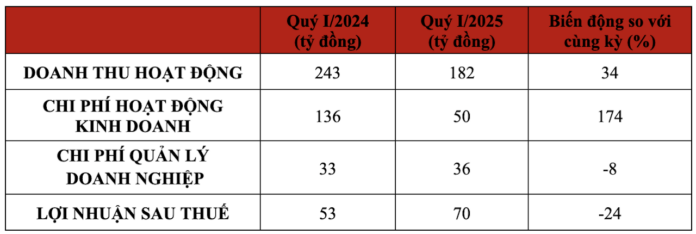

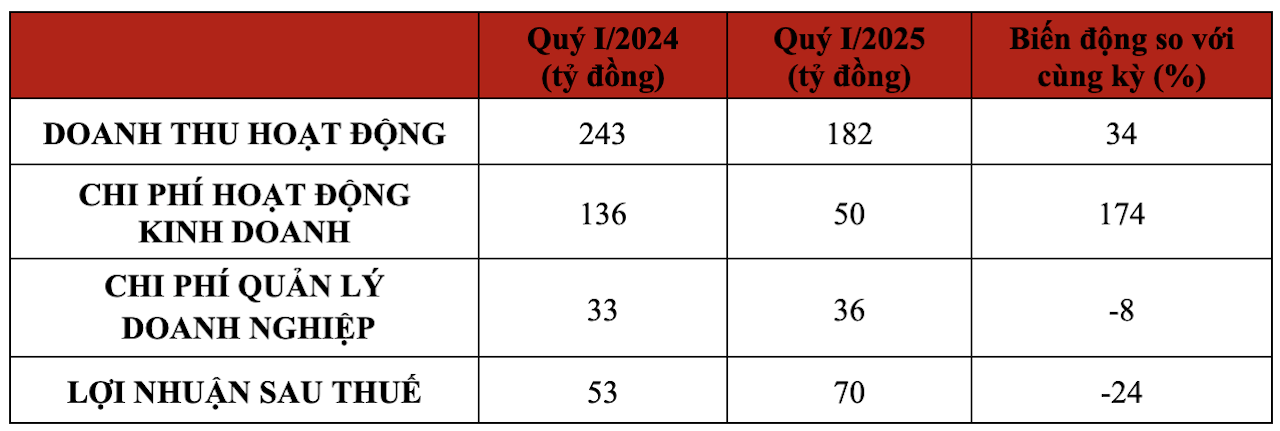

DNSE Securities has just announced its Q1 financial report, showcasing stable growth with an operating revenue of VND 243 billion, a 34% increase compared to the same period in 2024.

The main contributors to this revenue growth include: Interest from loans and receivables reached VND 104 billion, a 40% increase; and profit from held-to-maturity investments exceeded VND 70 billion, a 23% increase compared to the same period in 2024.

Securities brokerage revenue increased by 53% year-on-year, reaching VND 49 billion.

DNSE’s margin lending continued its positive growth trajectory, with total debt reaching VND 4,179 billion, a 10% increase since the beginning of the year.

Operating expenses amounted to nearly VND 136 billion, 2.7 times higher than the previous year, mainly due to financial asset impairment provisions, handling of bad debts, financial asset depreciation losses, and borrowing costs for loans. Therefore, after deducting expenses, pre-tax profit reached more than VND 66 billion, a 24% decrease compared to the same period in 2024.

In terms of capital scale, as of March 31, 2025, DNSE’s total assets exceeded VND 11,000 billion, a 5% increase from the beginning of the year.

Maintaining its lead in new securities account openings, capturing 33% of the market share

In Q1, DNSE continued its impressive customer growth trajectory, adding 128,000 new securities accounts. According to data from the Vietnam Securities Depository (VSD), the number of domestic investor accounts increased by nearly 388,000 in Q1. As a result, DNSE maintained its top position in new account openings, capturing 33% of the market share during this period.

Additionally, the derivatives securities segment also maintained its strong growth. According to HNX’s Q1 data, DNSE’s market share in derivatives securities surged by 70% compared to Q4/2024, reaching 16.7%. DNSE solidified its position as a strong number two, outperforming several well-known securities companies.

Mr. Nguyen Hoang Giang, Chairman of DNSE’s Board of Directors, has shared that one of the keys to increasing profits through a sustainable business model is a solid customer base. The company’s strategy of attracting customers through multiple channels, integrating stock investments into platforms like Zalopay and TradingView, and developing the niche derivatives market has set DNSE apart in a highly competitive market, allowing it to seize opportunities to expand into other business areas.

Mr. Nguyen Hoang Giang, Chairman of DNSE’s Board of Directors, at the 2025 Annual General Meeting of Shareholders

|

In parallel, this tech-focused securities company is also committed to building a robust ecosystem of products and services to ensure sustainable development. One of its flagship products, the Margin Deal system—which includes transaction-based margin management and lending, preferential loan packages starting at 5.99%, and the Fin X feature that automatically suggests loan packages based on customer needs—has significantly contributed to the growth in margin lending revenue in the past year.

During Q1, DNSE also introduced an enhanced version of its Investment Ideas feature, a paid service that provides stock portfolio suggestions. This feature utilizes technical indicators to generate buy and sell signals, monitors and evaluates investment portfolio performance, and proactively alerts users to potential risks. Stock recommendations are thoroughly vetted through a four-layer filtering process. In the year since its launch, the Investment Ideas feature has achieved a 76% success rate in profitable recommendations, with an average investment efficiency of 30%. The enhanced version has been well-received by investors, with a significant increase in registrations in the first month, surpassing 2,300 users.

Additionally, the tech-focused securities company will soon introduce an AI-powered automatic order placement solution, enabling optimal trade prices and helping customers seize investment opportunities at the best prices while saving time.

This year, DNSE is also focusing on building a bond investment channel to provide fixed-interest services to its customers, generating stable revenue for the company.

DNSE has set ambitious business goals, targeting a revenue of VND 849 billion and a post-tax profit of VND 262 billion. With the market’s positive outlook due to the upcoming launch of KRX, DNSE is poised to capitalize on its well-established technology ecosystem to drive strong growth.

Services

– 06:58 18/04/2025

SSI to Release 10 Million ESOP Shares, Chairman Nguyen Duy Hung Gets the Lion’s Share.

SSI Securities will issue a maximum of 10 million ESOP shares at a price of VND 10,000 per share. Chairman Nguyen Duy Hung will be offered the largest allocation, with the option to purchase up to 1 million shares.

SHS Earns a Profit of Over 325 Billion VND in Q1 2025, Announces 20% Dividend Payout

As of March 31, 2025, SHS’s total loan balance stood at VND 4,600 billion, reflecting an impressive 11% growth compared to the end of 2024.