|

SVH’s Business Performance in Q1 2025

Source: VietstockFinance

|

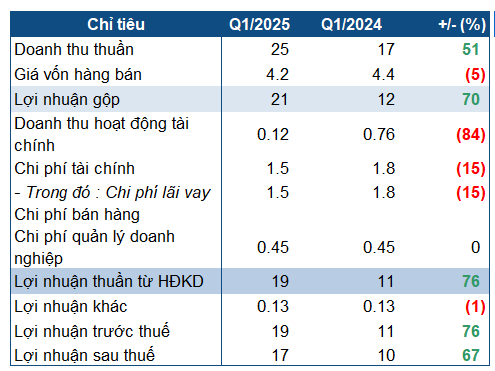

According to the Q1 2025 financial statements, SVH recorded revenue of over VND 25 billion, a 51% increase compared to the same period last year, while cost of goods sold slightly decreased. As a result, gross profit reached VND 21 billion, a 70% surge year-over-year. The company attributed this positive performance to favorable weather conditions in Central Vietnam, which boosted electricity production and improved overall results.

With a significant increase in gross profit and minimal impact from other factors, SVH concluded the first quarter of 2025 with a 67% rise in after-tax profit, amounting to VND 17 billion.

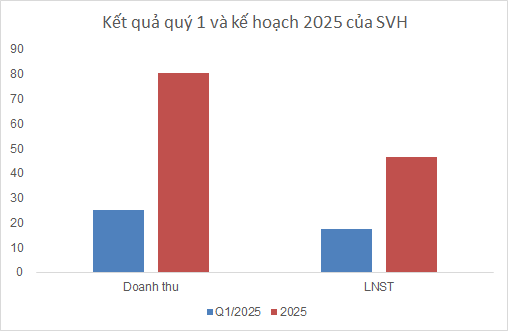

The Q1 results are in line with SVH’s expectations for the full year 2025. As per the documents from the 2025 Annual General Meeting of Shareholders, SVH forecasts a 34% increase in electricity output to nearly 70.5 million kWh, thanks to anticipated favorable weather conditions. The company has set targets for revenue of over VND 80.4 billion, a 34% jump from the previous year, and an after-tax profit of nearly VND 47 billion, representing a nearly 50% increase. After the first quarter, SVH has accomplished over 31% of its revenue plan and more than 37% of its after-tax profit target.

Source: VietstockFinance

|

As of the end of Q1, SVH’s total assets slightly increased by 2% from the beginning of the year to VND 518 billion, of which only VND 91 billion were current assets (a common characteristic of electricity companies). This marks a 6% increase. Cash balances stood at over VND 15 billion, up by 21%. Accounts receivable decreased by 42% to VND 7 billion.

The long-term construction in progress, associated with the An Diem II Hydropower Plant Expansion Project, amounted to VND 247 billion, a 2.7% increase. According to the AGM documents, the project’s completion date has been proposed for adjustment by the Board of Directors, and it is expected to commence operations in April 2026.

On the liabilities side, total liabilities decreased slightly to VND 278 billion, with only VND 79 billion in current liabilities. The current and quick ratios both exceeded 1.15 times, indicating that the company is not facing any immediate risk in meeting its short-term debt obligations.

Short-term borrowings decreased by 17% to VND 49 billion. Additionally, the company has long-term borrowings of nearly VND 200 billion.

– 09:13 21/04/2025

“Patience is Key: ADTD Shareholders Refrain from Dividends, Awaiting Project Permits”

The sluggish market conditions in the real estate sector prompted HAR to focus on financial cost-cutting measures and refrain from paying dividends. While a significant portion of the company’s capital is tied up in uninitiated projects, the leadership assures that the permitting process is currently delayed and advises shareholders to “exercise patience.”

MSB’s General Meeting: Q1 Profit Reaches VND 1,630 Billion, 2-3 Potential Buyers for the Finance Company

On April 21, 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) held its annual general meeting to discuss and approve key business strategies for the upcoming year. The agenda included proposals for dividend distribution, plans to increase charter capital, and decisions regarding the divestment from TNEX Finance and the potential acquisition of a securities company.

“LPBS Announces Impressive Q1 Results: Net Profit Surpasses VND 40 Billion, with an 81% Increase in Asset Size Since the Start of the Year”

Joint Stock Commercial Bank for Foreign Trade of Vietnam, or LPBank, announced that its securities arm, LPBS, recorded a net profit of over VND 40 billion in the first quarter of 2025. This impressive performance was driven by robust earnings from proprietary trading and lending activities, which successfully offset losses incurred in the brokerage division. As a result, LPBS’ total assets surged to a remarkable VND 9,175 billion, largely attributed to increased borrowing from its parent company, LPBank.