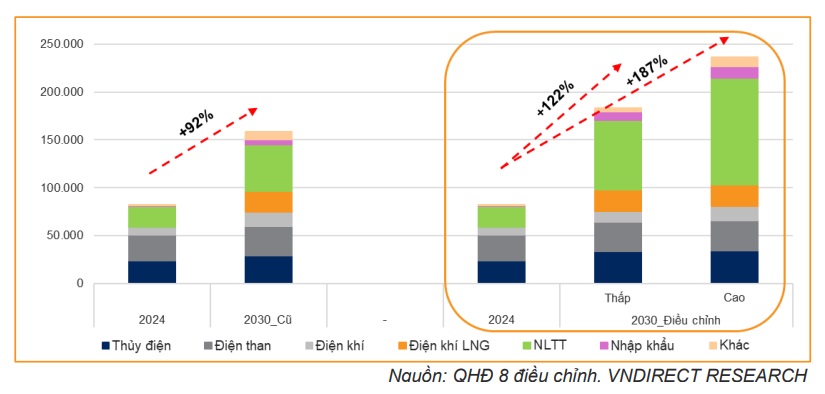

According to VNDIRECT, the adjusted Power Development Plan 8 (PDP 8) sets ambitious capacity targets to support GDP growth goals. The plan aims to achieve a total electricity production and import of 650–624 billion kWh by 2030, representing an increase of 82%–102% compared to 2024.

This targeted growth in electricity production is designed to ensure sufficient supply to support an average GDP growth rate of 10% during the period of 2026–2030. To meet this objective, the total electricity capacity by 2030 is projected to reach 183–236 GW, reflecting a significant increase of 122%–187% from 2024 levels, and a 16%–49% rise compared to the previous PDP 8.

|

Targeted Electricity Growth to Support 10% Average GDP Growth

|

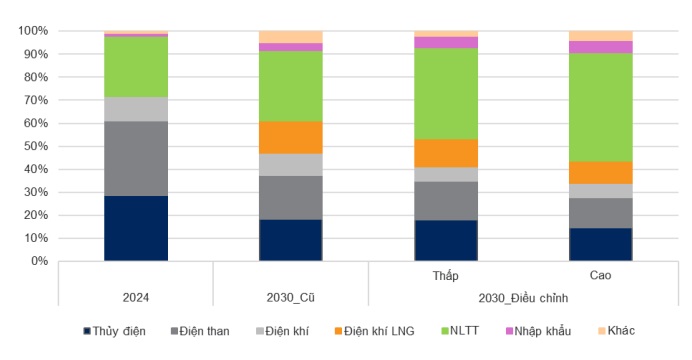

Curtailing Coal, Embracing Renewables

To honor environmental commitments, coal-fired power remains restricted in the adjusted PDP 8. Consequently, gas-fired power, including liquefied natural gas (LNG), is expected to play a pivotal role as the baseload power source for the entire system. Additionally, the government has incorporated nuclear power into the plan, targeting 4–6.4 GW of capacity by 2030–2035, and has shifted the timeline for offshore wind power to the same period, aiming for 6–17 GW.

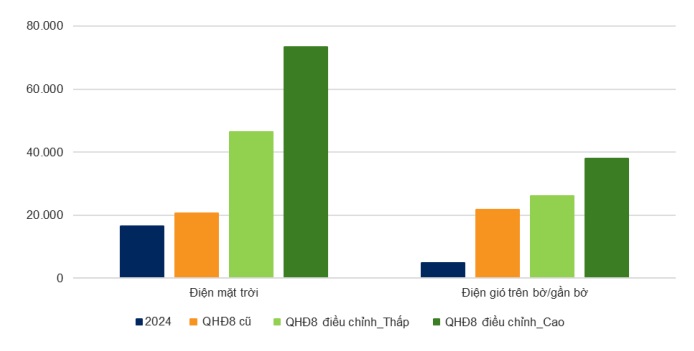

While hydropower, coal, and gas capacity targets remain unchanged, renewable energy sources take center stage, with the 2030 target increased by 50%–130% compared to the previous PDP 8, and representing a 3.4–5.2 times surge from 2024 levels.

|

Renewable Energy Capacity Targets as per the Plan

Source: VNDIRECT

|

Solar power undergoes the most significant adjustment, with a 2.3–3.6 times increase compared to the previous plan (possibly due to its ease of installation over a short period), while wind power targets are also raised by 1.2–1.7 times. According to VNDIRECT, this presents a promising opportunity for a new cycle of investment in renewable energy after a prolonged stalemate due to the absence of clear mechanisms and policies.

|

Renewable Energy Emerges as a System-wide Strength

Source: VNDIRECT

|

However, the substantial capital requirements remain a primary concern. As per the adjusted PDP 8, Vietnam needs to mobilize significant capital for power source investments, estimated at approximately $136 billion for the period of 2026–2030 and around $114 billion for 2031–2035. VNDIRECT emphasizes the crucial role of the private sector in this regard, underscoring the need for clear, consistent, and conducive mechanisms and legal frameworks from governing bodies to attract private investment into power development, particularly in the realm of renewable energy.

– 11:19 19/04/2025

The Vietnamese Dong: Could it Strengthen to 26,000 VND/USD by Year-End? Interest Rates to Remain Low.

According to a recent report on Vietnam’s macroeconomic outlook published by Tien Phong Securities (TPS, HOSE: ORS), exchange rates may continue to rise while interest rates remain low to support the economy.