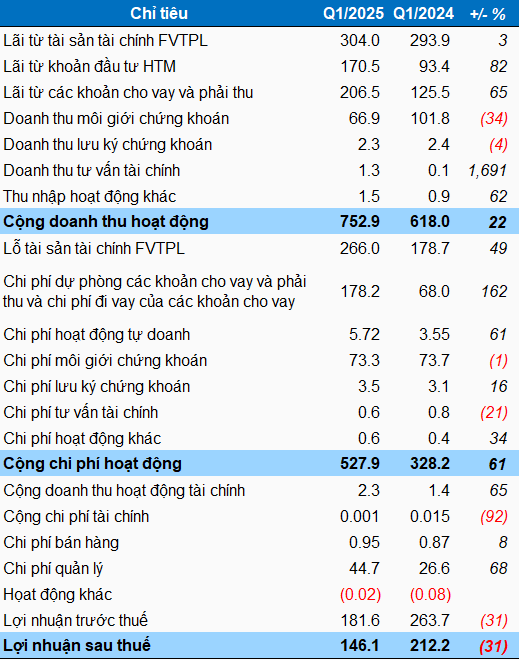

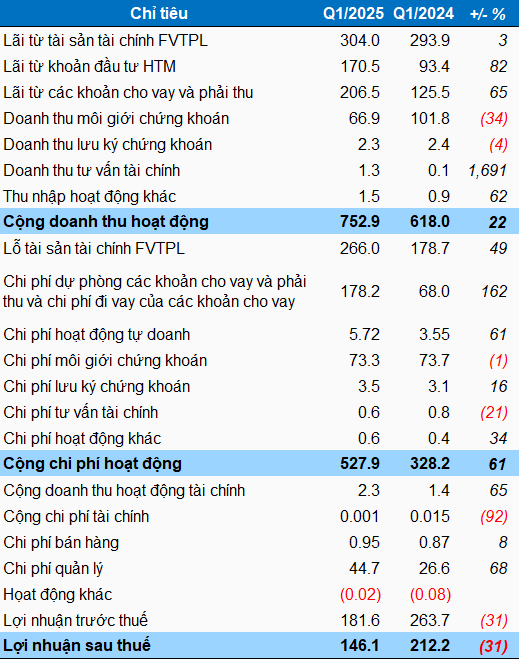

Pressure from multiple business segments

Specifically, the company’s proprietary trading profits stood at just over 32 billion VND, a 71% decrease despite the overall market gaining. Its brokerage segment also faced challenges, incurring a loss of more than 6 billion VND, compared to a profit of over 28 billion VND in the previous period.

A bright spot came from profits on held-to-maturity (HTM) investments, which increased by 82% to nearly 171 billion VND. Additionally, profits from loans and receivables rose by 65% to over 206 billion VND. However, the company also recorded a significant increase in loan loss provisions and borrowing costs for these loans, totaling over 178 billion VND, or 2.6 times higher than the previous period.

Management expenses also rose by 68%, reaching nearly 45 billion VND, further pressuring profits. Ultimately, ACBS posted a net profit of over 146 billion VND, a 31% decrease compared to the same period last year.

|

ACBS’s Q1/2025 Financial Results

Unit: Billion VND

Source: VietstockFinance

|

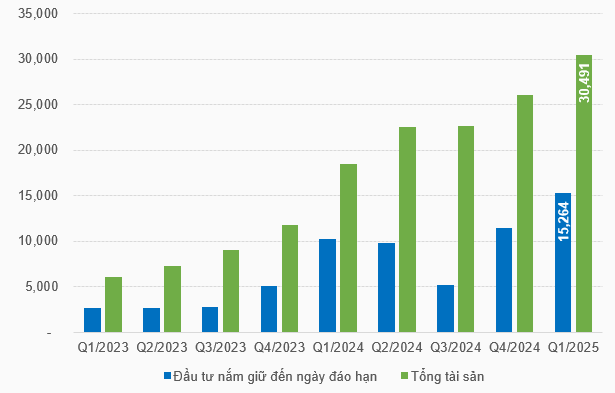

Asset scale surpasses 30 trillion VND

As of March 31, 2025, ACBS’s asset scale reached a new milestone of over 30,491 billion VND, an increase of 4,450 billion VND from the beginning of the year. For 2025, ACBS plans to further increase its total assets to 32,850 billion VND.

The growth in asset scale was mainly driven by an increase in the value of HTM investments by 3,775 billion VND, totaling nearly 15,264 billion VND. This included term deposits in banks amounting to over 15,045 billion VND.

Loan balances also increased from nearly 8,690 billion VND to over 9,423 billion VND, with the majority being margin loans totaling more than 9,338 billion VND.

The fair value of financial assets classified as FVTPL rose from over 3,126 billion VND to nearly 3,893 billion VND, with the majority invested in listed stocks and UPCoM-traded stocks, amounting to approximately 2,287 billion VND. The company also recorded a fair value of nearly 899 billion VND in underlying assets for warrant risk hedging activities and approximately 698 billion VND in government bonds.

|

ACBS’s Asset Scale Reaches a New High

Unit: Billion VND

Source: VietstockFinance

|

ACBS’s business operations are supported by a stronger capital base. Borrowed capital increased from 16,403 billion VND to 16,790 billion VND, with notable lending partners including BIDV, Eximbank, and Vietcombank.

Owner’s equity capital has been raised from 7,000 billion VND to 10,000 billion VND. In a recent move, the Board of Directors of Asia Commercial Joint Stock Bank (HOSE: ACB) resolved to increase the charter capital of ACBS to 11,000 billion VND.

– 21:58 19/04/2025

Anticipating EVF’s 2024 Audit Results

Electricity Finance Corporation (EVNFinance – HOSE: EVF) is set to release its 2024 audited financial statements in late February 2025.

The Businesses Smashing Profit Records in 2024

Vietnam Airlines, FPT, PNJ, Gelex, and Idico are among the top Vietnamese companies that have announced record-breaking profits for 2024. With impressive financial results, these businesses have showcased their resilience and growth amidst economic challenges. As they soar to new heights, they set a benchmark for success in the dynamic Vietnamese market.

The End of Exponential Growth: KSV and Yeah1 Shareholders Bitterly Welcome the New Year with “Pine Trees”.

The YEG stock has plummeted by 14% in just four days, while KSV stock has seen an even steeper decline of 16%.