MSB’s 2025 Annual General Meeting was held in Hanoi on the morning of April 21, 2025.

|

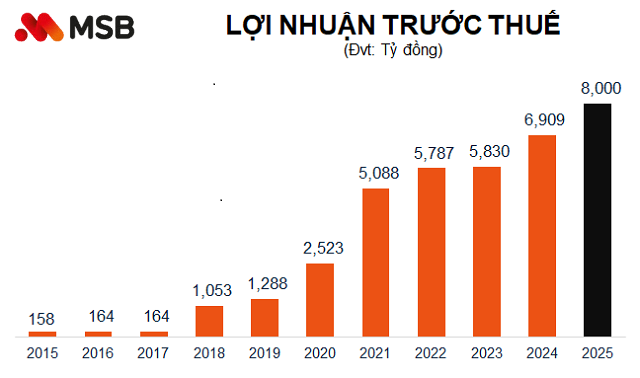

Profit target of VND 8,000 billion, up 16%

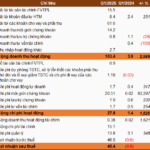

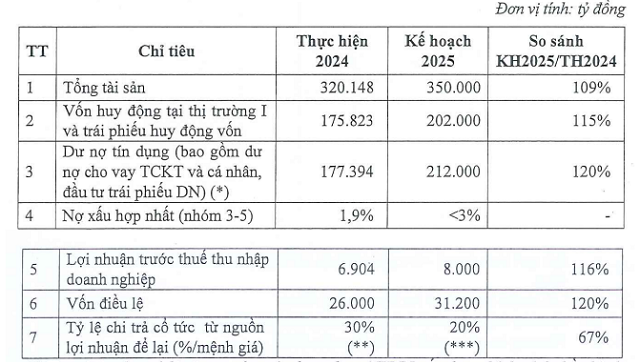

MSB sets a target of VND 350,000 billion in total assets by the end of 2025, up 9% from the beginning of the year. The total market 1 and bond mobilization capital reached VND 202,000 billion, up 15%. Total outstanding loans (including loans to economic organizations and individuals and corporate bond investments) reached VND 212,000 billion, up 20%. Bad debt ratio controlled below 3%.

The bank expects a pre-tax profit of VND 8,000 billion in 2025, up 16% from 2024 results.

Source: VietstockFinance

|

Q1 profit reached VND 1,630 billion

Information at the General Meeting, Mr. Nguyen Hoang Linh – CEO of MSB said that by the end of Q1, the bank’s total assets reached VND 314,000 billion. Loans to customers reached VND 192,000 billion, up 8.92% from the beginning of the year. Customer deposits reached VND 163,000 billion, up 6%. CASA ratio at the end of Q1 reached 24%.

The ROA ratio in Q1 reached 1.82%, slightly up from 1.79% at the end of 2024. The ROE ratio reached 15.54%, up from 14.94% at the end of 2024. The bank’s average NIM reached 3.5%. Non-interest income accounted for 23% of total revenue.

MSB’s Q1 pre-tax profit reached VND 1,630 billion, up from VND 1,530 billion in the same period in 2024.

The CAR ratio reached over 12%, the LDR ratio reached 79%, both meeting the requirements of the State Bank of Vietnam.

In response to a shareholder’s question, MSB’s CEO assessed that in 2025, with the push from the State Bank, MSB also expects to achieve a higher credit growth rate than the industry average of 20%. “In my assessment, this number is feasible because by the end of Q1, it has reached nearly 9%, and in the remaining three quarters, only 11% more is needed, so this target is completely feasible.”

Following the government’s orientation, this year, MSB will focus on infrastructure development, green finance, and key industries to promote economic growth. If permitted by the State Bank, MSB can definitely achieve this goal.

Loan portfolio is not much affected by tariffs

Assessing the bank’s situation in the context of the US tariff tensions, CEO Nguyen Hoang Linh said that with the unpredictable developments in the US tariff policy towards countries, including Vietnam, MSB has actively reviewed and adjusted its risk management strategy. As of now, MSB’s total outstanding loans are VND 191,000 billion, of which some industries such as wooden products, tra fish, cameras, chemicals, and cashew nuts have a relatively small total portfolio of about VND 3,900 billion, accounting for 9.5% of MSB’s total outstanding loans.

The bank has reviewed the operating capacity and market responsiveness of these customers. Currently, MSB is managing this portfolio well, and in the event of risks, the bad debt ratio may increase to around 2.3% of the total portfolio in this group. Meanwhile, MSB’s overall bad debt ratio will be controlled at around 1.8-1.9%.

For the period of 2025-2030, with the expected performance of MSB, the bank expects an average profit growth rate of 18-20% in the period of 2025-2030. With MSB’s scale, total assets need to increase by an average of 20%/year or more, corresponding to the same profit growth rate throughout the cycle.

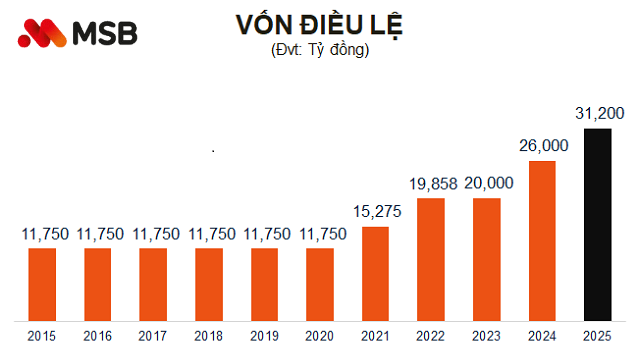

Dividend payout ratio of 20%, capital increase to VND 31,200 billion

In 2024, MSB earned nearly VND 6,904 billion in pre-tax profit. After making provisions and paying taxes, the bank had VND 4,414 billion left. MSB plans to issue a maximum of 520 million new shares to existing shareholders as dividends. The issuance ratio is 20% (for every 100 shares held, shareholders will receive 20 new shares).

If the issuance is successful, MSB’s charter capital will increase from VND 26,000 billion to VND 31,200 billion.

Source: VietstockFinance

|

MSB stated that the purpose of the issuance is to consolidate the bank’s competitive position by increasing its charter capital, strengthening its capital buffer and improving financial safety indicators, supporting medium and long-term credit capital sources, upgrading infrastructure and investing in systems.

Divesting from TNEX Finance

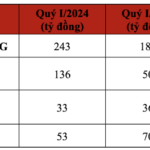

TNEX Finance Joint Stock Company, formerly known as FCCOM, has a charter capital of VND 500 billion and is 100% owned by MSB.

As of 2024, TNEX Finance has a network of: 1 branch in Ho Chi Minh City, 1 representative office in Phu Yen, and 22 service introduction points in 18 provinces/cities nationwide, serving nearly 11,700 local customers.

At the end of 2024, TNEX Finance recorded total assets of VND 3,807 billion, total outstanding loans of VND 1,774 billion, net revenue of VND 358.8 billion, and pre-tax profit of about VND 5 billion.

Shareholders approved the plan to divest from TNEX Finance, authorizing the Board of Directors to proactively decide on the plan to transfer a part or the whole of the capital contribution at TNEX Finance depending on the market situation and actual negotiations with the buyer.

CEO Nguyen Hoang Linh shared that from 2022 up to now, the consumer finance market has not seen much improvement. With the strong digital transformation within MSB, the bank has carried out two consecutive digital transformation projects with two large partners and is expected to complete the entire process in the consulting process this year. MSB wants to focus on its core banking business and target a higher segment, leaving the mass segment to finance companies. Therefore, the strategy is to divest from the finance company.

Currently, MSB has 2-3 potential partners, but due to the strict requirements of the State Bank for eligibility to purchase consumer finance companies, MSB is being selective. The partner must definitely meet the conditions and be ranked A- or higher according to international standards.

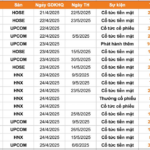

Capital contribution and purchase of shares in securities companies and fund management companies

At the General Meeting, shareholders also agreed to authorize the Board of Directors to decide on plans, find partners to implement capital contribution/purchase of shares or buy securities companies and fund management companies to become subsidiaries of MSB.

MSB’s CEO said that the bank has plans and has promoted with some securities companies based on the desire to complete the MSB ecosystem for the development of the fee-based individual customer segment. MSB has a strategy to develop Wealth Management for its Priority customers. Therefore, in 2025, MSB will promote the purchase of securities companies and fund management companies.

“We want to approach securities companies with a clean balance sheet, with a charter capital of VND 300-500 billion, and then the bank will operate and have a plan to increase capital appropriately, supporting MSB’s Wealth Management segment”, the CEO shared.

In addition, the General Meeting of Shareholders also approved the proposed plan to address the situation in case of early intervention, according to the Law on Credit Institutions issued on January 18, 2024.

Cat Lam

– 12:00 21/04/2025

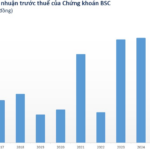

“LPBS Announces Impressive Q1 Results: Net Profit Surpasses VND 40 Billion, with an 81% Increase in Asset Size Since the Start of the Year”

Joint Stock Commercial Bank for Foreign Trade of Vietnam, or LPBank, announced that its securities arm, LPBS, recorded a net profit of over VND 40 billion in the first quarter of 2025. This impressive performance was driven by robust earnings from proprietary trading and lending activities, which successfully offset losses incurred in the brokerage division. As a result, LPBS’ total assets surged to a remarkable VND 9,175 billion, largely attributed to increased borrowing from its parent company, LPBank.

DNSE Captures 33% of New Brokerage Accounts in Q1

In Q1 of 2025, DNSE Securities witnessed a remarkable 34% surge in revenue compared to the same period last year. This impressive growth is further accentuated by a 10% increase in margin loan balances since the beginning of the year. DNSE Securities also maintained its dominant position in the market, capturing a substantial 33% of all new brokerage accounts opened, solidifying its leadership in the industry.