According to statistics from the Thanh Hoa Department of Construction, the prices of construction materials, especially building sand, have surged in the past year. Specifically, sand prices have increased by 50% compared to the same period in 2024.

The main reason for this price hike is the supply failing to keep up with the demand from construction projects in the province, while the demand for construction materials remains high, especially for infrastructure, industrial, and civil projects.

Mr. Le Duc Giang, Vice Chairman of the Provincial People’s Committee of Thanh Hoa, shared at a conference: “The increase in construction material prices, especially sand and fill dirt, not only affects enterprises but also increases investment costs and causes difficulties for many important projects in the province. Therefore, cooling down material prices is one of the urgent tasks that we are deploying.”

To address this issue, Thanh Hoa province has implemented a number of synchronous and drastic measures. Among them, inspecting and examining mineral mines is an important step. The provincial authorities have conducted comprehensive inspections of mineral mines in the area to ensure that the mines are operating within regulations and that there is no over-exploitation or illegal exploitation.

According to the Thanh Hoa provincial planning approved by the Prime Minister in Decision No. 153/QD-TTg dated February 27, 2023, there are 557 mineral mines for common construction materials and minerals in scattered, small, and scattered areas under the authority of the Provincial People’s Committee. As of March 15, 2025, there were 344 licensed mines still valid in the province.

The Department of Agriculture and Environment of Thanh Hoa has also proactively formed inspection teams to review construction material mines, especially sand and fill dirt mines. Mr. Cao Van Cuong, Director of the Department of Agriculture and Environment, said: “We have inspected 243 mines, including 189 stone mines, 33 soil mines, and 6 sand mines. We have discovered some mines operating in violation of regulations and environmental protection standards. These violations need to be strictly handled to create a sustainable mineral exploitation environment.”

Along with the involvement of functional agencies, mineral exploitation enterprises have also proactively sought solutions to minimize the impact of rising material prices. Representatives of some sand mining enterprises in the province said that they had proposed that the competent authorities re-evaluate the reserves of licensed sand mines to create conditions for enterprises to expand production to meet market demand.

“We understand that the increase in construction material prices affects the entire provincial economy. Therefore, mineral exploitation enterprises are always ready to cooperate with functional agencies to ensure reasonable, economical, and sustainable exploitation. However, there needs to be a reassessment of mine reserves and a more reasonable adjustment of material prices,” said a representative of the Thanh Hoa Business Association.

The forecast of the demand for construction materials by investors is inaccurate and unsuitable for reality. For example, the volume of stone used in 2024 was 12.33 million m3, but the forecast for 2025 is 8.43 million m3. Regarding the source of fill dirt, the remaining reserves in the licensed mines are 42.89 million m3, while the demand for the period of 2026-2030 is 151.33 million m3, resulting in a shortage of about 141.71 million m3.

To address the long-term shortage of construction materials, Thanh Hoa province has focused on building and adjusting mineral planning to suit practical development. Updating the mineral planning not only helps the mines operate efficiently but also protects natural resources and prevents over-exploitation.

Vice Chairman of the Provincial People’s Committee Le Duc Giang emphasized: “We will inspect all mineral mines, adjust the planning to suit the actual market demand, and encourage enterprises to use substitute materials, especially artificial sand, to reduce pressure on natural mineral mines.”

Mr. Giang requested that the departments and branches inspect and put the planned mines that meet the conditions up for auction for mining licenses according to regulations.

Along with that, consider proposing to supplement the provincial planning to ensure practicality, economical and effective use for socio-economic development, as a basis for licensing mineral exploitation in accordance with regulations. Encourage enterprises to process and use artificial sand. Prioritize providing materials for projects under construction in the province.

The National Construction Price Index Rises Again in 2024, Up 0.24% from 2023

The Ministry of Construction has reported a positive trend in the national construction cost index for 2024, reflecting a 0.24% increase compared to 2023 and a significant 15.35% rise since 2020.

The Soaring Property Prices: Navigating the Challenges

Recently, real estate prices in Hanoi have skyrocketed, particularly in the apartment sector. This trend has not only made the dream of homeownership more elusive for residents but also presented significant challenges for the banking system, where a large portion of collateral assets are real estate-based.

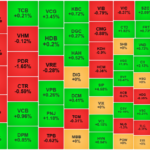

Drip Feed Selling, VN-Index Turns Green at the Last Minute, Foreigners Dump Again

Selling pressure mounted slightly in the afternoon session, pushing the VN-Index briefly into negative territory with a sea of red on the screen. However, the extremely low trading volume indicated that buyers were mostly sitting on the sidelines, and the market was quick to rebound as bottom-fishers jumped in.

Will Real Estate Prices Continue to Rise in 2025?

The real estate market is on the cusp of a significant transformation, with experts predicting a tumultuous journey towards 2025 and beyond.

The Stock Market Observer: Bottom Fishers Out in Force

Today’s market showed a significant boost in positivity, not just in terms of the upward index movement but also in the balance and strength of the bottom-fishing money flow. The shift from indiscriminate selling to price-conscious selling and a tug-of-war is a notable change in psychology and risk assessment.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)