Scenes from the HAR Annual General Meeting on the morning of April 18, 2025 – Screenshot

|

On the morning of April 18, the 2025 Annual General Meeting of HAR was held online. HAR is a real estate business that has been struggling in recent years, with revenue not exceeding 20 billion VND in 2023-2024.

For 2025, HAR’s leadership sets a plan to achieve a revenue of 65 billion VND and a net profit of 12 billion VND, an increase of 207% and 22% compared to the previous year’s results.

At the meeting, HAR Board Member, Mr. Nguyen Nhan Bao, shared that the company aims to achieve this plan through rental, hotel, and service operations in buildings located in the Thao Dien area of Ho Chi Minh City. Meanwhile, the team will restructure smaller assets to focus capital on larger and long-term projects.

In response to a shareholder’s question, Mr. Bao mentioned that HAR’s residential real estate projects are awaiting permits and adjustments to planning designs. This process has been delayed due to reforms, mergers, and the central apparatus’s ongoing refinement.

The company intends to continue withholding dividends for this year to retain resources for future project development. However, Mr. Bao also acknowledged that given the modest profits in recent years, “dividend payouts would not be significant.”

According to HAR’s leadership, the company is also exploring investments in the industrial real estate sector.

Discussion

HAR Board Member, Mr. Nguyen Nhan Bao, answers a shareholder’s question – Screenshot

|

Can you provide more details about the company’s 2025 plan regarding industrial real estate? Which province(s) will you focus on? Are there any investment plans for the intended projects?

Board Member Nguyen Nhan Bao: After 2022-2023, as we restructured our investment portfolio, we started exploring industrial real estate projects. Currently, the company’s strategy is to focus on industrial parks in the south due to our limited resources. It’s important to take a cautious approach as we embark on this journey.

Most industrial parks in the south are concentrated in Dong Nai and Binh Duong, with some logistics projects in the Mekong Delta. Additionally, we are seeking feasible projects and conducting pre-feasibility studies for potential ventures in Dong Nai. Our investment approach involves constructing factories for lease or building to suit our partners’ requirements.

As we make concrete progress, we will announce information in accordance with legal regulations.

Does the company plan to develop any real estate projects in 2025?

Mr. Nguyen Nhan Bao: Since 2022-2023, we have been studying, designing, and seeking permits for two projects in our affiliated companies, namely Co Khi Ngan Hang and Phuong Dong. However, the process of obtaining permits and making design adjustments has been delayed due to the central government’s merger and apparatus refinement.

Once the central apparatus is fully organized and the authority to grant permits and adjust planning designs is delegated to the relevant agencies, we will proceed with the next steps, including obtaining construction permits and mobilizing the necessary capital for project implementation.

How is the performance of Phuong Dong Trading and Production Company?

Mr. Nguyen Nhan Bao: Phuong Dong is an affiliated company of HAR, specializing in leasing spaces and organizing markets in District 5. In 2023-2024, some traders vacated their spaces due to market conditions, but the Phuong Dong Board of Directors strived to maintain business operations according to the initial orientation.

Share prices are too low. Can the company outline plans to improve share prices?

Mr. Nguyen Nhan Bao: Since the COVID pandemic and the past two years, especially this year, the stock market has been volatile. Real estate companies, in particular, have faced challenges in executing their business plans. Share prices are determined by market perceptions and the company’s operations.

Regarding our operations, we have projects awaiting approval. Once specific permits are granted and tangible progress is made, you will witness significant changes in our business performance.

Share prices are beyond the control of the Board of Directors and the Executive Board. We will focus on improving our business performance and enhancing timely and transparent communication with investors to keep them informed about our progress.

Why hasn’t HAR paid dividends in recent years?

Mr. Nguyen Nhan Bao: Over the past few years, we have been restructuring our investments. As a result, we have reduced financial expenses arising from interest and bonds. The Board of Directors and the Executive Board have navigated through challenging interest rate environments and strived to minimize operating expenses while awaiting project approvals.

We are one of the real estate companies with very low financial expenses. While this is a positive aspect, allowing us to concentrate our resources and sustain our operations, our annual profits in recent years have been modest. Therefore, if we were to distribute dividends, the amount would not be significant. Moreover, if we were to pay dividends, we would need to borrow funds for our projects.

The company possesses substantial assets and land banks, but the efficiency of asset utilization is low. Does the management have a specific roadmap for 2025 to convert these assets into actual cash flow? What is the specific strategy to utilize capital efficiently?

Mr. Nguyen Nhan Bao: In the past two years, we have been working on two fronts. Firstly, we aim to enhance the quality and revenue of our hotel and apartment rental businesses. Secondly, we are restructuring small-scale assets to concentrate our resources on long-term projects.

Our capital structure primarily comprises medium and long-term investments. A significant portion of our resources has been allocated to projects in our affiliated companies, Co Khi Ngan Hang and Phuong Dong. We must be patient as we await the necessary permits for these projects. We are optimistic that, in the shortest possible time, we will obtain the required permits and planning approvals to transform these ventures into profitable endeavors for the company. Consequently, shareholders will indirectly benefit from these successful business operations.

The AGM concluded with all proposals being approved.

– 13:51 18/04/2025

“An Apology from the CEO: Reflecting on 2024 Results and Our New Venture into Industrial Real Estate”

The Annual General Meeting of 2025, scheduled for the afternoon of April 21st, was unable to proceed due to insufficient attendance. Nonetheless, the company’s leadership dedicated significant time to discussing the business’s plans in the context of the evolving real estate market.

MSB’s General Meeting: Q1 Profit Reaches VND 1,630 Billion, 2-3 Potential Buyers for the Finance Company

On April 21, 2025, the Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) held its annual general meeting to discuss and approve key business strategies for the upcoming year. The agenda included proposals for dividend distribution, plans to increase charter capital, and decisions regarding the divestment from TNEX Finance and the potential acquisition of a securities company.

“LPBS Announces Impressive Q1 Results: Net Profit Surpasses VND 40 Billion, with an 81% Increase in Asset Size Since the Start of the Year”

Joint Stock Commercial Bank for Foreign Trade of Vietnam, or LPBank, announced that its securities arm, LPBS, recorded a net profit of over VND 40 billion in the first quarter of 2025. This impressive performance was driven by robust earnings from proprietary trading and lending activities, which successfully offset losses incurred in the brokerage division. As a result, LPBS’ total assets surged to a remarkable VND 9,175 billion, largely attributed to increased borrowing from its parent company, LPBank.

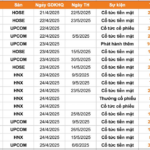

The Ultimate Guide to Cashing in on Dividends: Unlocking the Power of 30% Payouts and Beyond

This week, 13 companies are paying out cash dividends, with the highest being an impressive 30% and the lowest a respectable 4.5%.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)