**NTC Records Robust Growth in Early 2025**

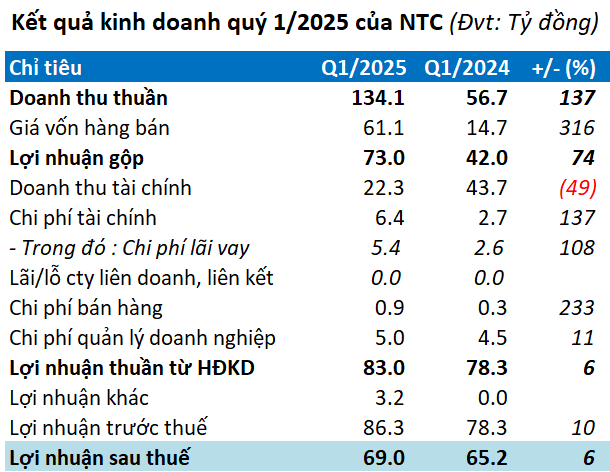

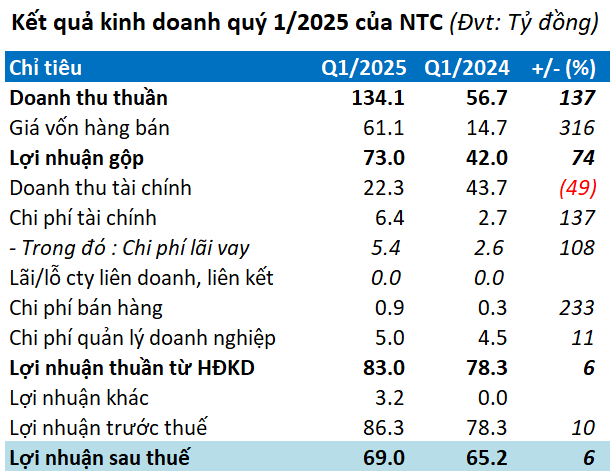

In the first quarter of 2025, Nam Tan Uyen reported remarkable growth with a revenue of over VND 134 billion, nearly 2.4 times higher than the same period last year. After deducting the cost of goods sold, the company’s gross profit stood at VND 73 billion, a 74% increase.

The only downside was a 49% decrease in financial income, amounting to over VND 22 billion, due to a loss in dividends and share of profits; the previous year’s figure for this item was nearly VND 14 billion.

Additionally, total expenses rose to over VND 12 billion, a 65% increase, mainly driven by a doubling of interest expenses to over VND 5 billion.

Despite the increase in expenses, NTC’s strong revenue growth resulted in a 6% year-on-year increase in net profit, amounting to VND 69 billion.

Source: VietstockFinance

|

As of the end of the first quarter, NTC’s total assets remained relatively unchanged from the beginning of the year, surpassing VND 7,353 billion. Long-term assets accounted for 74% of total assets, amounting to VND 5,439 billion. The company held over VND 1,560 billion in bank deposits, a 13% decrease, while also holding nearly VND 222 billion in cash equivalents.

NTC’s total liabilities stood at over VND 6,173 billion, a slight 1% decrease from the beginning of the year. The majority of these liabilities comprised of customer advances and unearned revenue, totaling nearly VND 3,623 billion, a 5% increase from the start of the year and accounting for 59% of total liabilities. Financial borrowings amounted to VND 2,465 billion, an 8% decrease, and represented 40% of total liabilities.

Looking ahead, NTC anticipates a complex global economic landscape with a continued slowdown in global investment. However, the Vietnamese economy is expected to rebound strongly, potentially attracting more foreign investment.

NTC is currently exploring the development of a smart industrial park model, along with convenient services and a livable urban environment to attract high-quality human resources.

The company is also in discussions with the People’s Committee of Binh Duong province and relevant stakeholders regarding the procedures for leasing land in the expanded Nam Tan Uyen Industrial Park, phase 2. Additionally, they are considering expanding their business to include factory leasing in the expanded Nam Tan Uyen Industrial Park, phase 2, as a stable and annually increasing source of revenue.

– 10:29 19/04/2025

DNSE Captures 33% of New Brokerage Accounts in Q1

In Q1 of 2025, DNSE Securities witnessed a remarkable 34% surge in revenue compared to the same period last year. This impressive growth is further accentuated by a 10% increase in margin loan balances since the beginning of the year. DNSE Securities also maintained its dominant position in the market, capturing a substantial 33% of all new brokerage accounts opened, solidifying its leadership in the industry.

BAOVIET Bank: Accelerating Digital Transformation, Leveraging the Power of the Bao Viet Ecosystem

As per the recently published 2024 audited financial report, BAOVIET Bank has demonstrated impressive growth across key metrics, further cementing its position as a powerhouse in the Vietnamese banking sector. The bank has strategically leveraged its digital transformation journey and synergistic strengths within the Bao Viet ecosystem to drive this remarkable performance.