mr. Chu Ka Kit, Investment Strategy Director at Yuanta Hong Kong, the Vietnamese stock market is demonstrating its potential when compared to other countries in the region, especially in terms of recent performance. However, to reach new heights, Vietnam needs to address some core issues and attract domestic and international institutional investors.

VN-Index dropped to its lowest level of 1,073 points before recovering back above 1,200 points in April

The Power of Persuasive Writing: Crafting a Compelling Title

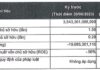

“BSC’s AGM: Record-breaking Profit Target of VND 560 Billion, 10% Dividend Payout”

The leadership team foresees a positive outlook for the stock market this year. They attribute this to the macroeconomic recovery and the low-interest-rate environment, which encourages capital inflows into the stock market. The potential market upgrade further enhances these favorable conditions.